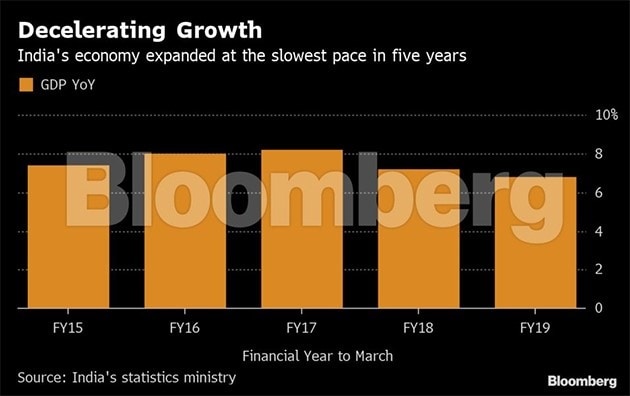

After a sweeping election victory, Indian Government is hoping to use the Union Budget to restart reforms across a range of sectors and tackle the country’s economic woes. The Budget comes at a crucial juncture - growth has slowed to a 5-year low of 5.8% in the first quarter of 2019 and the economy has been going through a difficult phase - prompting many to look at the Budget as a roadmap to boost recovery.

Union Budget 2019 aims to push for growth while ensuring mechanisms for fiscal stability are in place, the financial budget will have to tackle rising unemployment, decelerating consumption, a truant monsoon and weakening credit markets. With banks cautious of lending due to rising non-performing assets (NPAs), private investments have taken a setback - resulting in unemployment and a decrease in job creation. The interim budget earlier this year failed to address the deepening employment crisis in the country, with funds allocated for job schemes decreasing to ₹60,000 crore for the financial year.

The Union Budget should aim to support investments by providing allocations for public expenditures, while enabling incentives for private investors. In order to strengthen the economy, the Finance Minister should target the following key areas to drive change:

Budget 2019 – Power Sector

For developers facing stressed and idle assets, including power projects as part of investments that are eligible for deductions and enabling restructuring of loans will provide significant relief to the industry. Moreover, making room for tax incentives and providing subsidies will drive demand for solar installations and other emerging technologies that support green energy. The general budget should also cut out a clear plan for the usage of electric vehicles, while including subsidies for buyers and allocating funds for further research and development initiatives.

Budget 2019 – Infrastructure Sector

Touted to be a critical sector for the country, infrastructure is crucial to driving demand. It’s oftentimes marked as a gamechanger for transport and logistics, and is the second biggest area that provides employment opportunities after agriculture. The Government should increase allocations to sustain, if not increase, the momentum of developing highways, metro connectivity, roads, improved ports and freight corridors. A huge factor that would support the plan would be to simplify land acquisition norms and issuing bonds that provide benefits like tax-free income. This would play an important role in raising ample capital for financing infrastructure projects.

Budget 2019 – Employment Sector

To promote job creation, the Government will need to support projects that invests in and incentivises sectors that taps into the workforce and provide employment opportunities. Sectors such as manufacturing, logistics and transport, construction, retail, textiles and tourism employ a significant number of workers. By providing avenues like special economic zones that come with tax benefits, cheaper land and acquisition costs, and duty exemptions for imported products and services, the Government can support initiatives that go beyond job schemes like the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA).

Income Tax Slabs in India

The Union Budget’s tax slabs and corporate tax rates can be rationalised, with reductions in the corporate tax slabs increasing the probability of investments and also aligning the tax rates with that of other countries. This would improve the country’s competitiveness. Better yet, expenses that are tagged under corporate social responsibility (CSR) schemes of the company should be accounted as an expense, rather than marking them as profits. Tax reforms that increase the disposable income for consumers could incentivise them to spend more and thereby, increase consumption while sustaining their savings. For the middle-class worker, tweaking the income tax slab for FY 2019-20 by increasing the basic exemption limit to ₹5 lakh will bring much cheer. Along with the Union Budget’s income tax exemptions, enhancing tax deductions in ULIPs under Sec 80C and health insurance premiums under 80D will amplify disposable income in the hands of the consumer.

The upcoming budget day is an opportunity to steer the economy towards recovery, with a heavy focus on growth, reforms and a stable policy environment. “Now that elections are over and the country has given an unambiguous verdict, this budget should take some hard decisions towards initiating a host of structural reforms that would trigger off corporate investment,” remarked Partha Ray, a professor at IIM, Kolkata.