The Mudra loan refers to loans provided by banks and financial institutions to micro and small enterprises (MSEs) in India under the Pradhan Mantri Mudra Yojana (PMMY) scheme. The PMMY scheme was launched in 2015 by the Government of India with the aim of providing financial support and promoting entrepreneurship in the country.

Mudra loans are collateral-free loans, meaning you do not need to provide any security or collateral to avail of the loan. The loans can be used for various business purposes, including working capital, buying machinery or equipment, expanding business operations, and more.

For a deeper understanding of the Mudra loan details and to learn all about Mudra loan variants, read on.

Financial Year |

2015-2016 |

2016-2017 |

2017-2018 |

2018-2019 |

2019-2020 |

2020-2021 |

2021-2022 |

No. of PMMY Loan Sanctioned |

3,48,80,924 |

3,97,01,047 |

4,81,30,593

|

5,98,70,318 |

5,83,65,823 |

4,31,72,305 |

4,86,00,000 |

Loan Amount Sanctioned |

₹1,37,449.27 Crores |

₹1,80,528.54 Crores |

₹2,53,677.10 Crores |

₹3,21,722.79 Crores |

₹3,21,722.79 Crores |

₹2,78,520.37 Crores |

₹3,07,00,000 Crores |

Loan Amount Disbursed |

₹1,32,954.73 Crores |

₹1,75,312.13 Crores |

₹2,46,437.4 Crores |

₹3,11,811.38 Crores |

₹3,11,811.38 Crores |

₹2,63,741.95 Crores |

₹3,07,190 Crore |

The types of companies that can avail a loan under the Pradhan Mantri Yojana scheme include:

Proprietorship

Partnership

Private Limited Company

Limited Liability Partnership (LLP)

Small Scale Industries (SSI)

Micro-enterprises

Small enterprises

In short, any micro or small enterprise engaged in manufacturing, services, or trading can avail of Mudra Loans under the Pradhan Mantri Mudra Yojana scheme.

