India’s first woman Finance Minister, Nirmala Sitharaman, has her hands full. She will present the Union Budget for 2019-20 under Prime Minister Narendra Modi’s second Government term on July 5, 2019. The budget is expected to deal with falling economic growth and high rates of unemployment. For this reason, economists are keeping a close watch on fiscal measures to boost domestic economic growth, rural consumption and welfare spending towards programs announced by Modi’s Government.

In 1970, Indira Gandhi was the first woman minister to hold responsibility for the post in addition to being the Prime Minister. Almost half a century later, Sitharaman’s policies are under close scrutiny as there is pressure to uplift India’s position from its five-year low of slumping growth. In the first three months of 2019, growth slowed to 5.8%, pushing the country’s status as the fastest-growing economy below that of China’s at 6.4% expansion. Rainfalls have been almost negligible in large parts of the country. Farmer distress has risen. Several industries including telecommunications, power production and real estate are performing dismally. The focus is now on the Government to play its role in stabilizing India’s performance in key areas. Let’s look at some of the crises faced by the country today and what the Finance ministry must address in the Union Budget.

Budget 2019 - Reformation of labour laws and minimum wages

The Cabinet on Wednesday approved the Wages Bill that will be introduced in the Budget session. The bill seeks to universalize the provision of minimum wages and timely wage payments to all employees irrespective of their sector or wage ceiling. Currently, the Minimum Wages Act and Payment of Wages Act is only applicable to workers below a particular wage ceiling working in specific employment. The bill would ensure that each worker is provided with a minimum wage and each state would notify the wage payments to workers digitally.

Source: Business Standard

The central Government will take the decision to set a separate minimum wage for different regions or states. In February, a Government-appointed expert committee had proposed doubling the minimum wage for a worker to Rs. 9,750 a month (up from Rs. 4,576). Details of this legislation will be another key highlight of the upcoming budget since rationalizing labour laws is usually seen as a cumbersome and politically risky task.

Budget 2019 - Focus on internal connectivity and road infrastructure

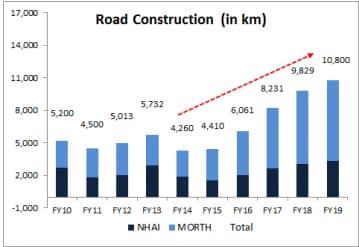

With regard to the roads and highway construction front, the Government had announced an ambitious Bharat Mala Project (BMP) meant to optimize and increase the efficiency of road freight and passenger movement. Due to the Government’s inclination for further disinvestment and privatization in this sector, there is likely to be more space in the budget for road infrastructure. The significance of a road network is understated in an economy’s progress cycle. Good quality road infrastructure boosts trade and promotes the development of towns and cities through easier access and improved connectivity.

Source: Bajaj Allianz Life Research

The road transport ministry this year set an ambitious target for itself by seeking Rs. 1.20 lakh crore as budgetary support. However, the interim budget had sanctioned Rs. 83,000 crore towards the ministry. If the Union Budget 2019 is unable to sanction the requested amount, there could be compromises in pending expenditures related to National Highway development and construction, as per a report citing senior officials of the ministry. Data from the National Highway Authority of India displays notable progress of the Government’s road construction in its previous term. More such projects are expected to be part of the financial budget 2019 to ensure the investment cycle continues.

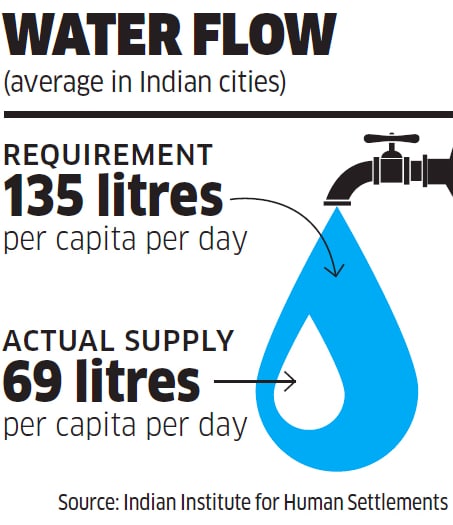

Budget 2019 - Need for urgent water conservation practices

The current Government has created a new ministry to deal with its threatening water crisis - the Ministry of Water Power or Jal Shakti. More than 60% of the country’s population is dependent on farming and favorable monsoons. However, water shortages are one of the biggest problems in states like Tamil Nadu, Karnataka and Uttar Pradesh and are likely to be worsened by climate change in the coming years. It is crucial that the Finance Ministry allocates significant funds towards water conservation and management in the upcoming general budget.

