Stay compliant and maximise your financial benefits by understanding the essentials of tax filing.

Accurate and timely ITR filing is a legal requirement. It is essential for maintaining financial transparency and contributing to the Indian economy. Individuals and businesses can easily e-file their ITR with a little help.

To navigate the e-filing of income tax efficiently, you must understand the process. Also, know the required documents and other considerations. This will ensure you choose the appropriate ITR form for your situation.

Here’s how you can file your ITR through Bajaj Markets:

- Enter your number and email address

- Verify the details and click on ‘Submit’

- Enter the OTP sent to your registered mobile number

After this, you will be redirected to Quicko’s official website. Here, you can explore a range of tax filing services offered.

Here are some simple steps to follow when completing your income tax e-filing through the official website:

Step 1: Access the e-filing portal

- Login to the official income tax e-filing portal of India using your PAN details

Step 2: Initiate e-Filing ITR

Go to the 'e-File' tab and click on 'Income Tax Returns'

Select 'File Income Tax Return' to begin e-filing your income tax

- Choose the assessment year and select 'Online' for the filing mode

Step 3: ITR Details

Select your filing status (Individual, HUF, Others)

Choose the appropriate ITR form based on your income and circumstances

- Briefly explain why you're filing an ITR (e.g., regular filing, revised return, etc.)

Step 4: Enter Tax Information to Complete the Return

Review and confirm the accuracy of pre-filled data from previous filings

Enter your bank account details, income sources, investments, exemptions, and deductions

- Settle any outstanding tax liabilities before submission

Step 5: Finalise and Verify the ITR

- Electronically verify your ITR within 30 days using Aadhaar OTP, EVC, or Net Banking. This confirms your submission and completes the e-filing process.

Following these steps, you'll receive confirmation from the Income Tax Department of India. Keep a copy of the submitted form and receipts. If required, pay any tax due or request a refund.

Note: These steps might vary slightly depending on the specific platform used. You can use online e-filing services or consult a Chartered Accountant (CA) for help.

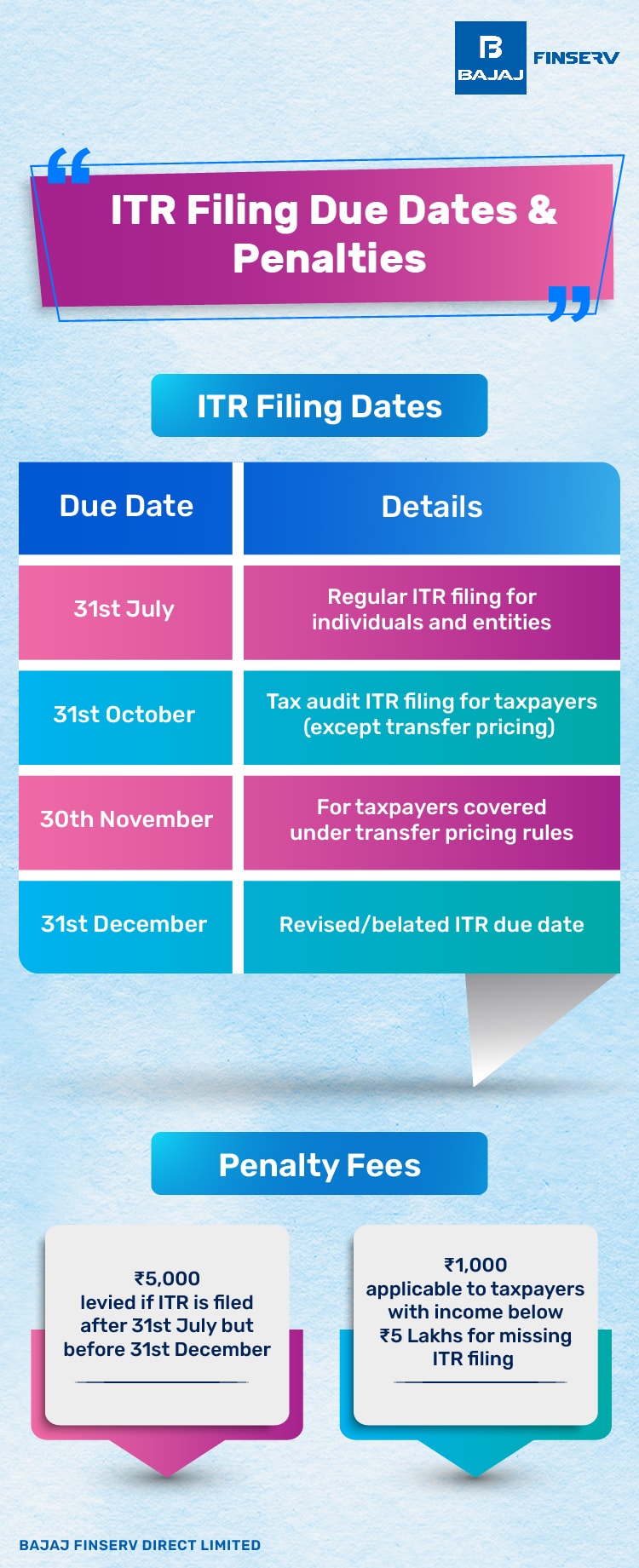

In India, understanding ITR filing deadlines is crucial. Missing these deadlines can result in penalties. Let's take a look at the due dates and associated penalties.

