A lot of speculations are doing the rounds with regard to Budget 2020. The GDP growth rate of India in the ongoing fiscal year went down to as low as 4.5% in the second quarter. Finance Minister Nirmala Sitharaman will be challenged to put forth provisions and initiatives that help revitalize the economy and put India back on the track of being a $5 trillion economy by 2025.

Business owners in India are actively looking forward to Budget 2020. With an increasing need for a stimulus package for various business sectors, these leaders and entrepreneurs expect the Government to bring forth relevant provisions that help increase consumer spending and boost business. Here are the four key aspects that the business owners must focus on in the upcoming budget.

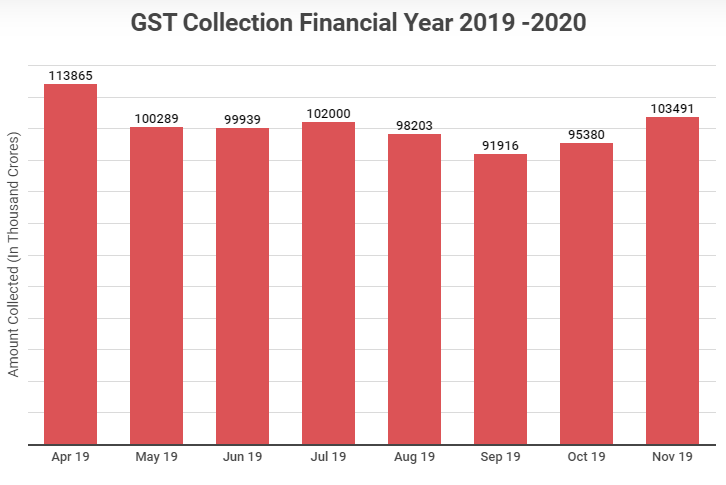

Revision of GST rates

Following the economic slowdown, the Government witnessed a decline in GST collection. In fact, the Government hasn’t even been able to pay state GST (SGST) quota back due to the country’s revenue crisis. It is important for business owners to note that the Government might revise GST rates in the upcoming budget, in order to meet this revenue deficit.

Certain sectors may, however, be spared a GST slab or rate hike. A number of sectors facing the brunt of the economic slump are calling for relief, in order to stimulate growth. The automobile sector is expecting a reduction in the GST rate from 2% to 18%. The healthcare industry, too, is gunning for the zero-rating of healthcare services. On the other side of the spectrum, lithium batteries may just get their big tax break, with an exemption on customs duty (currently levied at 5%). Moreover, a single window GST return filing system is expected to be introduced soon to sanction new returns. Although such expectations are high, it remains to be seen whether the Budget 2020 meets these needs of its GST taxpayers.

Source: Inc42

Encouragement of start-ups and the implication on taxation

Budget 2019 was a major boost for the startup industry in India. A relaxation of angel tax, incentives for EV startups, and improved digital payment systems brought hope to the industry. The government has been supportive of the growth of the industry, as portrayed by the introduction of the Startup India initiative in 2016.

Early-stage business owners can expect continued support in Budget 2020 as well. It’s speculated that the Government might introduce various tax incentives such as GST rate reduction on the alternate investment fund management fee. Additionally, businesses might witness tax benefits on Employee Stock Ownership Plans, which could prove significant for businesses to attract skilled taskforce and lead to more job creation.

Lowering of tax-rates for LLPs and partnerships

Even as corporates and manufacturers availed a slew of tax cuts in 2019, MSMEs consisting of LLPs and partnerships are still taxed at the rate of 30%. Such business owners should keep an eye out for a reduction in these rates, come Budget 2020.

Further, the tax-saving benefits offered under Section 32AC can also be expanded to provide more relief to businesses. Section 32AC provides deductions on investments made in plants and machinery. This section was introduced particularly to prompt more investments from the business community. The threshold for deductions on such investments has, until now, been Rs. 25 crore. There is talk of lowering this threshold and relaxing the limits of this deduction, so as to allow a larger number of businesses to benefit from the same. Since this could be largely beneficial to business-owners, they should keep a keen eye out for it.

A dedicated effort to grow Infrastructure

In December 2019, Finance Minister Nirmala Sitharaman announced a pipeline of infrastructure projects with an allocation of INR 102 trillion. A task force dedicated to the identification of such projects and consultation with stakeholders was also set up under the Economic Affairs Secretary. It’s imperative to expect that Budget 2020 will continue to push infrastructural development in the sectors of energy, mobility, digital, education, health, railways, irrigation and urban development. This shall, in turn, help many businesses with relevant opportunities such as job creation (given that unemployment is at a record high currently), equitable infrastructure access and improved economic competitiveness.

Conclusion

You don’t have to wait for Budget 2020 to be implemented to help accelerate your business and reach new heights. As a business owner, you can do your bit to give your business a much-deserved boost. You can use the Bajaj Finserv Business loan on Bajaj Markets to purchase new plant machinery, state-of-the-art infrastructure or even increase your working capital. Customised loans are available for all kinds of businesses on Bajaj Markets, from MSMEs (Micro, Small and Medium Enterprises) to start-ups. Avail Bajaj Finserv Business Loan on Bajaj Markets with speedy approvals, disbursals, and zero collateral requirement to overcome the economic slowdown and grow your business.