Types Of Life Insurance Plans

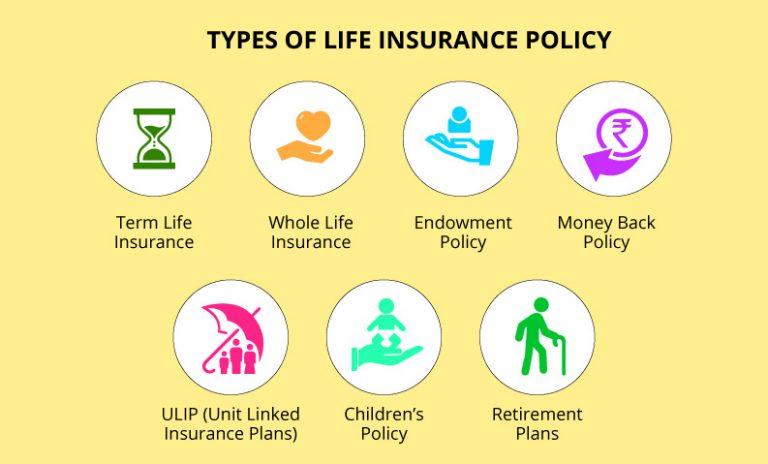

It’s a common misconception that life insurance is an investment option that merely offers death benefits and/or maturity benefits. However, the fact remains that there are different kinds of life insurance policies available in the financial market. Different plans offer varying sets of benefits. Learning about the many kinds of insurance policies can help you decide on the right plan for yourself and your family.

In addition to death benefits and maturity benefits, investing in insurance plans can also help you enjoy tax breaks. Section 80C of the Income Tax Act, 1961, allows investors to deduct the premium paid for life insurance and term insurance from their total income. A maximum of Rs. 1.5 lakhs can be deducted, thus bringing down the tax liability. Furthermore, even the maturity or death benefits obtained from an insurance scheme are tax-free, owing to the provisions of section 10 (10D).

Source: Paisabazaar

Here’s a quick look at the 4 different types of life insurance that you definitely should know about.

Following are the types of life insurance plans:

Term insurance

Among the many life insurance plans available to investors, this one is by far the most basic. Term insurance plans provide only a life cover with no profit component added thereon. This essentially means that only a death benefit will be paid out to the beneficiaries of the policyholder. No maturity benefit will be payable at the end of the policy term.

For instance, if the policyholder dies during the active term of the policy, the death benefit, (which is the sum assured plus any added bonuses, if any) will be paid out to the beneficiaries of the insured. Alternatively, if the policyholder survives till the end of the term, there is no pay-out due.

One of the biggest advantages that term insurance has over the other types of life insurance is lower premium requirement. As the insurer only provides a death cover, the premiums that are payable are far lower than those charged for other traditional insurance plans.

A case in point is the term insurance plans, available on Bajaj Markets. By paying low premiums for a cover of Rs. 1 crore, you can enjoy the many benefits that this pure term plan offers. If you prefer not to pay premiums for several years at a stretch, this plan also offers you the option of paying up all your premiums within a limited period of 5 years. In return, your protective cover remains in place until you reach the age of 99. You can even opt for including your spouse in the plan, with the joint life cover benefit.

Endowment plan

Also known as a traditional life insurance plan, an endowment plan is very similar to a regular term insurance policy. The only difference is that an endowment plan also comes with a maturity benefit in addition to a death benefit. It is a lucrative investment option that incorporates both insurance and savings aspects.

In these types of life insurance policies, the insurer typically charges a higher amount of premium. One part of the premium amount goes towards the life cover, and the remaining premium is invested in the financial market.

As the insurer invests a part of your premium, the plan periodically accumulates bonuses. These bonuses are then paid out along with either the maturity benefit or the death benefit depending on whether or not the policyholder survives the policy term.

Unit Linked Insurance Plan (ULIP)

A Unit Linked Insurance Plan is the best investment option for individuals wanting to enjoy both life cover and return on investment. A ULIP differs from other types of life insurance policies as it focuses on long-term wealth creation.

A portion of the premium that you pay towards a ULIP is invested in a pool of either debt, equity, or a combination of the two, much like a mutual fund. As a result, the performance of a ULIP is entirely dependent on the financial markets.

