India was the sixth-largest economy in 2017, pushing France to the seventh spot. It was in striking distance of fifth-placed UK. In 2018, however, France and UK surged ahead, largely due to currency fluctuation, but also due to softening growth in India. The Indian economy has been battling a marked slowdown with demand for automobiles, FMCG, cement and steel slumping.

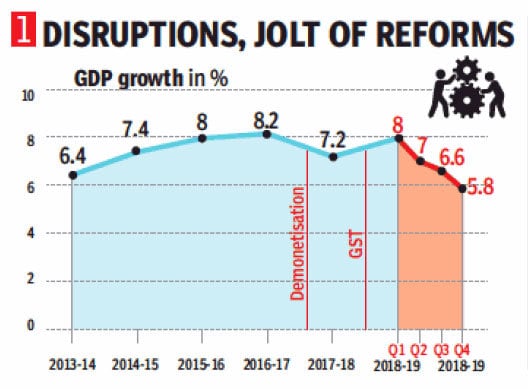

The inflation-adjusted or ‘real’ GDP growth rate witnessed gradual deceleration in 2018-19. Starting with 8.2 percent in the first quarter, growth declined slightly to 7.1 percent in the second quarter. The country’s GDP growth rate slipped to 6.6 percent in the third quarter and further deteriorated to 5.8 percent in the last quarter of FY19. The growth rate for the entire year was 6.8 percent as against 7.2 percent in 2017-18, confirming fears of an economic slowdown.

The Indian economy runs on four engines—consumption, private investments, government investments and exports. Investment by private entities in the country was sputtering since 2013 as a credit-fuelled boom in previous years had led to overcapacity. Even though merchandise exports hit a record high of $331 billion in FY19 in absolute terms, the growth was just 12.6 percent between 2014 and 2019. In contrast, the growth in merchandise exports was 69 percent in the preceding five years.

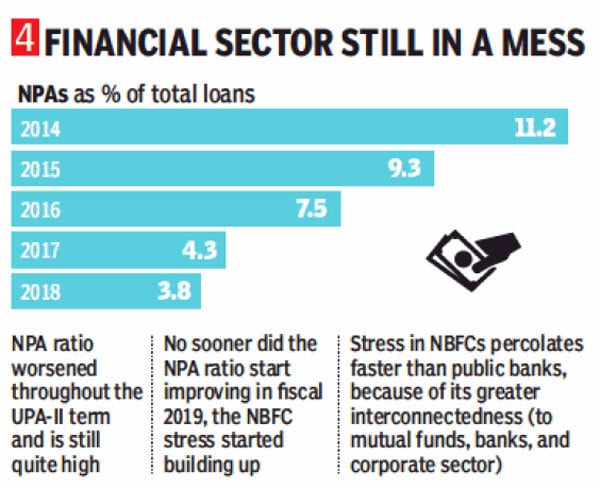

This leaves us with consumption and government spending. The two pillars supporting the Indian economy started faltering in 2016. The most important driver of the economy—consumption—took a hit due to demonetisation, which knocked off the largest informal sector in the country. It was followed by the disruption caused by the implementation of the goods and services tax in 2017. As the economy was getting accustomed to the change, the NBFC crisis hit with the default of sector behemoth IL&FS in 2018. The liquidity crunch led to the slowdown in consumption and the larger economy.

It is hard for the government to single-handedly drive the economy. That too when the government’s spending power is limited due to fiscal deficit constraints.

Focus on consumption

It is amply clear that the government will have to stimulate economic activity to spur growth. Since consumption accounts for 70 percent of our GDP, it is important to revive consumption to revitalise the investment cycle. A virtuous cycle will have to be created. When consumption increases, capacity utilisation will improve. When capacity utilisation will reach a critical level, companies will invest more to set up new factories. New factories will generate new jobs and further boost consumption, which will create a virtuous cycle in the economy.

Reviving the investment cycle is not a simple process. Several structural reforms will have to be initiated in tandem with medium and short term reforms. Medium and short term reforms will give an instant boost to consumption as structural reforms take 4-5 years to show results.

Tax Reduction

The best way to boost consumption is to leave more disposable income in the hands of the individuals and more investible surplus with businesses. It can be done through a slight reduction in income tax for individuals and implementing a 25 percent corporate tax for companies across the board. The goods and services tax slab rates can also be tinkered with to support specific crucial industries.

For instance, car manufacturers have been demanding a reduction in GST rate on vehicles to 18 percent from 28 percent to battle a severe slowdown being faced by the sector. The government can also make financial investments attractive through lower taxation. Tax saving mutual fund investments such as equity-linked savings scheme have come under the shadow of long term capital gains. Even after being taxed, ELSS remains one of the most tax-efficient investment options. You can invest in a wide variety of mutual fund schemes through Bajaj Markets from the comfort of your home.

Public Spending and Rate Transmission

The government could also boost public spending to develop infrastructure which generally has a positive impact on several connected sectors such as cement, steel, wires, paints and tiles. The government has been requesting the Reserve Bank of India to cut interest rates in order to improve liquidity. The RBI has reduced the repo rate in the last four consecutive monetary policy meeting, but the transmission has been weak. Banks have passed on only 1.1 percent of the total 2.6 percent reduction in interest rates to the industry and consumers. The government could nudge banks to improve the transmission of rate cuts to consumers.

Structural Reforms

Besides immediate steps, the government will have to take some long-pending structural reforms. The government should focus on relaxing FDI rules, land and labour reforms and ease of doing business. The government should take up long-pending land and labour reforms to make land acquisition easier for industries and reduce labour compliance costs. The majority of jobs are generated by the micro, small and medium enterprises and they continue to face high compliance costs across the country. A focus on ease of doing business beyond major cities like Delhi and Mumbai and help in improving investment sentiments. Source: SIMCON Blog.

Without fresh investments, it is very difficult to generate meaningful jobs. The revival of the investment cycle has become the most pressing need for the economy currently. The government can also take sector-specific steps that employ a large number of people. A tailor-made package for the automobile and real estate industries could give an instant boost to the economy as these industries employ a large number of people.

Quick Links