Electronically file your ITR by 31st July to ensure timely filing

The due date for taxpayers required to undergo a tax audit is 31st October

If you're covered under transfer pricing rules, the due date to file your ITR is 30th November

You can revise your ITR by 31st December

A penalty of ₹5,000 applies for ITRs filed after 31st July but before 31st December

Taxpayers with an income below ₹5 Lakh facing a late filing penalty will pay a reduced amount of ₹1,000

The requirement to file an ITR in India depends on your income source. It also depends on your age and total income for the financial year. Those who typically need to file include:

Salaried Individuals

If your total income exceeds the basic exemption limit, you must e-file your ITR. This includes salary, interest, and rental income. Use your ITR login credentials on the official income tax e-filing website.

Business Owners and Professionals

Business owners must file an ITR if their annual income exceeds a specific limit. The same applies to those practising professions as defined by the Income Tax Act, 1961.

Individuals with Other Income Sources

If your income from capital gains, rental income, or interest exceeds the limits, you must file an ITR. This step is mandatory in such cases.

Senior Citizens with High Income

Senior citizens (aged 60-80) must file an ITR if their total income exceeds the basic exemption limit. Super senior citizens (aged 80 and above) enjoy a higher exemption limit.

Identity Proofs

PAN Card

Aadhaar Card

Income Proofs

Form 16 (Salary Income Certificate)

Form 16A, 16B, and 16C (For specified income sources)

Tax Information Details

Form 26AS (Tax Credit Statement)

AIS/TIS (Annual Information Statement/Tax Information Statement) (if applicable)

Investment and Deduction Proofs

Bank Statements (for income and deductions)

Investment Statements (mutual funds, stocks, etc.)

Capital Gain Details (for selling assets)

Rent Receipts (if claiming HRA deduction)

Medical Bills (if claiming medical expense deduction)

Life and Health Insurance Statements (for premium payments)

Loan Statements (for interest payments)

Receipts of Donations (for claiming charitable donation deduction)

Tax filing can be complex. However, these factors can help you understand e-filing your ITR online. Here are some key points to consider on the income tax e-filing website:

Accuracy and Updates

Make sure all information on your ITR is accurate. It should reflect your current income sources and deductions.

Calculation Errors

Double-check your calculations to avoid discrepancies in your tax liability.

Tax Regime Selection

If applicable, choose the appropriate tax regime. Consider its impact on tax rates and eligibility for deductions or credits.

Complete Income Reporting

Fully and truthfully disclose all your income sources.

Signing and Dating

Don't forget to sign and date your return before submitting. If filing jointly, both spouses must sign.

Supporting Documents

You might need to attach supporting documents based on your claimed deductions. These can include receipts, invoices, or investment statements when e-filing your ITR.

Tax Payments

Monitor your tax liability throughout the year. Make timely payments to avoid penalties.

Deduction Optimisation

Explore deductions you may qualify for to reduce your tax burden. Consulting tax resources or professionals can help maximise your tax benefits.

Deadline Awareness

Monitor ITR filing deadlines and tax payment due dates to avoid late filing penalties.

Record-keeping

Make copies of your ITR filing for future reference. Keep copies of supporting documents and any correspondence with tax authorities.

Here are some aspects to note once you have successfully filled your ITR:

Verify Your ITR

This crucial step confirms your ITR submission. You have 120 days to do this using Aadhaar OTP, EVC, or net banking.

Save a Copy of Your ITR

Download and save a copy of your complete ITR filing. This includes the acknowledgment and any supporting documents attached. This serves as proof of successful submission.

Supporting Documents

Keep copies of all documents submitted with your ITR for at least six years. This is important in case of inquiries from the Income Tax Department.

Track ITR Processing Status

Check your ITR status on the income tax e-filing website. Use your PAN and login credentials.

Check for Tax Refunds

If your ITR processing shows an excess tax payment, the department will notify you. You will receive a refund to your linked bank account.

Pay Outstanding Dues

If your ITR processing shows any tax due, pay it within the given timeframe. This will help you avoid penalties.

If you have any concerns or queries related to tax filing, you can raise a request by clicking here.

Follow these simple steps to get started:

Login using your mobile number and Date of Birth > Enter OTP > Click on ‘Raise a Request’ > Select Product as VAS and Product Type as Tax Filing.

Queries Related to ITR e-Filing

Can I file my ITR online by myself?

Yes, you can navigate the ITR filing process yourself without a Chartered Accountant (CA). The Income Tax Department of India provides an official e-filing website. This user-friendly platform allows you to e-file your ITR directly.

Is it mandatory for a salaried person to file an ITR?

Yes, salaried individuals earning above the basic exemption limit must file their ITR. The limit is ₹2.5 lakhs for the old regime and ₹3 lakhs for the new regime, as per the Income Tax Act, 1961.

What is the last date to file my ITR online?

The deadline for ITR filing is July 31st. A late filing option is available until December 31st with a penalty.

My employer deducts TDS. Do I still need to file my income tax return?

Yes, TDS deductions and ITR filing are separate requirements. Your ITR reflects all taxes paid, including TDS. It helps identify any tax dues or potential refunds.

What is the last date for ITR 2.0 filling?

In case you miss the July 31st deadline then you can still file a belated return by December 31st. However, keep in mind that late filing can lead to excessive penalties and charges.

What is the difference between ITR-2A and ITR 2?

The only difference is that ITR-2A cannot be used for income with capital gains.

Quick Links