During its first term, the Narendra Modi-led NDA Government showed laudable perseverance in introducing one of the landmark taxation overhauls in the country, the Goods and Services Tax (GST), which has changed the face of the taxation structure in the country. Though the ambiguity around the newly introduced tax structure adversely impacted the market sentiment during the first few months of its tricky implementation, we are slowly coming around and getting a hang of it now.

The second term of the Modi Government bears the weight of a plethora of expectations. A crucial one among them is direct tax reforms. Been in the talks for almost a decade now, direct tax reforms have assumed greater significance with time, especially a year after the GST reform which changed the landscape of indirect taxes in India, ushering in an era of a uniform taxation regime.

There is an urgent need to revamp the existing direct tax structure and the Government has rightly put the reform proposal on top of its agenda.

The Direct Tax Code (DTC) proposed by the Government in Union Budget 2019 is currently being worked upon by a task force which is trying to widen its scope to improve compliance. The task force is scheduled to submit its report by July 31, 2019. Earlier, the task force was granted a two-month extension by the previous Finance Minister Arun Jaitley. The Direct Tax Code aims to reform the complex income tax laws by breaking them down into simpler tax codes with reduced rates, fewer exemptions, and tax slabs.

Here’s one case in point for perspective: A company below the Rs 250. crore turnover benchmark is liable to pay 25% corporate tax. This act was introduced in order to safeguard the interests of smaller companies in the domestic market which consequently penalizes the larger ones just for their strength and magnitude. This imbalance in the tax structure needs to be looked at and improved upon. Now, the Government wants to reform India's corporate tax structure by reducing the rates to remain globally competitive.

The task force has been directed to analyze the norms prevalent in other countries and assimilate those that appear best-suited to the country’s interests, considering its unique economic needs.

In the previous financial year, the direct tax collections fell short by Rs. 12 lakh crore and the Government wants to work on this front in order to increase its revenue. In the Direct Tax code, the Government offers lower tax rates to act as an incentive for taxpayers to comply, pay their taxes, and file returns, thus leading to a greater revenue for the country. Lowering the tax rate would catapult into more disposable income, spurring demand, and getting the wheels of the economy rolling. Currently, the country’s economic growth is sluggish, standing at a nearly five-year low of 5.8% in the January-March quarter.

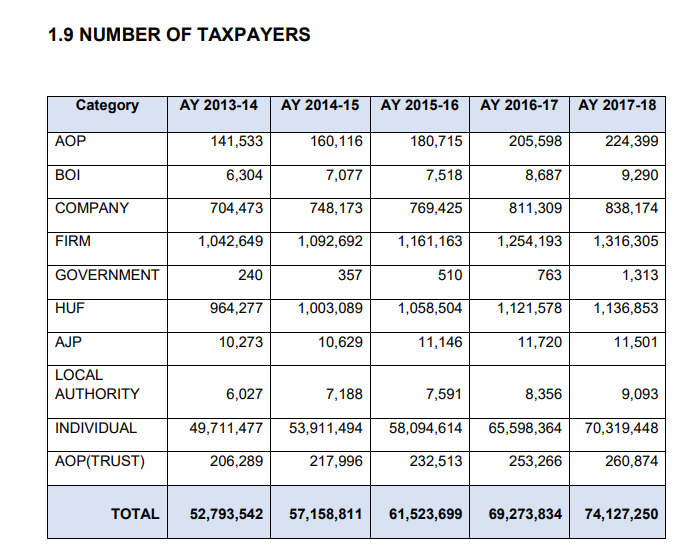

Data: Income Tax Department

India’s top tax rate, applicable on incomes above Rs 10 lakh, is 30% (exclusive of cesses and surcharges). The direct taxpayer base of a country with a headcount of 1.3 billion was as low as 74,127,250 in the year 2017-18.

The task force by the Central Board of Direct Taxes (CBDT) has also been assigned to incorporate provisions for reducing litigation and reducing the time taken for deciding on appeals by the department’s officials and courts, including high courts and the Supreme Court. Backlogs of tax cases have been systemic to India’s financial structure. The code needs to put in place a framework that makes the process of appeal filing and the entire process thereafter seamless and efficient.

The basic structure of the Income Tax Act appears complicated and its language increasingly complex. It is not a surprise that an average Indian taxpaying man or woman finds it difficult to understand the intricacies of the laws. The Government has acknowledged the issue and wishes to change the status quo.

Another significant proposal is that of anonymous e-assessments. The Government has proposed that the assessments will be faceless in most of the cases, carried out by back-end teams with sufficient sector knowledge and expertise. This should go a long way in ensuring a swift, efficient process with a better appreciation of sector-specific issues.

The new code will also have provisions for GST authorities, customs officials, and the financial intelligence unit to share information. The Government now wants both the direct and indirect wings of taxation to collaborate and arrest rampant tax evasion. The ministry also asked the panel to work on cross-verification of transactions by the department’s IT systems.

The initiative to cut red tape demonstrates the Government’s seriousness about these reforms. The GST roll-out in 2017 was also an impressive initiative by the Government but had to face some backlash from small traders and on account of ambiguities around some technical intricacies. The Government is expected to have learned a lesson from the previous mistakes and ensure an effective and rollout of the Direct Tax Code when the time arrives.

Read more about Union Budget 2019 Highlights at Bajaj Markets.