India’s startup ecosystem has become a force to be reckoned with. The domestic technology landscape has gone a drastic change in the past few years with the country emerging to be the third fastest growing startup hub globally with over 4,200 startups creating more than 80,000 job opportunities.

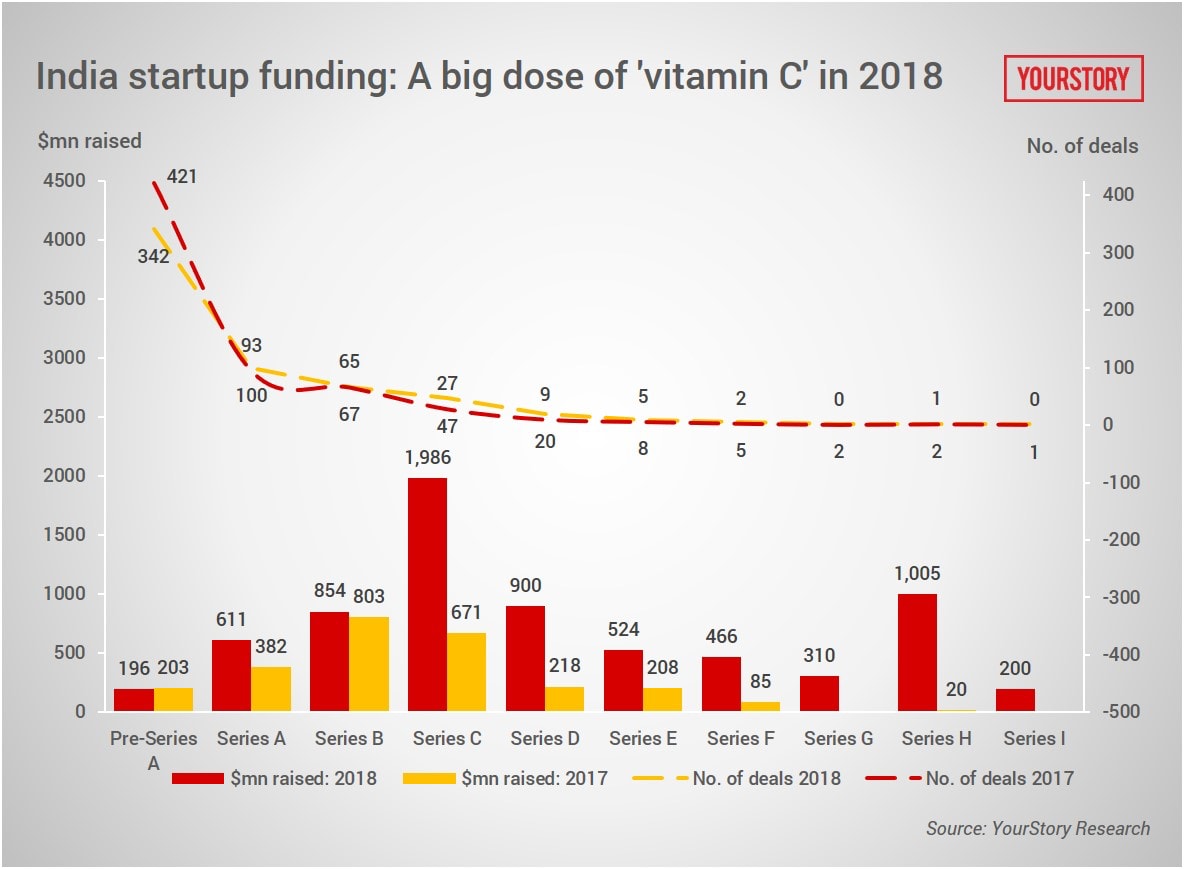

In 2018 alone, India produced 11 unicorns. Unicorns are startups that have a valuation of $1 billion or more. Last year, startups raised nearly $12.68 billion in equity funding, in addition to $1.14 billion raised in debt funding, taking the total to a whopping $13.88 billion. The year 2018 was a milestone year for startups in the country with the culmination of the Flipkart-Walmart deal, one of the biggest the sector has ever witnessed.

As its ripple effect, startups in India have already raised a record $3.9 billion from venture capitalists in the first six months of 2019. The investments this year across 292 deals is a 44.4% jump from the $2.7 billion received by domestic startups in the first half of 2018.

With the tremendous growth clocked in the sector, some rough edges have also been brought to the fore. Stakeholders have often enunciated the need to strengthen the position of Indian companies and their promoters in relation to big investors worldwide. Indian promoters have had to cede control of companies, which have prospects of becoming Unicorns, due to the requirements of raising capital through issue of equity to foreign investors. This is where Differential Voting Rights (DVR) come into play.

Before we delve deeper into its implications, it is important to try and understand DVR in simple terms. A DVR share is just like any other ordinary equity share, but it provides fewer voting rights to the shareholder. Consider this example - A normal shareholder can vote as many times as the number of company shares held by him/her, but someone who holds the company’s DVR shares will need to hold 100 DVR shares to cast one vote. This number of DVR shares required differs from one company to another. Companies issue DVR shares for prevention of a hostile takeover and dilution of voting rights. It also helps strategic investors who do not want control, but are looking at a reasonably big investment in a company. The government had capped the DVR at 26%.

Acknowledging the gravity of the problem, the government recently approved the amendment of the Companies Act provisions to help entrepreneurs retain control even as they raise equity capital from global investors. Companies can now have up to 74% differential voting rights shares of the total post issue paid up share capital. This move empowers startups, giving their founders the last say on critical issues of the company. Though not every decision might tilt in their favour, this power would ensure that the larger interests of the startup are taken care of. This boost given to startups by giving them a more protected an enabling environment is likely to encourage IPOs (Initial Public Offerings).

Another key change in regulation is the removal of the requirement of distributable profits for three years for a company to be eligible to issue shares with DVRs. The government has also increased the period within which Employee Stock Options can be issued by startups to promoters or directors holding over 10% of the equity shares. Earlier, it was 5 years which has now been extended to 10 years from the date of their incorporation.

These regulatory changes are likely to make 2019 a watershed year for startups in the country, making it buoyant amid increased confidence of the stakeholders. The government has been trying to scaffold this fledgling sector into maturity and is certainly moving in the right direction.Recently, the income tax department also eased assessment norms for startups.

Foreign investors are increasingly looking towards India, and foreign venture capital (VC) and private equity (PE) funds are on the rise, especially from Japan, Europe and West Asia.

The sector is leveraging India’s friendly relations with countries with the rest of the world and startups are now a significant contributor to FDI (Foreign Direct Investment). Now, with these regulatory changes by the governments, startups in the country are poised to expand further with renewed confidence without the apprehension of having to cede control in the face of big, foreign investors. Given the government of India’s latest ‘Make in India’ push, along with a significant jump in FDI flows, the Indian startup sector is poised for rapid growth.

Moreover, with the ease in accessibility of financial services online, young entrepreneurs today have an edge over those a few years ago. Today, you can avail a business loan easily to lay down the foundation of your enterprise or to scale it. For instance, Bajaj Finserv business loans available on Bajaj Markets, offer convenience at your fingertips through minimal documentation. Business Loans of up to Rs. 30 lakh are available to small businesses at low interest rates.

Quick Links