What happens when one of the wheels of a vehicle comes off? It could lead to a catastrophic accident. If India is the vehicle, the automobile sector is one of the wheels. The Rs 4.8-lakh-crore auto industry employs 37 million people and single-handedly contributes 7.5 percent to the country’s GDP and 49 percent to the manufacturing GDP. The crucial sector is battling an unprecedented slowdown.

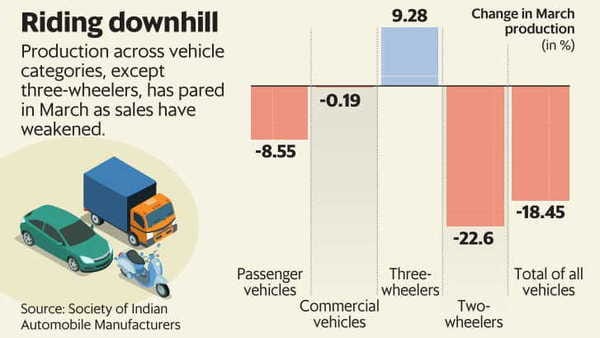

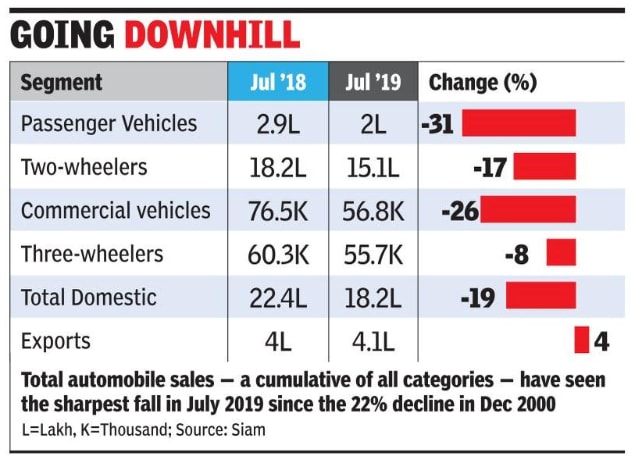

The Indian auto sector had been growing at a rapid pace. With sales of over 4 million cars and commercial vehicles, India had surpassed Germany to become the fourth largest automobile market in the world last year. All that seems like a dream now with companies reporting a double-digit decline in sales. According to data from industry body Society of Indian Automobile Manufacturers, sales across categories, including cars and two-wheelers, declined 19 percent to 1.8 million units in July. July is no outlier, automobile sales have been declining for nine consecutive months.

The importance of the automobile industry stems from the extensive backlinks of the sector. Major companies are supported by thousands of small component manufacturers, besides tyre, plastic, steel and paint manufacturers. On the front-end, many entrepreneurs who operate vehicle dealerships are dependent on the sector. The slowdown has resulted in the closure of 286 dealership outlets in the 18 months to July. Every major car manufacturer has either initiated production cuts or has halted production for a few days. The drastic slump has resulted in 3.5 lakh people losing their jobs as manufacturers, component makers and dealers are rationalising operating costs.

It has been convincingly established that the auto sector is facing one of its worst slumps. What led to the slowdown in the crucial sector? The answer is not simple, as the industry is facing a slump due to a mix of factors.

In recent years Non-Banking Financial Companies had helped finance nearly 55-60 percent of commercial vehicles, 30 percent of passenger cars and nearly 65 percent of the two-wheelers in the country. NBFCs are facing a funding crunch after the collapse of one of the biggest shadow bankers IL&FS. Since raising funds has become difficult and costly for NBFCs, they have slashed lending drastically affecting the auto sector.

Besides the liquidity crunch, softening of rural demand, price increase and change in axle norms have impacted the industry. The demand for vehicles has decreased, especially in rural areas, which has specifically impacted tractor and two-wheeler sales. Generally, when sales dip, companies decrease the price of the product, but auto companies cannot take price cuts to boost demand. The introduction of Bharat VI emission norms from April 2020 has led to an increase in the price of automobiles, especially diesel vehicles. Higher motor vehicle insurance costs and stricter safety requirements too have resulted in an increase in the acquisition cost of vehicles.

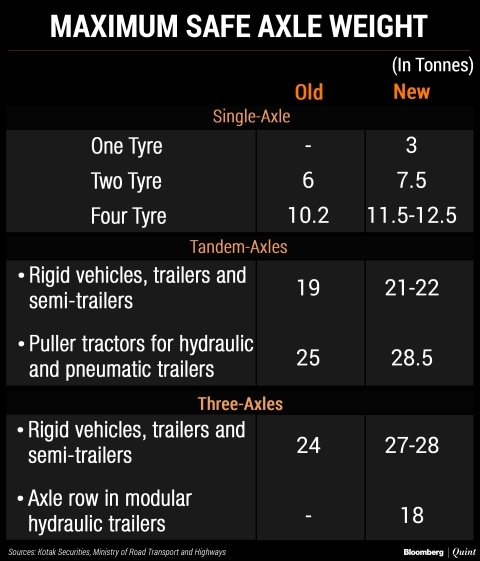

Commercial vehicle sales have faced the brunt of new axle load norms. The government with an aim to reduce logistics costs increased the official load-carrying capacity of heavy vehicles by 20-25 percent. The decision had the unintended effect of reducing the demand for new commercial vehicles. Along with a few short-term factors, the auto industry has also been signed by some structural changes. The rising acceptance of shared mobility solutions such as Uber and Ola is likely to have hurt the sale of new vehicles. The uncertainty created by the shift towards electric vehicles has rattled original equipment makers as well as component manufacturers. The confusion is more evident in two and three-wheeler manufacturers who may have to compulsorily shift to battery-powered vehicles by 2015 and 2022, respectively.

The auto sector is battling a slowdown for a variety of reasons. Some can be solved through policy interventions, but carmakers may have to live with some. Demand for automobiles cannot be revived without reducing the cost of finance. The government will have to gently prod the banks to increase direct lending to the sector as well as to NBFCs. Consumption can also be given a boost through the reduction of goods and services tax on vehicles. Currently, automobiles fall in the highest 28 percent GST bracket. They can be brought into the 18 percent bracket, which will reduce the cost of vehicles and spur demand. Auto companies will also have to adjust to the softening growth of new car sales. To remain profitable, car dealers will have to share overhead expenses and experiment with multi-brand showrooms.

Quick Links