How else is the water crisis meant to be dealt with? Traditional water conservation practices have been lost through the generations. This has made it even more unfavourable for villages and towns that the country is dependent on for food consumption. Now that the water situation has gained national attention in the country, the budget will be inspected for inclusion of financial backing towards water management.

Budget 2019 - Pre-election promise of Rs. 25 lakh crore agri-rural investment

The Indian economy cannot be revived unless its agriculture and farm welfare is taken care of. The Government had promised to double farmers’ income by 2022 due to large-scale farm distress in the last few years. Welfare schemes such as a direct money transfer plan, farm insurance and soil health cares are needed to make this sector economically viable but it cannot be done without sufficient financial assistance from the Government.

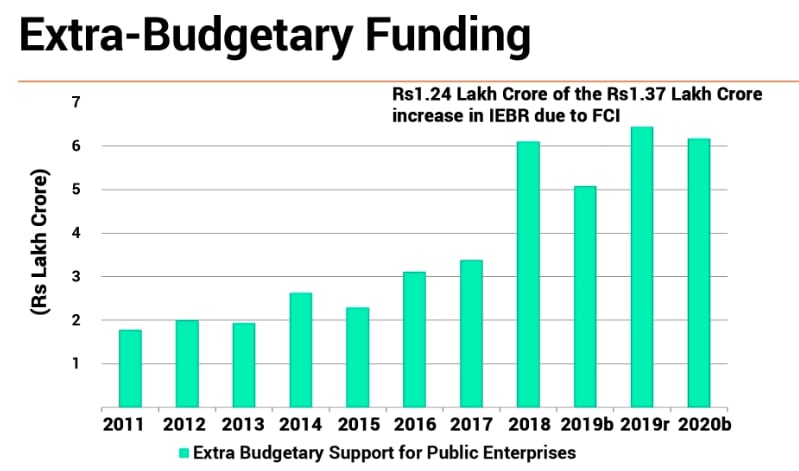

Source: Budget Documents, Credit Suisse Research

Balancing agricultural productivity along with limitations of scarce water resources by way of an inclusive strategy will highlight the efficacy of the budget this year. The Food Corporation of India (FCI) has an outstanding debt of about Rs. 1.81 lakh crore from the National Small Savings Fund for procurement of foodgrain for the public distribution system. The Government has already provided about Rs. 80,000 crore to the FCI for the shortfall. Out of the guaranteed Rs. 100 lakh crore investment in infrastructure, Rs. 25 lakh crore has been promised to the agri-rural sector. This will be one of the most watched promises in the budget.

Income Tax Slabs in Budget 2019

A popular question doing the rounds is whether high net worth individuals will be taxed more through an additional levy or reintroduction of wealth tax. Wealth tax, which is a higher tax on the super-rich, is a concept borrowed from developed countries where social security regimes drive the Government. However, in a developing economy like ours, it is imperative to evaluate the outcomes of such a proposal before taking an informed decision. Due to the absence of social security protection of Indian citizens, taxing the wealthy may turn out to be a dis-incentive to creation of wealth. The general budget should ideally represent measures that indicate a thorough analysis of widening the tax base, creating a better regulatory framework and keeping the tax-rate structure simple. People should be encouraged to invest in instruments like Unit Linked Insurance Plans (ULIPs) to get tax exemptions under Section 80C of the Income Tax Act.

Conclusion

Since the economy is now under the second-term of NDA administration, fiscal deficit levels are not a worry. Other emerging situations that directly affect the daily lives of an individual can be addressed through a top-down approach by the Government. The concerns outlined above are broadly what most economists, professors, think tanks and businesses will be interested in. Since the budget cannot expand on every major announcement and policy change, we can hope only for streamlined measures that uplift the current domestic economy.