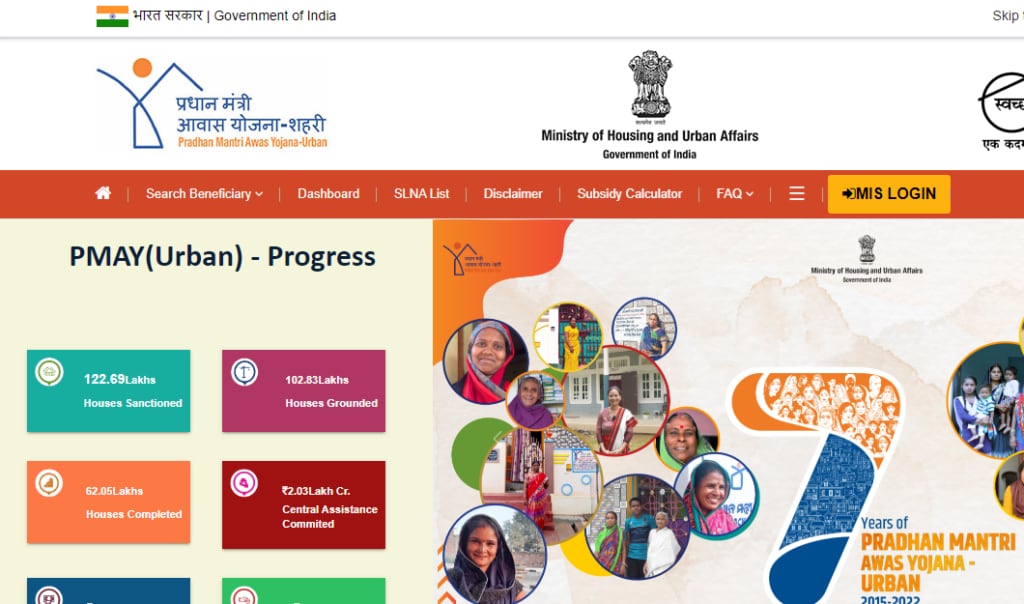

The Pradhan Mantri Awas Yojana is a special scheme that is aimed to benefit first-time homebuyers. As part of the scheme, beneficiaries can avail a PMAY subsidy on the home loan interest rate. Claiming the PMAY subsidy under the scheme is simple as long as your income and the home carpet area norms fit the requirement.

The main objective of the Pradhan Mantri Awas Yojana Application Status is to help beneficiaries to verify their application status. This would help the beneficiaries check their progress online.

To check the PMAY subsidy status online, you need to follow these steps:

Step 1: Visit the official PMAY website

- Step 2: Following this, you will receive two options to track your assessment status. Choose the one that best suits you

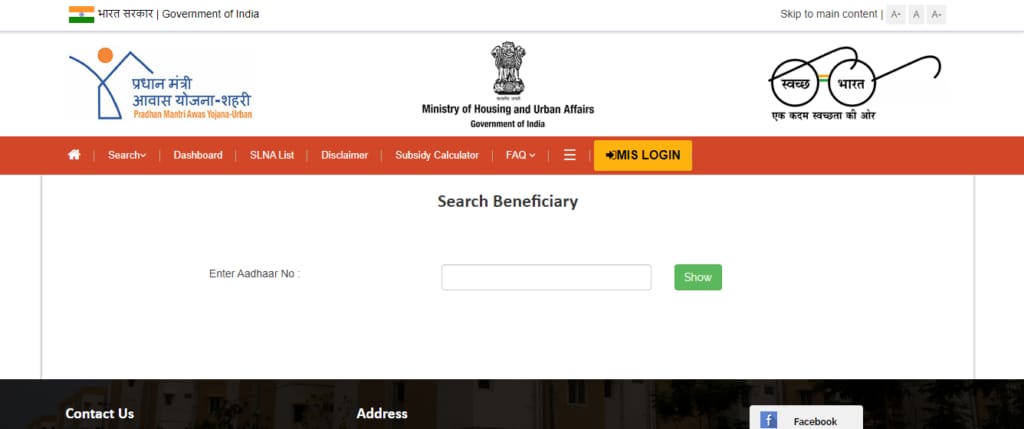

1. PMAY Subsidy Status Check by Aadhaar Number

- Start by visiting the PMAY scheme’s official website.

