The Finance Ministry of India has established a new tool through the Income Tax department that offers quick PAN issuance based on the Aadhaar number. Moreover, the entire procedure is paperless and free of cost. Due to this new initiative, now you can conveniently apply for a PAN card through an Aadhaar card just by sitting at your home. Additionally, you may utilise your Aadhaar card to obtain a PAN card.

Here are the steps to apply for a PAN through an Aadhaar card.

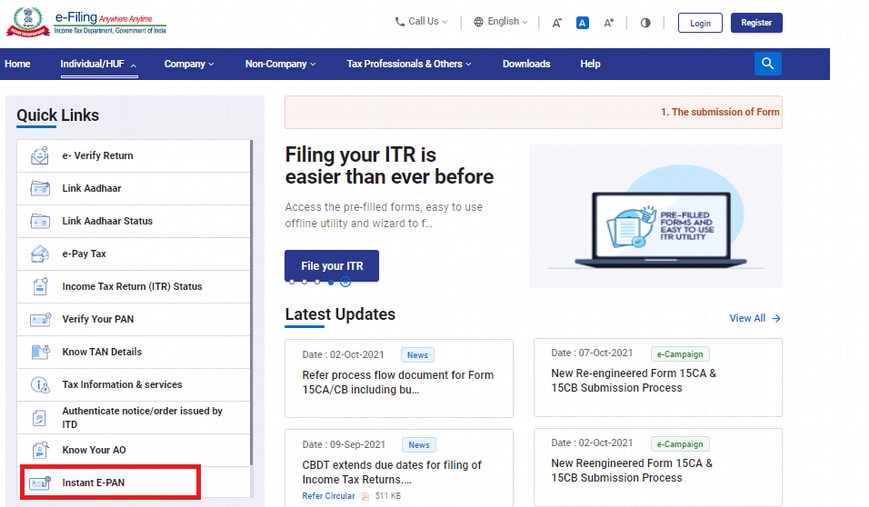

Step 1: Go to the official page of the Income Tax department.

Step 2: On the left of the homepage, you will view a box titled ‘Quick Links’ with multiple options.

Step 3: Scroll down the box and click on ‘Instant E-PAN.’

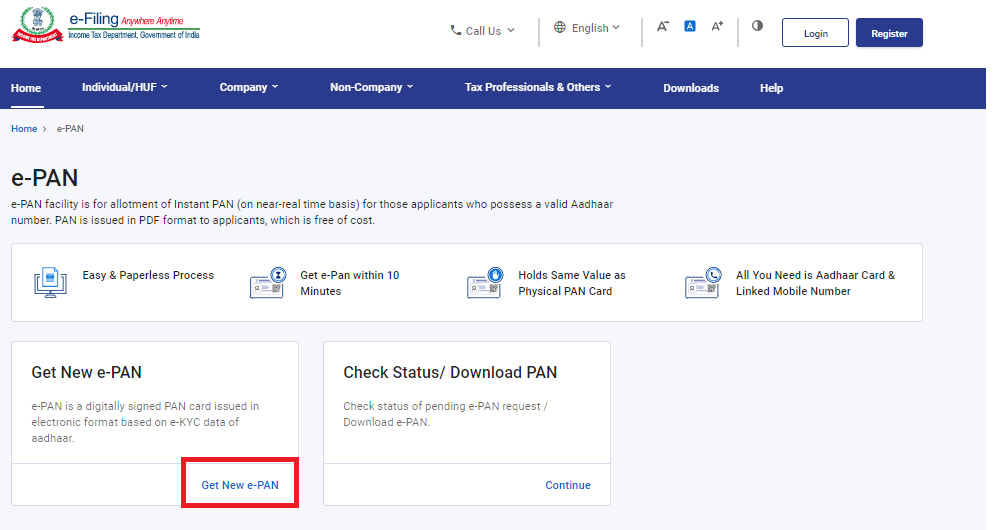

Step 4: Next, click on ‘Get New e-PAN.’

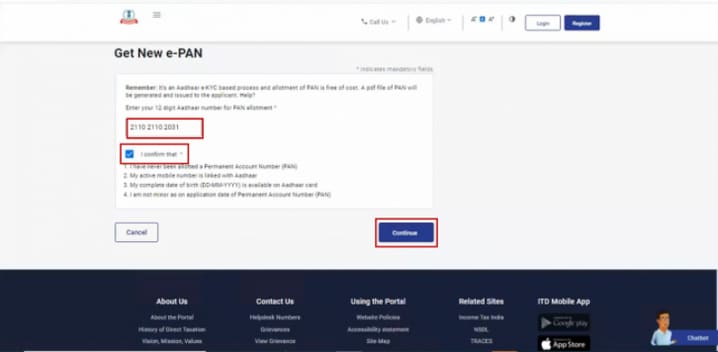

Step 5: Provide your Aadhaar number and tick the ‘I confirm that’ box.

