India’s finance minister, Nirmala Sitharaman, presented the first Union Budget 2019 of Modi’s second government on Friday. She announced that the Indian economy will grow to a 3 trillion dollar economy within the financial year. Towards this end, measures towards how the government expects India to boost its status as the world’s fastest growing economy were presented. Although several proposals to boost India’s infrastructure were announced, the first key concern for any individual is how would hard-earned income be taxed? Are there any benefits or limitations for the regular taxpayer? Let’s take a look at the state of personal taxation under the new general budget.

The government declares that its taxation policy is meant to stimulate growth, incentivize housing and encourage startups by uplifting their entrepreneurial spirit. The policies are aimed at simplifying tax administration and bringing about greater transparency in the economy.

Income Tax Budget 2019 - Increase in direct tax revenue

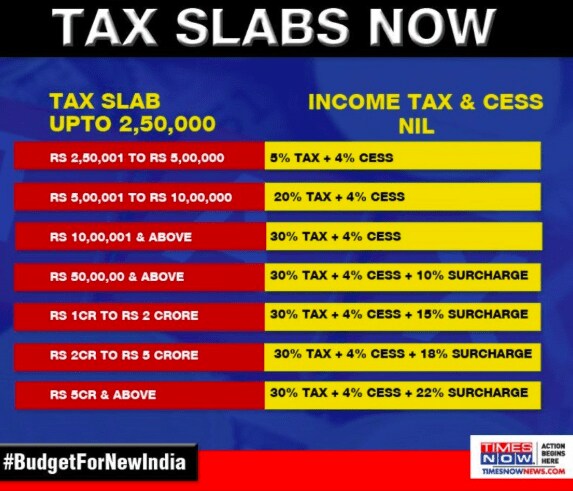

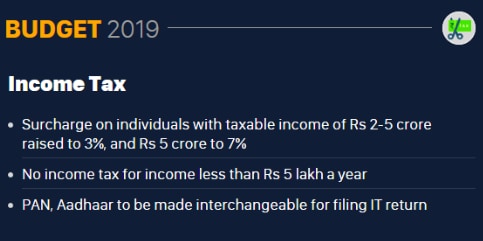

According to the government, direct tax revenue has increased over the past couple of years from Rs. 6.38 lakh crores in 2013-14 to Rs. 11.37 lakh crores in 2018-19, a significant 78% rise. The figure is growing at a double digit rate each year. The government has indeed made an effort made over the past five years to relieve tax burden on small and medium income-earners. This includes individuals who are self-employed and make a living as small traders, salary earners and senior citizens. They are taxed only if their annual taxable income exceeds Rs. 5 lakh.

Source: Times Now

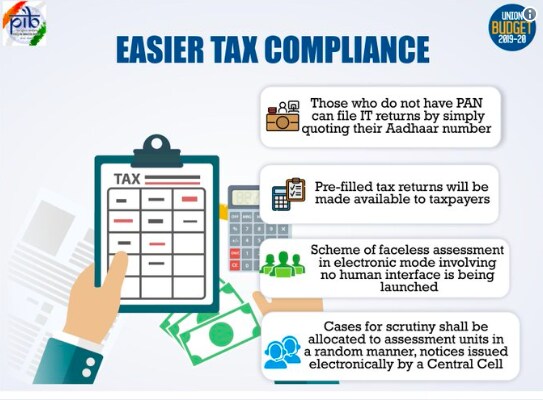

Income Tax Budget 2019 - Proposal to make PAN and Aadhaar interchangeable

When the Aadhaar mandate rolled out in 2009, it was not very popular with the masses except for those who needed a quick LPG connection. 10 years later, more than 120 crore Indians now have an Aadhaar number and for the ease and convenience of taxpayers, the government has proposed to make the age-old PAN and Aadhaar interchangeable. This would allow those who do not have a PAN number to file income tax returns via Aadhaar. They may also use it wherever else the PAN number is required to be quoted.

Source: Press Information Bureau

Income Tax Budget 2019 - Consequences of failing to link Aadhaar and PAN

At present, if the PAN is not linked with Aadhaar, provisions state that the PAN will be made invalid. In order to protect past transactions carried out through the usage of such a PAN, the government proposes that if the user fails to intimate the Aadhaar number, the PAN allotted will be made inoperative.

Source: NDTV

Income Tax Budget 2019 - Pre-filling of income-tax returns

The government has authorized pre-filling of tax returns which will be made available to taxpayers containing details of salary income, capital gains, bank interests, dividends and tax deductions. Information against each of these incomes will be collected from the concerned institution such as banks, stock exchanges, mutual funds, State Registration Departments etc. This would make it extremely convenient for the taxpayer as it would reduce the time taken to file a tax return, while also ensuring accuracy of reporting of income and taxes.

Income Tax Budget 2019 - Proposal to enhance surcharge on super-rich individuals

The finance minister declares that those in the highest income bracket need to contribute more to national development. For this purpose, the government has announced a surcharge for the super-rich. The rise in income tax for those earning between Rs. 2 crore and Rs. 5 crore increased to 25%, an effective tax rate of about 39% of their income. Those earning above Rs. 5 crore a year would pay a 37% surcharge on tax, bringing it to an effective rate of 42.7% of income. India’s highest tax-bracket has risen above that of the United States’ which is currently at 40%. Taxpayers having an annual turnover of less than Rs. 5 crore shall have to file quarterly returns.

Income Tax Budget 2019 - Additional tax relief for home-loan holders

The government seems to have incentivized affordable housing especially after having completed construction of a total of 1.5 crore rural homes in the past five years. To provide further incentives for home loan holders, an additional deduction of Rs. 1.5 lakh on interest paid on loans borrowed up to March 30, 2020 has been put in place. This is only relevant to purchases of a house up to Rs. 45 lakh.

Income Tax Budget 2019 - Large amount cash payment drawbacks

Continuing the raid on black money, Modi’s government aims to discourage business payments in cash. Hence, tax deduction of 2% at the source is to be levied on cash withdrawal exceeding Rs. 1 crore in a year from a bank account.

Conclusion

The 89th Union Budget has overall equated significance to each crisis that the economy faces today. However, there weren’t many mentions of exact fund allocations towards each program. The streamlining of multiple labour laws into four labour codes will ensure a standardized process of labour registration and filing of returns. Continued development of roads and highways are expected under the budgetary allocation this year. Modernization of railway stations is expected to launch as well. Impressively, the government also declared that it would ensure tap water for all homes by 2024. Yet, it is too soon to tell what possible outcomes may ensue in regard to India’s economic fate.

Read the latest budget highlights at Bajaj Markets to understand how the Union Budget of 2019 affects you as a taxpayer.