On July 5, India’s first full-time female Finance Minister Nirmala Sitharaman presented the Union Budget 2019. A country’s budget is similar to a household budget. Just like every household, the government has several expenses and has many sources of income. Through a budget, the government provides a statement of revenues and expenditure for a fiscal year. One of the most surprising announcements of the union budget was the fiscal deficit target for 2019-20 (Apr-Mar). The government revised the fiscal deficit target to 3.3% of the GDP from 3.4% announced in the interim budget.

What is a fiscal deficit?

The government earns through various means such as taxes and dividends from companies it owns, among other things. It also has many expenditures like subsidies, salaries and infrastructure investments. The government aims to balance its revenues and expenses, but being a developing country Indian government’s expenditure outstrips its income. The shortfall between the revenue and expenditure of the government is known as fiscal deficit. In case, revenues are more than the expenditure, it is known as fiscal surplus. The fiscal deficit is also a measure of borrowings needed by the government in a year. The government’s borrowings are not considered as revenues and hence do not help in balancing the budget.

The fiscal deficit in India is expressed as a percentage of the gross domestic product. For instance, when the finance minister announced a fiscal deficit target of 3.3%, she meant the fiscal deficit will be 3.3% of the GDP. With a projected GDP of Rs 211 lakh crores in 2019-20, the fiscal deficit in the year is estimated to be around Rs 6.96 lakh crores.

How does the government bridge fiscal deficit?

There are several ways in which the government manages the fiscal deficit. The primary tool is to borrow through treasury bills and bonds. The bulk of the deficit is bridged through debt instruments, which is why the budget deficit is also known as the measure of borrowings. Banks and financial institutions are the primary buyers of T-bills and bonds. T-bills are short term debt instruments issued by the government. It does not pay any interest and is sold at a discount to its face value. At the time of maturity, the government pays the face value. For instance, suppose a 91-day T-bill is issued at Rs 97. After maturity, the government will pay Rs 100 to the investor, earning him a profit of Rs 3. Bonds are long-term debt instruments which the government issues to finance large projects or bridge huge deficits. Government bonds are interest-paying instruments and can also be traded in the market.

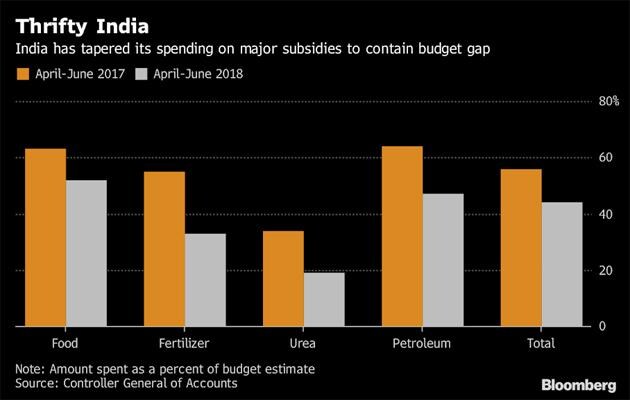

Source: Bloomberg

What guides fiscal deficit targets?

Huge fiscal deficits every year are not desirable as it leads to increased borrowing by the government. Long-term borrowings add to the interest burden of the government which results in additional borrowings every year just to pay the interest on previous borrowings. To inculcate financial discipline in government expenditure, the Fiscal Responsibility and Budget Management (FRBM) Act was enacted in 2003 which set targets for the government to reduce fiscal deficits. After the targets were put off several times, the government constituted a committee under NK Singh to review the act. The committee recommended that the government should target a fiscal deficit of 3 percent of the GDP in years up to March 31, 2020, reduce it to 2.8 percent in 2020-21 and 2.5 percent by 2023. The government has been failing to meet targets set by the NK Singh committee due to several factors such as low GST collections, a spike in oil prices and pressure to spend more to boost slowing consumption.

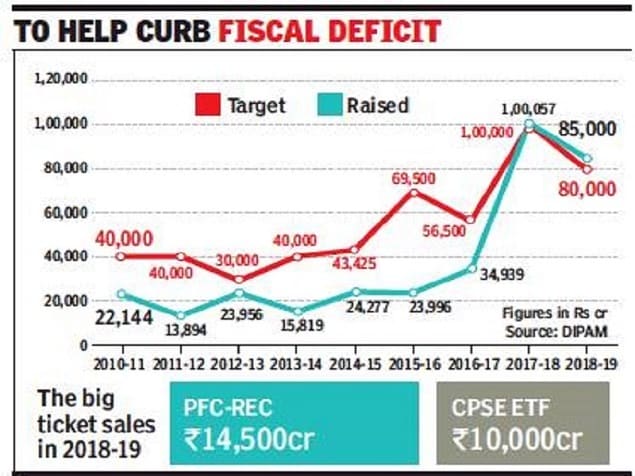

Source: The Times of India

Conclusion

The present dispensation has increasingly relied on divestment to shore up revenues. In the union budget, the disinvestment target has been increased to Rs 1.05 lakh crore from Rs 90,000 crore estimated in the interim budget. Some reports also point towards smart accounting by the government to meet the fiscal deficit target. The government rolled over some expenditure from 2018-19 to the current fiscal year to contain the fiscal deficit. For instance, the government did not pay the entire amount on fertiliser subsidy that was budgeted. A part of it has been rolled over to 2021.