Choose the ‘Search Beneficiary’ option from the menu on the homepage.

Then, choose the ‘Select by Name’ option.

Under this option, enter your Aadhaar number.

- After this, your details and your application status will be displayed on the page.

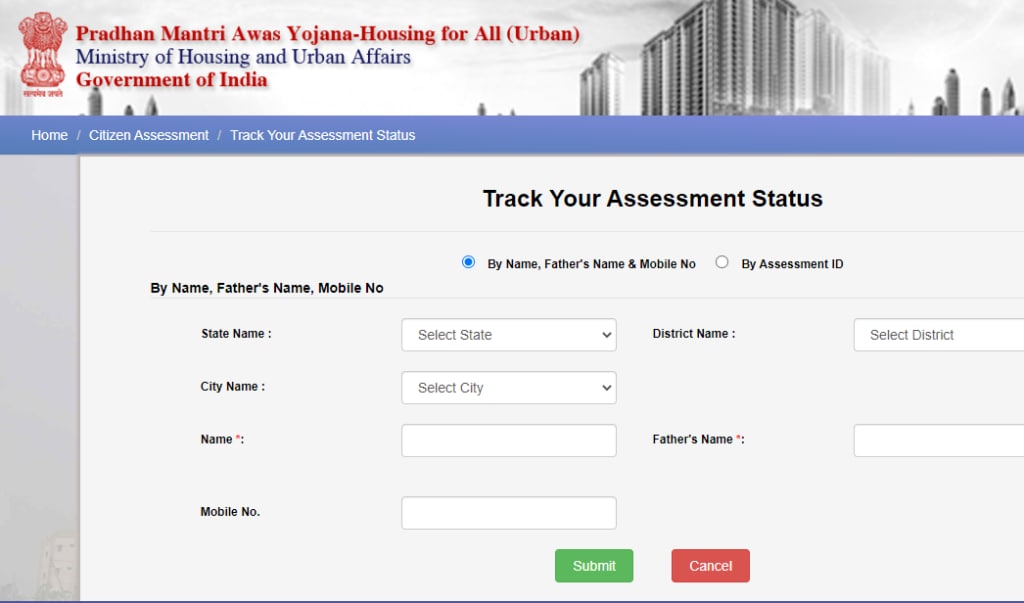

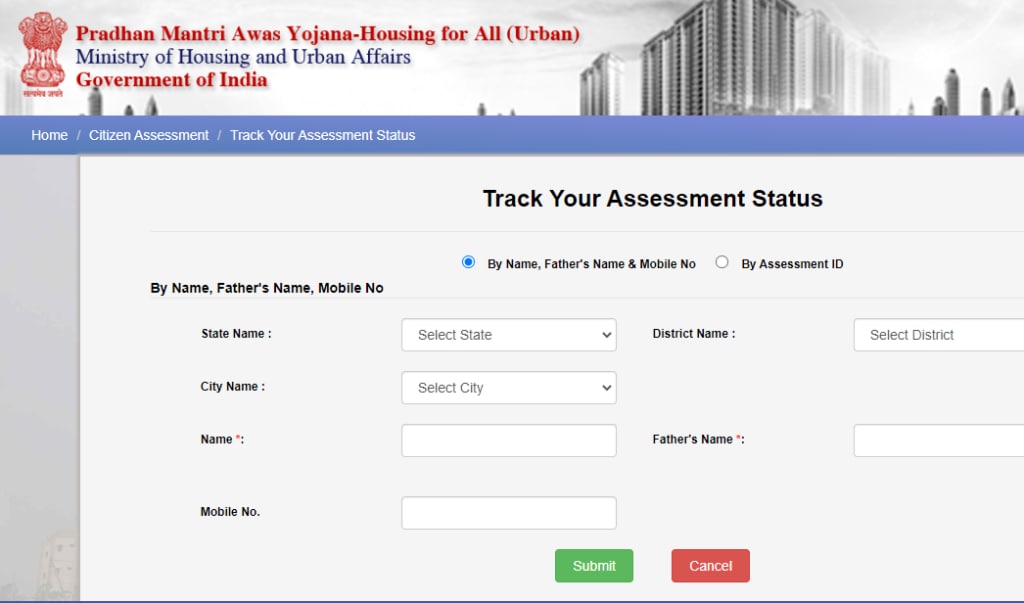

2. PMAY subsidy status check by application ID

Go on to the PMAY website’s ‘Track Application Status’ section - https://pmaymis.gov.in/track_application_status.aspx.

Click on the ‘Citizen Assessment’ option on the website's homepage.

Choose “Track Your Assessment Status” from the dropdown menu.

- Enter your assessment ID to check your PMAY subsidy status.

Go on to the PMAY website’s ‘Track Application Status’ section - https://pmaymis.gov.in/track_application_status.aspx.

Click on the ‘Citizen Assessment’ option on the website's homepage.

Choose “Track Your Assessment Status” from the dropdown menu.

- Enter your father’s name, your name and your registered phone number to check your PMAY subsidy status.

You can also check your PMAY subsidy through your Aadhaar number. To check your PMAY status using the Aadhaar card, follow these steps:

Step 1: Visit the official PMAY website and click on the ‘Search Beneficiary’ option listed against the main menu.

Step 2: Next, click on ‘Search by name’ before entering your Aadhaar number.

Step 3: Upon entering the Aadhaar number, you can view the status of your PMAY application.

Upon following these steps, you will get your Pradhan Mantri Awas Yojana status.

You can also check your PMAY subsidy through your Aadhaar number. To check your PMAY status using the Aadhaar card, follow these steps:

Step 1: Visit the official PMAY website and click on the ‘Search Beneficiary’ option listed against the main menu.

Step 2: Next, click on ‘Search by name’ before entering your Aadhaar number.

Step 3: Upon entering the Aadhaar number, you can view the status of your PMAY application.