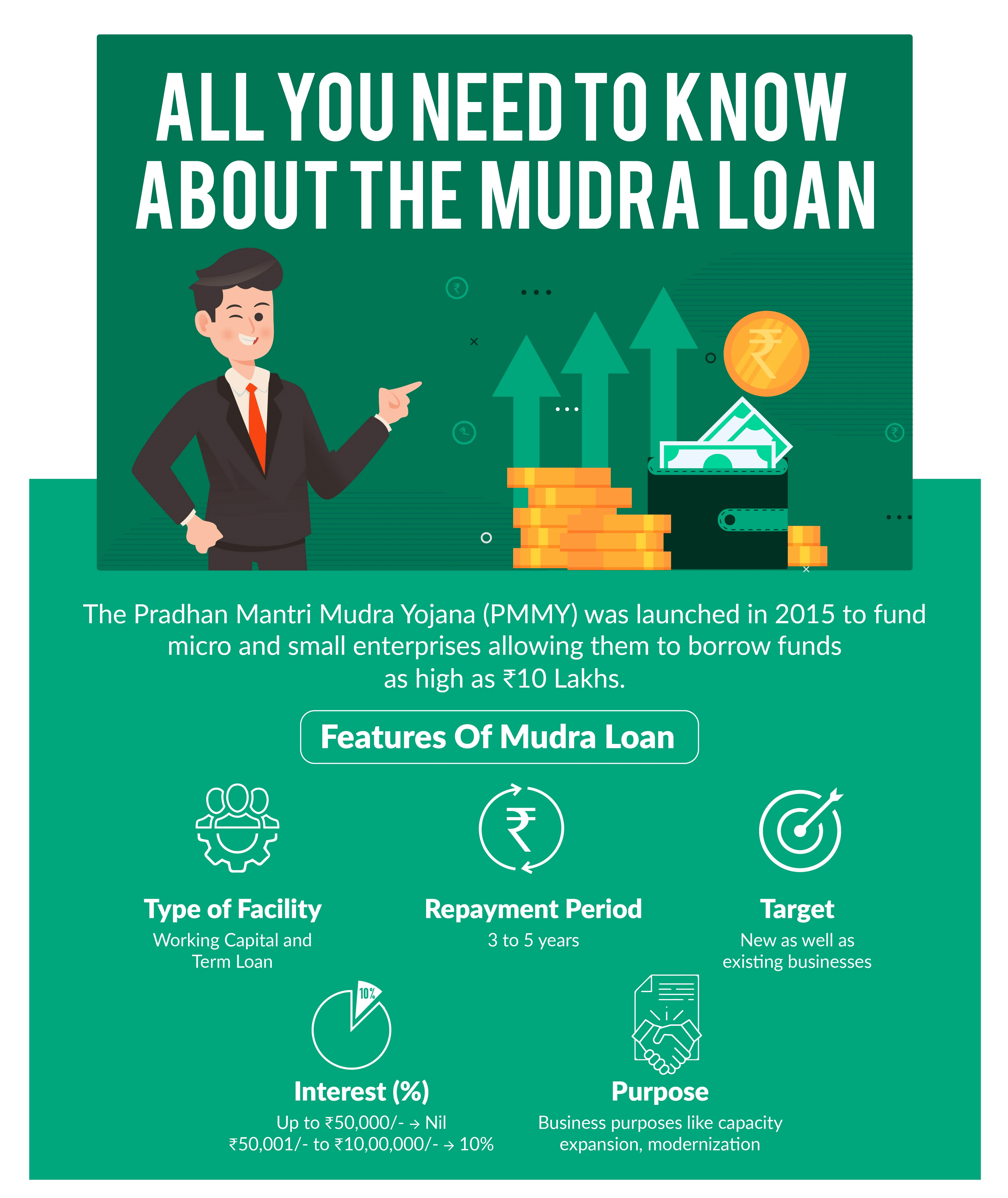

Features of Mudra Loan

The Mudra business loan has several defining features that distinguish it from other financial products offered by the government. Some of the features of Pradhan Mantri MUDRA Yojana (PMMY) are as follows:

It is targeted at businesses engaged in trading, manufacturing, or providing services.

The loan amount can be used to fulfil working capital requirements.

The funds can be employed for a diverse group of purposes such as the purchase of machinery, growth expansion, business restructuring, and meeting extended working capital requirements, among other things.

Both new and existing enterprises can apply for a Mudra scheme.

The loan repayment tenure ranges between 3 to 5 years.

One can apply for a Mudra Loan through the official www.Mudra.org.in portal.

The PMMY scheme offers three products namely Shishu, Kishore, and Tarun to eligible entities. The details of these three types of Mudra loan products are as follows.

1. Shishu

Shishu loans provided under the Mudra scheme allow entrepreneurs on the threshold of starting a business to borrow up to ₹50,000. The following details need to be furnished to avail the Mudra Shishu loan.

Quotation of the machinery being purchased and other items that need to be purchased.

Details of the plant and machinery that has been purchased.

Details of the supplier who is providing the plant and the machinery.

2. Kishore

Kishore loans stay within the range of ₹50,001 and ₹5,00,000. They are ideal for business people who require additional monetary resources for expanding their trade. Here is the checklist of the documents needed:

The balance sheet of the business goes back two financial years

Income Tax and Sales Tax returns

Bank account statements going back 6 months

Estimated balance sheet for the next 1 year or the duration of the loan sought

Memorandum of Association (MOA) and Articles of Association (AOA), if applicable

A report exploring the technical and economic sustainability of the applicant’s business

3. Tarun

Tarun loans under the PMMY scheme range from ₹5,00,001 to ₹10,00,000. Business owners who wish to avail of a Tarun loan need to furnish these documents listed below:

Proof of address

Proof of identity

Certificate of SC, ST, OBC, if applicable

The primary purpose of the Pradhan Mantri Mudra Loan Yojana (PMMY) is to provide financial assistance and support to micro and small enterprises in India. The scheme was launched in 2015 with the aim of promoting entrepreneurship, creating employment opportunities, and encouraging financial inclusion.

The MUDRA loan can be availed from a range of financial institutions, including public sector banks, private sector banks, regional rural banks (RRBs), small finance banks (SFBs), and micro finance institutions (MFIs).

The eligibility for Mudra Loan is listed below.