On maturity of the policy or on the death of the policyholder, the insurer pays out either the sum assured as per the policy terms or the net asset value of the investment, whichever is higher. One of the primary advantages of investing in such a policy is that the policyholder can avail ULIP tax benefits at the time of investment as well as at the time of maturity.

Retirement plan

Unlike the other types of life insurance mentioned here, retirement plans focus primarily on building a corpus to help you retire peacefully without any worries or financial stress. With most retirement plans, you usually get a portion of the accumulated corpus as a lump sum settlement on maturity.

The remaining corpus is automatically invested in an annuity scheme. The earnings from the annuity scheme are then periodically paid out to the policyholder as pension, resulting in a steady stream of income.

Retirement plans also come with a life cover aspect. So, if the policyholder dies before the end of the policy term, the beneficiaries become eligible to receive a death benefit. In India, there are around 7 different types of retirement plans to choose from, with some of them even being eligible for tax-breaks.

Conclusion

These are 4 of the most commonly preferred life insurance plans. Other kinds of protective covers include whole life insurance, guaranteed issue life insurance, and group life insurance. Additionally, there are also life insurance plans that offer the option of added riders such as accidental death benefits, critical illness benefits, and disability benefits. Each kind of insurance comes with its own set of unique advantages. Whether you are looking to buy an endowment plan, a ulip plan or a term insurance plan, the insurance app by Bajaj Markets gives you the best insurance buying experience online. Download today!

Term Insurance Covers and Requirements

- Term insurance plan with return of premium

- Critical illness insurance

- Cancer insurance

- Joint life insurance policy

- Term insurance maturity benefit

- Term insurance for family

- Term insurance age limit

- Use Term Insurance Premium Calculator

- Spouse Term Insurance

- Term Insurance For Senior Citizen

- Bajaj Allianz Term Insurance Plans

- One Crore Term Insurance Plan

- Term Insurance Nominee

- Term Insurance For Nri

- Term Insurance Riders

- Joint Term Insurance For Couples

- Term Insurance Payout Options

- Term Insurance Claim Process

- Term Insurance Benefits

- Single Premium Term Insurance

Read More About Term Insurance

- Term insurance comparison

- How much return to expect from a term insurance

- Difference between term insurance and life insurance

- Term insurance tax benefits

- Difference between term plan and endowment plan

- ULIP vs Term Insurance

- Types of term insurance plans

- Term Insurance Claim Settlement Ratio

- Ways To Reduce Your Term Insurance Premium

- Is Term Life Insurance Worth It

- All About Term Life Insurance

- Lump Sum Term Insurance Payout

- How To Purchase Lowest Premium Term Plan

- Online Vs Offline Term Insurance

- Term Insurance Terms And Conditions

- Critical Illness Insurance Benefits

- What Is Decreasing Term Insurance

- What Is Section 80Ccc And What Are Its Tax Benefits

- Term Insurance Vs Life Insurance

- 5 Year Term Life Insurance Policy

- Married Womens Act Mwp Act

- Limitations Of Group Term Life Insurance

- Increasing Term Insurance Plan

- Importance Of Term Insurance Renewal

- 5 Short Term Investment Options To Consider

- Best Term Insurance Plan

- Difference Between Term Insurance And Whole Life Insurance

- Pmjjby Vs Pmsby Differences And Similarities

- The Comprehensive Section 80C Deduction List

- Importance Of Term Insurance For Women

- Term Insurance Buying Guide

- Difference Between Child Plan And Term Plan

- Reasons To Buy Term Insurance

- Group Term Life Insurance Vs Individual Term Insurance

- How To Choose Best Critical Illness Insurance

- Difference Between Term Insurance And Health Insurance

- Term Insurance Myths

- Why Is It Important As Parents To Have Term Insurance

- How Is Term Insurance Premium Calculated

- Irdai Regulations For Term Insurance

- How To Buy Suitable Term Plan

- 5 Term Insurance Claim Rejection Reasons

- 5 Tips To Choose The Best Term Insurance Plan In India

- How To Buy Term Insurance Online

- What Is Whole Life Insurance

- What Is Term Insurance

- Benefits Of Group Term Life Insurance

- Cheap Term Life Insurance

- Types Of Deaths Not Covered Under Term Insurance

- Term Insurance Without Medical Test

- 5 Reasons For Low Premium In Term Insurance Plans

Happy Customers of Bajaj Markets

Enter Your OTP