The government needs resources to pay its employees, fund welfare schemes and develop infrastructure. How does the government raise resources? There are several sources, but the primary source is direct and indirect taxes. Taxes that are levied directly on individuals or entities such as income tax and corporate tax are a direct tax, while goods and services tax and customs duty are an example of indirect tax. Due to outdated mechanisms and poor compliance, the tax base remains low in India. GST, implemented in 2017, subsumed several indirect taxes and helped in reforming the indirect tax system.

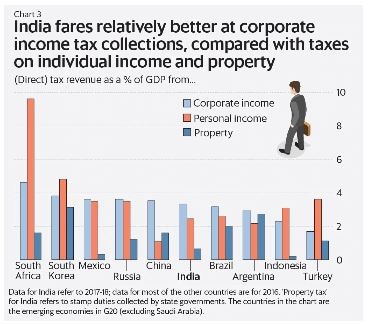

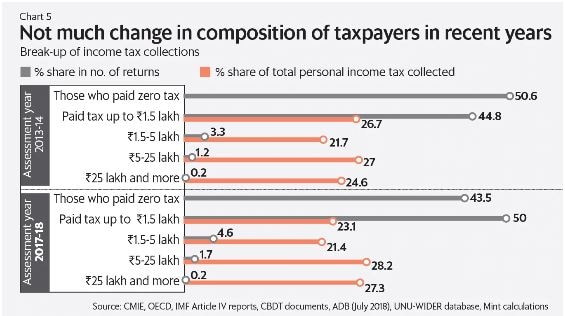

The direct tax system, however, remains out of sync with the modern economy. India had a tax-to-GDP ratio of 6% in 2017-18, which is decent when compared to other developing economies. When one digs deeper, then the anomaly in direct tax collection numbers come to light. The respectable figure is supported by robust corporate tax collections, but India fares poorly when it comes to personal and property tax collection. Only 1.5% of the 130 crore people in the country pay Income Tax and only 30,000 people earn more than ₹1 crore per annum. Together 90% of the taxpayers contribute just 23% to the tax revenue.

Successive governments have been trying to comprehensively revamp the direct tax system. The current dispensation had formed a task force under the leadership of Central Board of Direct Taxes (CBDT) member Akhilesh Ranjan in 2017 to draft a Direct Tax Code to simplify taxation in the country. After several delays, the tax force is expected to submit its report on August 19. Here are seven ways in which direct taxes may get reformed.

The task force has taken into consideration tax systems prevalent in other countries, international best practices and economic needs of the country to simplify the direct tax system. As part of the simplifications, the number of exemptions and deductions currently provided may be scaled down. The number of tax slabs may also be rationalised to five slabs. People earning less than Rs 5 lakhs may not be taxed, while Rs 5 Lakhs to Rs 10 Lakhs are likely to be taxed at 5%. Income between Rs 10 Lakh and Rs 1 crore is expected to be taxed at 10%. The next slab till Rs 10 crore could be taxed at 15% and anything above that at 20%. But considering the precarious revenue situation of the government, rationalisation of tax slabs may not be implemented.

It has been seen that a higher tax rate leads to lower compliance. The Direct Tax Code may raise the income tax exemptions limit to Rs 5 lakhs from Rs 3 lakhs currently. This will also result in more money in the hands of people which would boost consumption. Even though an annual income of up to Rs 5 lakh was made tax-free in the Interim Budget 2019, it was not entirely exempted. People below 60 years, who have an income between Rs 2.5 Lakh and Rs 5 Lakh were given tax rebate under Section 87A. Besides exemption on income, the government also allows tax deduction on investments. For instance, investment in health insurance is eligible for tax deduction under Section 80D of the Income Tax Act. You can get health insurance through Bajaj Markets with just a few clicks of the mouse.

Tax officials have often been caught harassing honest taxpayers. To root out corruption and reduce human interaction, the Direct Tax Code is likely to suggest processing a taxpayer’s return aided by technology. The new code will incorporate ‘faceless assessment’ which is likely to eliminate the possibility of the assessee and the tax official from getting to know each other.

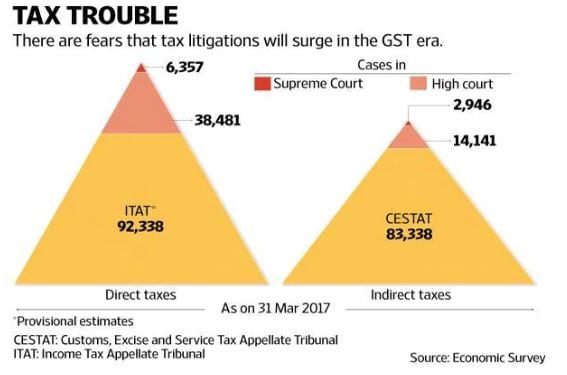

The government is the biggest litigator, and the tax department forms the bulk of government cases. One of the boldest reforms is likely to be the reduction of litigations and the time taken to decide on appeals by tax authorities and various courts. An alternative dispute resolution mechanism is also expected to be incorporated in the new tax code. Nearly 3.9 lakh tax cases are pending before several forums, which can be drastically reduced through a simplified law.

To reduce leakage, the new code may suggest sharing of information between GST authorities, customs officials and financial intelligence units. GST is a fool-proof system and cannot be bypassed as returns between sellers have to be matched for tax rebate purposes. When different tax information systems are integrated, it will be difficult to hide sales reported in the GST system from income tax returns.

The finance ministry has asked the task force to suggest measures to cross-verify transaction through IT tools. It is expected to cut red tape and increase efficiency. Use of IT systems will also make the system free from human manipulation.

Similar to what GST did with indirect taxes, the new tax code is expected to do with direct taxes. GST subsumed various indirect taxes and has helped in avoidance of multiple taxation on the same item. The task force is likely to suggest tax integration to eliminate instances of double taxation. For instance, the tax code may suggest either removal of taxes such as dividend distribution tax and securities transaction tax, or a form of set-off against income tax paid.

The report that will be submitted by the task force will be studied by the Central Board of Direct Taxes and officials in the revenue department. After suggestions are incorporated, the report will be forwarded for a political decision. The current economic slowdown has, however, raised a question mark over the acceptability of suggestions such as a reduction in tax incidence and an increase in tax exemption limit.

FAQs

What is the primary focus of the Direct Tax Code?

The Direct Tax Code focuses on reducing tax rates and simplifying tax laws. It aims to create a fair, efficient taxation system, ensuring transparency and minimizing disputes between taxpayers and the government.

Is direct tax good or bad?

Direct tax is generally good as it promotes fairness and funds public services. However, it can be challenging for higher income groups and may discourage investment.

Is TDS a direct tax?

Yes, Tax Deducted at Source (TDS) is considered a direct tax. TDS is collected directly from the taxpayer's source of income.

Quick Links