Criteria |

Eligibility |

Minimum Age |

18 years |

Maximum Age |

65 years |

Eligible entities |

New and existing units for service sector, trading, or manufacturing activities |

Security or Collateral |

No collateral or third-party security is required |

Institutions Eligible |

Public Sector Banks, Private Sector Banks, Micro Finance Institutions, and Regional Rural Banks |

Documents Required |

Proof of identity, proof of residence, application form and passport size photos |

Interest Rates: The Pradhan Mantri Mudra Yojana allows eligible applicants to borrow funds up to ₹10 Lakhs. The interest rate on the Mudra loan varies depending upon the applicant’s profile and business requirements as well as the discretion of the lending institution.

Processing Charges: No processing fee is applicable on a Mudra loan for amounts up to ₹50,000. For amounts ranging between ₹50,001 and ₹10 Lakhs, an interest rate of 10% and a processing fee of 0.50% are applicable in addition to GST.

The Mudra card is an innovative product that makes credit easily accessible to small businesses while providing flexibility to the card owner at the same time. It can be used as a credit card with an overdraft (loan) limit and can also be used as a debit card for making withdrawals at an ATM.

As such, the borrower can use a Mudra card to make multiple withdrawals and credits. Such cards also help with the digitalisation of Mudra transactions, which would be instrumental in creating a credit history for the borrower.

With the PMMY scheme, you can borrow up to ₹10 Lakhs. If your business needs more capital or funds, or if you don’t qualify to borrow under the PMMY scheme, you could always avail of a business loan at www.bajajfinservmarkets.in. At Bajaj Markets, you can apply for business loans as high as ₹75 Lakhs without the need of any collateral. The application process is online, making the procedure quite simple and easy, from approval to disbursal.

Mudra Loan Articles

FAQs on Mudra Loan

Who is eligible to apply for Mudra Loan?

While it is smart to avail a Mudra loan, to apply and get funding successfully, you need to meet the terms. Small manufacturers, shopkeepers, artisans, and individuals carrying on agricultural activities like rearing livestock and raising poultry are all eligible to apply for the Mudra loan under the PMMY scheme.

All small businesses, whether they’re proprietary concerns or firms in rural or urban areas, can avail Mudra loans. Keep in mind that the applicant must be an Indian citizen above 18 years of age.

What is the maximum amount of loan you can avail under the PMMY scheme?

You can avail loans under any of the three products offered by the PMMY scheme and the maximum amount available is ₹10 Lakhs.

Does CIBIL score affect Mudra loan eligibility?

Your eligibility to apply for a Mudra loan does not depend on your credit score. So, anyone who fulfils the other criteria required to avail this loan can go ahead and apply for the same, irrespective of their credit history.

Is there any subsidy on Mudra Loan?

At present, there is no Mudra loan subsidy on offer. But, the interest rates are much lower than what banks charge. Through Mudra Loan, credit to small businesses is given at reasonable rates.

Can a bank reject Mudra loan?

Yes, a bank can reject a Mudra loan application if the applicant fails to meet the eligibility criteria or if the bank finds the project or business plan to be unviable.

What happens if Mudra loan is not paid?

If a borrower fails to repay a Mudra loan, the bank can take legal action to recover the outstanding amount, including seizing the collateral, if any.

Is GST compulsory for Mudra loans?

No, GST (Goods and Services Tax) registration is not mandatory to avail a Mudra loan. However, GST registration may be required depending on the type of business activity.

What are the synergies aligned with PMMY?

The Pradhan Mantri Mudra Yojana (PMMY) is aligned with other government initiatives such as Startup India, Digital India, and Make in India, which aim to promote entrepreneurship, innovation, and manufacturing in India.

What is the normal repayment of Mudra loans?

The repayment period for Mudra loans varies depending on the type of loan. For Shishu loans, the repayment period can be up to 5 years, while for Kishore and Tarun loans, it can be up to 7 years.

Is there an offline method of availing the Mudra loan?

Yes, you can complete the Mudra loan registration process offline by visiting any of the authorised financial institutions such as public sector banks, private sector banks, regional rural banks (RRBs), small finance banks (SFBs), and micro finance institutions (MFIs).

You can also download the Mudra loan application form from the official website of the Mudra Yojana and submit it offline to the nearest authorised financial institution.

Enter Your OTP