India started 2018-19 on a strong footing, clocking a growth rate of 8.2% in the first quarter. However, the economy gradually decelerated to 5.8% in the last quarter, ending FY19 with an overall growth rate of 6.2% as against 7.2% in the previous fiscal year. The economic slump is probably more severe than what GDP growth numbers show. Consumption, which contributes 60-70% to the economy has collapsed drastically.

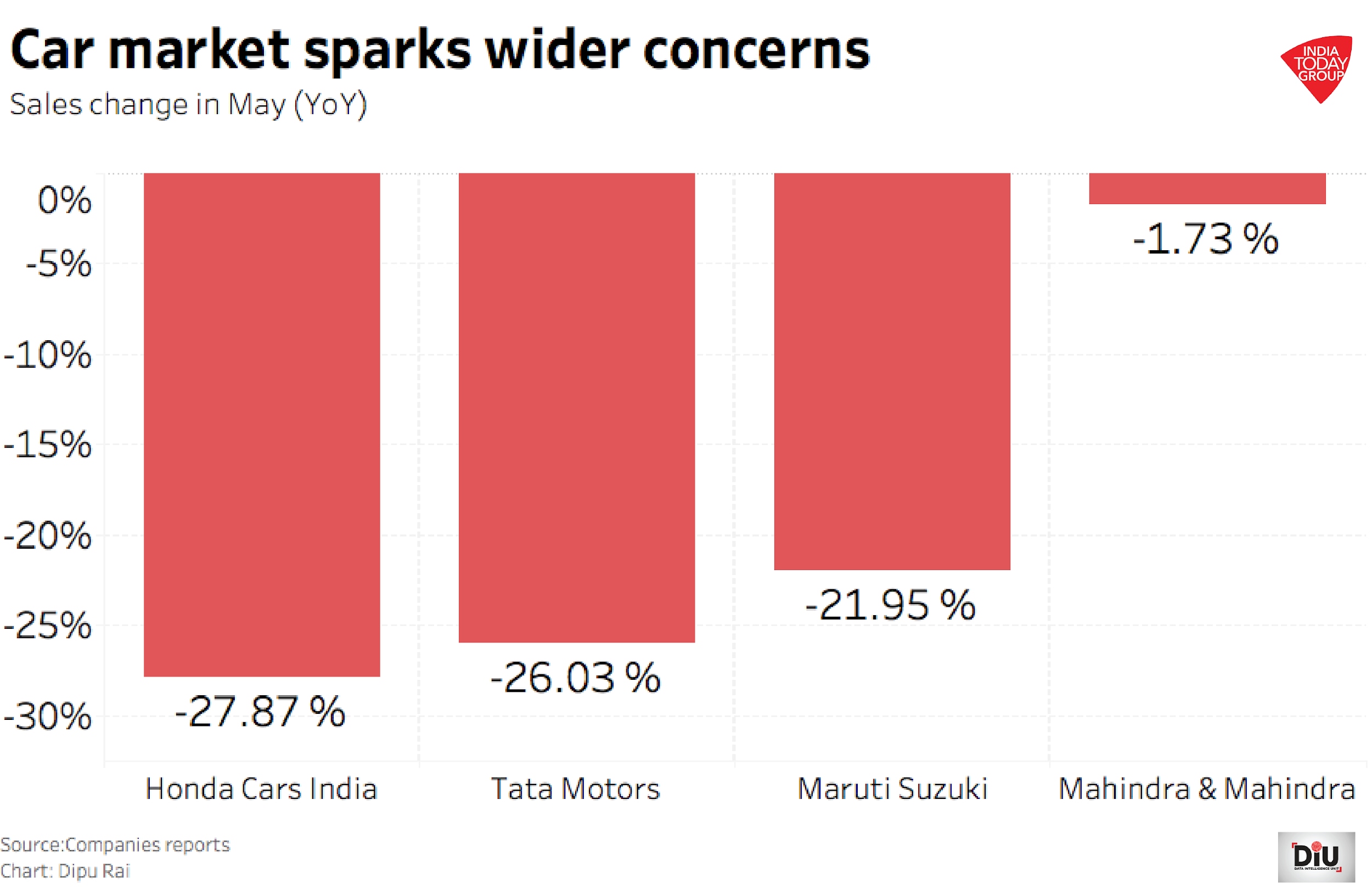

Automobile sales have been falling consecutively for the last nine months. The growth in the volume of FMCG companies has fallen to 4-6% from double-digit growth in the previous year. The growth in consumption of finished steel mellowed down to 6.6% between April and June, as against 8.8% in the same period a year ago. The number of unsold housing units across major Indian cities has risen to 1.28 million as of March 2019 from 1.20 million a year ago. Real estate and automobile are crucial sectors and employ millions of people. To arrest the slump and stimulate economic activity, the government is considering a stimulus package.

Finance Minister Nirmala Sitharaman held consultations with business leaders and experts to understand the nature of the slowdown. The government is said to be preparing a comprehensive package to boost demand, in addition to sector-specific measures. Industry leaders in their meeting with the finance minister have requested a stimulus package of over Rs 1 lakh crores. Automobiles, real estate, infrastructure and capital markets are likely to be at the centre of the government's stimulus package.

The automobile sector has been witnessing one of the worst slowdowns in two decades. The slump in consumer demand has led to a loss of around 3.5 lakh jobs and closure of nearly 300 dealerships in 18 months. The government may accept a long-pending demand of the industry and lower GST on vehicles to 18% from 28% currently. The additional cess levied on vehicles may also be removed. The government could also introduce a scrappage policy that will do away with old vehicles and create demand for new vehicles. The government may also request state governments to lower registration and road tax to lower cost of vehicle acquisition.

The government may largely focus on improving liquidity and the transmission of rate cuts by the RBI. The crisis in the NBFC sector has dried up crucial funds for the sector. Till FY 2018, NBFC/HFCs used to lend Rs 35,000-45,000 crore to the sector every year, which has substantially come down. The government is likely to come out with a mechanism to revive lending to the sector. The transmission of rate cuts too has not been satisfactory. The government could nudge banks to lower home loan rates to support demand for housing units.

Public investment in infrastructure development is the only engine driving the Indian economy right now. Investment in infrastructure has a huge contagion effect as it generates employment, besides the demand for paint, cement and steel. Government to government deals may also be explored to help companies divest functional assets and raise funds for new projects.

The capital markets have expressed some relief since the Government declared it's new income tax regime in Budget 2020. The government needs a robust capital market as it is important to meet divestment targets for the year. Although the long-term capital gains tax was left untouched, the Finance Minister declared that companies will no longer have to pay dividend distribution taxes to the government. This tax will be collected from the recipients instead.

Apart from a stimulus package that will give an instant boost to consumption, the government will have to focus on structural reforms. Land and labour reforms cannot be delayed anymore. The government will also have to develop a strategy to increase the productivity of Indian labour. The focus should be on ease of doing business for micro, small and medium enterprises across the country and not just major cities.