Step 6: Select the ‘Continue’ button to proceed further.

Step 7: You will receive an OTP on your registered mobile number. Provide that for verification.

Step 8: If your email ID has not been validated, click ‘Validate email Id’ in the next step. Press the ‘Continue’ button after ticking the box.

Step 9: Once you have provided your Aadhaar card information for confirmation, you will be given an acknowledgment number.

Step 10: By using your Aadhaar number, you may check your PAN allocation status.

Before applying for a PAN card using an Aadhaar card, you must be aware of the eligibility criteria and the required documents in order to avoid any difficulty. Here’s a closer look at the details.

1. Eligibility Criteria

Applicant should be an Indian citizen

The age of the applicant must be 18 years or above.

Hindu Undivided Family (HUF) can also apply for it

The applicant must have a mobile number linked with an Aadhaar card

2. Required Documents

Identity proof

Residence proof

Date of Birth proof

If you have applied for an online PAN card, you can track your application status by following the below-listed steps:

Step 1: Browse the official portal of ‘e-filling’ or the Income Tax department.

Step 2: Select the ‘Instant E-PAN’ alternative from the Quick Links box.

Step 3: Next, click on the ‘Check Status/Download PAN’ option.

Step 4: Provide your Aadhaar card number and captcha code.

Step 5: Submit the details.

Step 6: You will receive an OTP on your registered mobile number. Enter that in order to complete the verification process.

Step 7: Select the ‘Continue’ button and tick the confirmation box.

Step 8: A new page will appear where you can check the status of your PAN card application.

Here are the steps to follow to download the allotted PAN card.

Step 1: Visit the Income Tax department's or ‘e- filling’ official website.

Step 2: From the Quick Links box, choose the 'Instant E-PAN' choice.

Step 3: After that, select ‘Check Status/Download PAN.’

Step 4: You must enter your Aadhaar card number and captcha code to complete the process.

Step 5: An OTP will be sent to the registered mobile number. To finish the verification procedure, enter that.

Step 6: After ticking the confirmation box, click ‘Continue.

Step 7: You will be taken to a new page where you may track the progression of your PAN card application.

Step 8: If you have been issued a PAN card, you can download a PDF copy.

Step 9: The file will have a password. To open it, enter your date of birth in DDMMYYYY format.

Ever since the launch of Aadhaar by the UIDAI, it has become quite convenient for Aadhaar cardholders to apply for different services like opening a bank account, obtaining a driving license, applying for a passport, etc. In the same way, an Aadhaar number can be used to apply for a PAN Card as elaborated above.

In addition to this, your Aadhaar card is also used as a valid ID/address proof. So, if you wish to avail a home loan, for instance, you can visit Bajaj Markets and check out the loans available at competitive rates. Your Aadhaar card can then be submitted as a part of the paperwork.

FAQs on Apply for Pan Card Using Aadhaar Card

What does the ‘instant PAN card’ facility mean?

The Finance Ministry of India has established a new tool through the Income Tax department that offers quick PAN issuance based on the Aadhaar number. Moreover, the entire procedure is paperless and free of cost. Due to this new initiative, now you can conveniently apply for a PAN card through an Aadhaar card just by sitting at your home and obtaining a soft copy in just 10 minutes.

Can I apply for a PAN card if I don't have an Aadhaar card?

Yes. You can apply for a PAN card in the event of a lost Aadhaar card. However, if you have chosen your Aadhaar card as an identification document, you are mandated to provide your Aadhaar card.

What are the charges and fees for applying for a PAN card using an Aadhaar?

Applicants are required to pay a charge of ₹101, which comprises a processing fee of ₹86 and 18.00% Goods and Services Tax.

Can I apply for an e-PAN using my Aadhaar if I have misplaced my Aadhaar card?

No. In the event of a lost Aadhaar card, you can’t apply for e-PAN through Aadhaar. However, you may use another mode to apply for an e-PAN.

What should I do if I am unable to amend my date of birth during the e-PAN application process?

You can get the correction/change request form from the official website of UTI Technology Services Limited. To support a request for the correction or alteration of PAN data, such as date of birth, name, and so on, the applicant must submit additional required documents.

How long would it take for me to acquire my PAN card?

After submitting your application, you may receive your soft copy of your PAN card within 10 minutes. The hard copy of your PAN card, on the other hand, will be issued within 15-20 working days.

Is it necessary to link my PAN to my Aadhaar card?

No. You are not obligated to link your Aadhaar card with your PAN card.

What does the PAN card status ‘Application is inwarded’ mean?

It means your PAN card application has been successfully submitted and received by the authorities and further steps are being taken in accordance with it.

Are the PAN card and e-PAN the same thing?

e-PAN is the soft copy of your PAN card and regular PAN is the hard copy you receive. However, both cards contain similar details.

Will I receive all the notifications to my mobile number and email ID regarding my PAN card?

Yes. You will get all the updated notifications concerning your PAN card on your registered mobile number and email ID.