Know about Form 16, its importance for salaried employees and how to download Form 16 online easily.

A Form 16 is one of the most important documents you may require when filing your income tax return. It might not only provide details about your salary and tax deductions but could also act as a reliable proof of tax paid. This document can make the process of filing an IT return much simpler, especially for salaried individuals. This guide explains more about Form 16 and how to download it online with ease.

Form 16 is a certificate which an employer issues to a salaried employee. It gives a summary of the income you earned and the tax deducted (TDS) during the financial year. This document is usually issued annually after the end of a financial year.

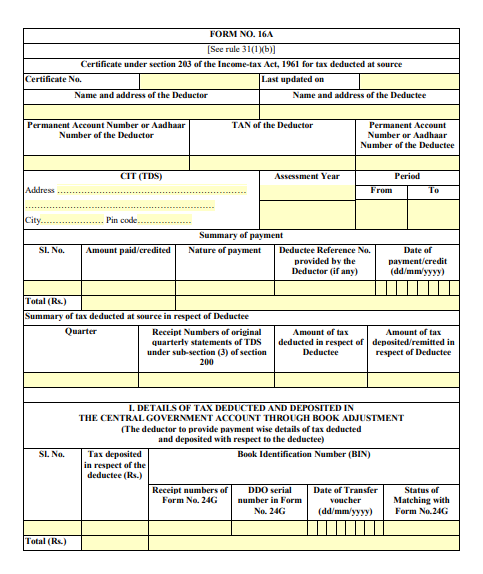

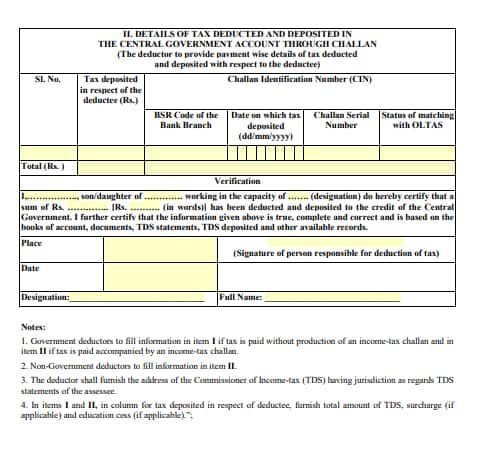

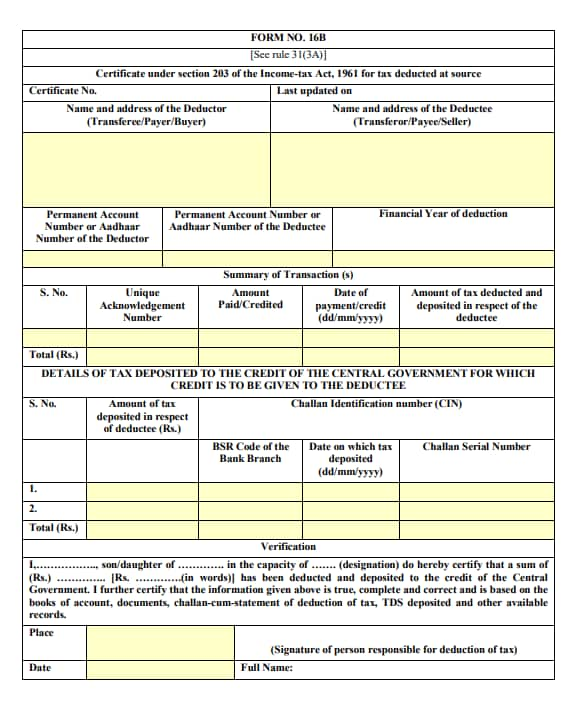

Form 16 is divided into two parts:

Part A - Key Details:

Employer's name

Employer's PAN

Employee's PAN

TDS deducted and deposited

Other related information

Part B - Income and Tax Breakdown:

Salary and allowances

Deductions under Section 80C to 80U

Taxable income

Tax payable

Form 16 plays a key role in helping salaried individuals file their Income Tax Returns accurately. Here’s why it’s important and how it simplifies the process:

Acts as a proof of tax payment

Makes it easier to file your ITR correctly

Helps you verify details like gross salary, deductions, and taxable income

Required when applying for visas, home loans, or during financial verification

Useful for claiming refunds or avoiding tax mismatches

For Employees:

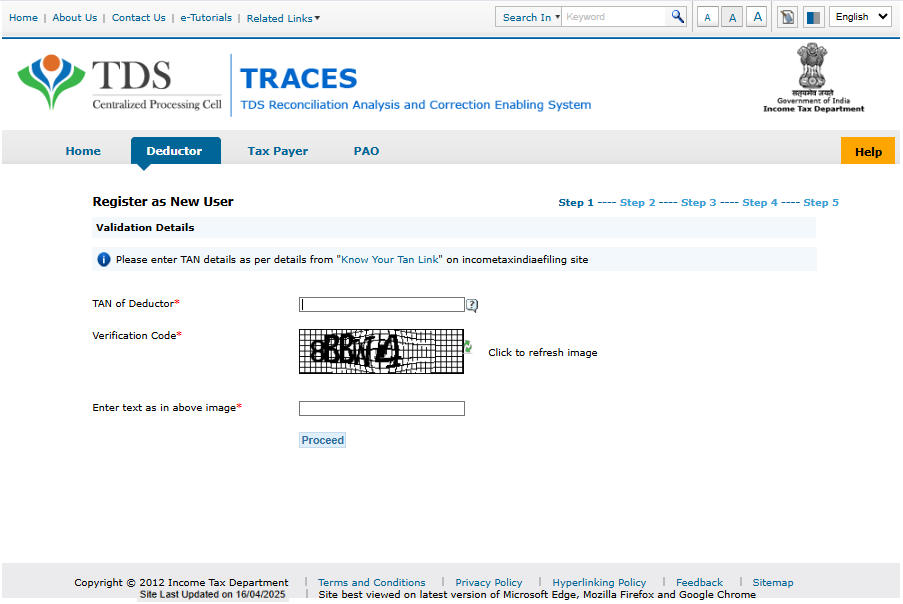

Usually, employers generate Form 16 using the TRACES portal (TDS Reconciliation Analysis and Correction Enabling System), available at https://contents.tdscpc.gov.in/en/taxpayer-home.html. They generally provide it to employees by June 15th after the conclusion of the financial year in which the income was earned.

Here’s how you may access it:

Check your email inbox – Many companies might email Form 16 directly to their employees.

Login to your HR portal – If your organisation uses a self-service HR system, you could download Form 16 from there.

Request it – If not shared, you may request your HR or payroll department to send it to you.

For Employers (Generating Form 16 Online):

If you’re an employer or authorised to handle payroll:

Visit the TRACES portal.

Log in with TAN credentials.

Go to Downloads > Form 16.

Select the assessment year and enter required PAN details.

Submit the request and download the Form 16 ZIP file once processed.

Even without Form 16, it's still possible to file your Income Tax Return (ITR) by using alternative documents and details such as:

Collect payslips to calculate your taxable income

Check Form 26AS for exact TDS details

Claim HRA if you're paying rent and might be eligible

Add all eligible deductions (like under 80C, 80D, etc.)

Include income from other sources (like interest)

Pay additional tax if needed

File your Income Tax Return online

FAQs About Form 16

How can I download my Form 16?

If you are wondering how to get Form 16 online, remember that only the deductor, i.e., the employer, can generate it. The employer will issue you a certificate for TDS deductions made during the financial year.

How can one generate Form 16?

To generate Form 16, an employer must log into the TRACES portal website using the User ID and password. They need to select ‘Form 16’ and enter relevant details, including the assessment year. Click on the ‘Go’ button to generate the form and download it.

How can I get Form 16 for salaried employees?

Salaried employees cannot download Form 16 online. A salaried employee must request their employer or company’s HR team to issue the form.

What is the password for Form 16?

If you are an unregistered user, you can log in to the TRACES website using the TIN and TAN. Enter the former as your User ID and the latter as your password to log in as a deductor.

Can I download my Form 16 certificate without enrolling myself on the TRACES website?

Yes, you can get Form 16 online without enrolling yourself on the TRACES website. Form 16 Part A and Part B can be downloaded online in a PDF format from the Income tax website.

What if Form 16 is lost?

Learning how to get Form 16 again if you have misplaced or accidentally deleted the file is simple. Request your employer for a duplicate of the document. The TRACES portal allows deductors to generate this form online easily.

Can I view Form 16 online?

Only the employer can access the form from the Income Tax website. You can view the form once the employer issues it to you.

When can I get Form 16?

The employers must issue Form 16 to their employees by June 15 of the assessment years. So, if your employer has deducted TDS between April 2023 and March 2024, they will need to issue Form 16 by 15th June 2024.

Can I get Form 16 if no TDS is deducted?

No, your employer will provide you with Form 16 only when they deduct TDS from your income.

Can I file my income tax return without Form 16?

Yes, you can. However, you may need to submit other documents, such as Form 26AS, if your income exceeds the exemption limit.

Can I fill out Form 16 myself?

No, only the employer (deductor) can issue and download Form 16 online from the TRACES portal.

Quick Links