Upon following these steps, you will get your Pradhan Mantri Awas Yojana status.

You can also track the status of your PMAY subsidy by the following methods:

1. Via toll-free number

If you have any doubt in relation to CLSS, you can contact National Housing Bank (NHB) or Housing and Urban Development Corporation (HUDCO).

Here are their contact numbers:

- NHB: 1800-11-3377, 1800-11-3388

- HUDCO: 1800-11-6163

2. Via local authority

You can also get in touch with an officer present at your local municipality for more details regarding your PMAY status.

You can visit the CLSS Awas portal to check your PMAY UCLAP subsidy status. Here are the five stages of this process:

Generate application ID

PLI’s due diligence

Upload claim on the Central Nodal Agency Portal

Subsidy claim approval

Subsidy release to PLI

To track your application through CLSS tracker, follow these steps:

Step 1: Visit the PMAY UCLAP website

Step 2: Click on application ID on the home page and then click on get status

Step 3: Enter the OTP you received on your registered mobile number

Upon doing so, you will receive your application status.

CLSS allows interest subsidy on home loans taken out by eligible urban poor (EWS/LIG) for the purchase, construction, or improvement of a house.

|

Household income (in Rs.) |

Carpet area (in sq. m.) |

Interest subsidy (in %) |

Max. loan tenure |

Loan amount |

Discounted NPV rate |

Upfront subsidy amount (in Rs.) (for 20-year loan) |

Approx monthly savings (in Rs) (at an interest rate of 10%) |

EWS |

Up to 3 Lakhs |

30 |

6.5 |

20 years |

6,00,000 |

9% |

2,67,280 |

2,500 |

LIG |

3 – 6 Lakhs |

60 |

6.5 |

20 years |

6,00,000 |

9% |

2,67,280 |

2,500 |

MIG I |

6 – 12 Lakhs |

160 |

4 |

20 years |

9,00,000 |

9% |

2,35,068 |

2,250 |

MIG II |

12 – 18 Lakhs |

200 |

3 |

20 years |

12,00,000 |

9% |

2,30,156 |

2,200 |

Calculating PMAY subsidy will help you in better understanding of this scheme. For convenience, you can make use of a PMAY subsidy calculator.

