Take the full benefit of the available tax-savings options and reduce the tax outgo significantly

Saving on taxes is a smart way to keep more of your hard-earned money. Explore the different deductions, exemptions, and tax-saving investment options available to reduce your taxable income. Certain tax-saving strategies include utilising deductions specified under Section 80C of the Income Tax Act, 1961. Alternatively, you could benefit from the exemptions provided on home loans and medical expenses.

There are various tax-saving schemes that you can consider, such as ELSS, life insurance, NPS, PPF, etc. Find out how to save tax in India with the help of the following avenues:

Investment Option |

Details |

Tax Benefits and Deductions |

Equity-linked Savings Scheme (ELSS) |

|

|

Public Provident Fund (PPF) |

|

|

Tax-saver Fixed Deposit (FD) |

|

|

Life Insurance Policies |

|

|

National Pension Scheme (NPS) |

|

|

Some tax-saving options for salaried individuals include House Rent Allowance (HRA) and Leave Travel Allowance (LTA). You can benefit from them, along with deductions.

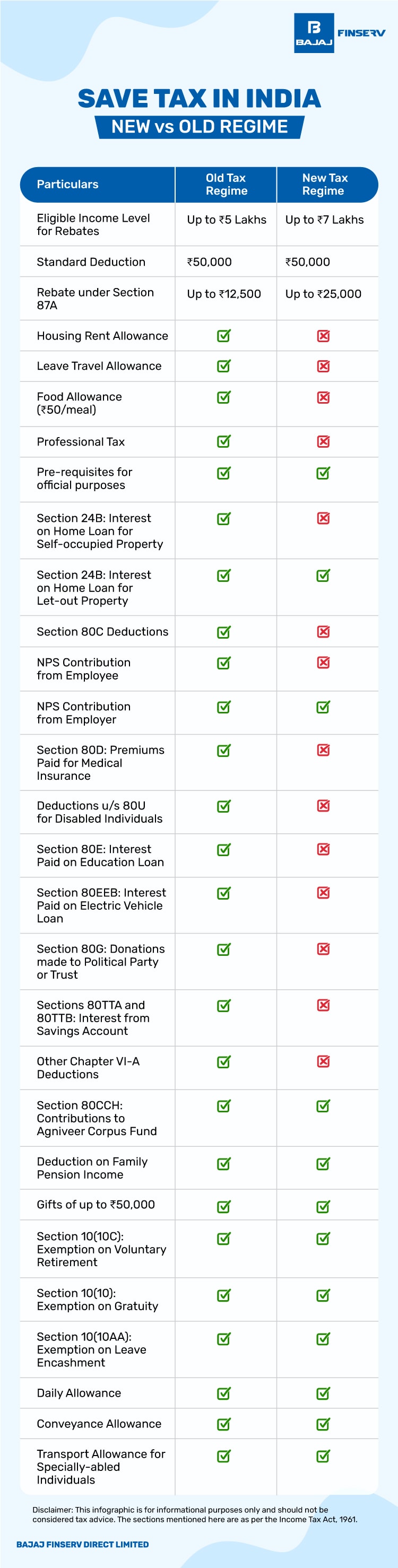

New Tax Regime

Deduction |

Applicability |

Employer contribution to NPS u/s 80CCD(2) |

|

Transport and conveyance allowance |

Exemption allowed to the extent of ₹3,200 per month |

Interest on home loan u/s 24 |

Deduction applicable if it is a let out property |

Leave Travel Allowance |

Not applicable |

House Rent Allowance u/s 10(13A) |

Excluded |

Old Tax Regime

Deduction |

Applicability |

HRA |

Applicable |

LTA |

Included |

Interest on home loan u/s 24b on vacant or self-occupied property |

Included |

Employee’s contribution to NPS |

Applicable |

Daily and conveyance allowance |

Included |

FAQs on How to Save Tax

Which tax saving scheme is best?

The best tax-saving scheme depends on your financial goals. Popular options include Public Provident Fund (PPF), Equity-Linked Savings Scheme (ELSS), National Pension System (NPS), and Fixed Deposits (FDs).

Does investing through SIP save tax?

Yes, you can save tax by investing in a SIP under Equity Linked Savings Schemes (ELSS). ELSS investments are eligible for tax deductions of up to ₹1.5 lakh per financial year under Section 80C of the Income Tax Act, 1961.

How can I save tax smartly?

Save tax smartly by investing in ELSS, PPF, and NPS. Claim deductions under Sections 80C and 80D, opt for home loan interest deductions, and utilize HRA exemptions if renting.

How can I avoid tax on my salary?

Avoid tax on salary by investing under Section 80C in PPF, EPF, and ELSS. Use deductions for HRA, LTA, and health insurance, and consider the new tax regime if it’s beneficial.

How can I save tax on my annual salary of ₹9 Lakhs?

Learning how to save tax on ₹9 Lakhs salary does require proper planning. First, you must assess your risk appetite and investment preferences and choose the suitable investment option. These include ULIP, FDs, PPF, NPS, NSC, mutual funds, etc. Based on your contributions, you can then enjoy deductions on your taxes.

How can I increase my tax savings?

The first step to learning how to save income tax is to understand and try to get tax deductions. You can claim deductions and exemptions such as House Rent Allowance (HRA) and Leave Travel Allowance (LTA), along with the deductions under various sections of the Income Tax Act.

What is HRA exemption?

Salaried individuals receiving HRA can claim exemption to reduce taxable income partly or fully if they pay rent.

What are some tax-free investment options?

There are various tax-free investments that you can consider, such as ULIPs, pension plans, NPS, PPF, etc.

Quick Links