People belonging to the economically weaker sections of the society can apply for PMAY subsidy. This also includes light income group, medium income group 1 and medium income group 2.

You can proceed with PMAY status check by visiting the CLSS Awas portal at https://pmayuclap.gov.in/ and following these steps:

Step 1: Navigate to the CLSS tracker and enter your PMAY application ID

Step 2: After clicking on get status, you will receive an OTP on your registered mobile number. Enter it and you will be able to check whether your PMAY subsidy is credited in the home loan account or not.

The Credit Linked Subsidy Scheme (CLSS) is one of the four inclusions of the Pradhan Mantri Awas Yojana-Urban (PMAY-U) that provides interest subsidies on home loans availed by eligible individuals of the Economically Weaker Section (EWS) and Low-Income Group (LIG) for the purchase/re-purchase or construction of houses, as well as for incremental housing.

Here are the features of this scheme:

The Pradhan Mantri Awas Yojana (PMAY) scheme is only available if the loan amount is up to Rs 6 Lakhs.

The maximum subsidy available is Rs. 2.67 Lakhs.

This scheme is only available to applicants looking to buy or build a home.

Any amount in excess of 6 Lakhs will not be eligible for a subsidy.

The applicants are only eligible for PMAY home loan subsidy if they do not own a 'pucca' house in India, either in their own name or in the name of any member of their family.

If a beneficiary family has previously received central assistance from the Government of India under any housing scheme, he/she will be unable to benefit from this scheme.

One of the primary benefits of this scheme is that it allows subsidy on home loan, which makes purchasing a house convenient and affordable.

Home Loan Quick Links

- Apply for Home Loan

- Home Loan Eligibility

- Home Loan Interest Rate

- Home Loan EMI Calculator

- Home Loan Documents

- Home Loan for Government Employees

- Home Loan for Self Employed

- Home Construction Loan

- Home Renovation Loan

- Home Loan Tax Saving Calculator

- Home Loan for Women

- Home Loan Procedure

- Home Loan Top Up

- Home Loan Statement

- Joint Home Loan

Government Schemes

- Banglarbhumi West Bengal Land Record

- AnyRoR Gujarat Land Records

- Meebhoomi Andhra Pradesh Land Record

- Telengana Land Record

- Bhulekh Odisha

- Online EC Karnataka

- IGRS Telangana

- E-Swathu Karnataka

- IGRS Andhra Pradesh

- TN RERA

- Maha RERA

- Encumbrance Certificate

- MHADA Lottery

- Dharitri Assam

- Affordable Housing Scheme

What is the difference between Application ID and Beneficiary ID for credit-linked interest subsidy?

The beneficiary ID is a unique identifier for the CLSS beneficiary of PMAY-U who has availed of the subsidy amount into their home loan account. The application ID, on the other hand, is a system-generated number that’s unique for each borrower and is available only upon successful verification with the UIDAI and de-duplication with beneficiaries of other three verticals from the PMAY (U) MIS system.

Why was my PMAY application rejected?

One of the common reasons why the PMAY application gets rejected is that you might not belong to the eligible income group.

How can I follow-up on the PMAY subsidy application status?

To follow up on your PMAY status, you need to visit the official https://pmayuclap.gov.in/ website and navigate to track your assessment status. Enter your mobile number and assessment ID to proceed.

How many days will it take to get the PMAY subsidy?

Typically, you will get approval on your application in 3-4 months.

Does the CLAP software send SMS to PMAY applicants?

Yes, you will receive an SMS stating your application status through the CLAP website.

Can the PMAY help residents in slum areas?

Yes, slum dwellers are eligible to avail Rs.1 Lakh per house under this scheme.

Can I apply for PMAY twice?

No, you cannot avail the benefits of PMAY twice.

How does subsidy in PMAY CLSS work?

Under the CLSS subsidy, eligible individuals can avail home loan at a subsidized interest rate, depending on the category they fall in.