Diversify your investment portfolio with Sovereign Gold Bonds, combining security and potential for appreciation through government-backed gold investments.

Sovereign Gold Bonds (SGBs) were introduced by the government in 2015 as part of the Gold Monetization Scheme. Denominated in grams of gold, SGBs are a substitute for physical gold issued in the form of certificates by the Reserve Bank of India.

The RBI notifies the details of new tranche issuance periodically. If you are planning to invest in this government-backed scheme, you can find the listing of SGBs on stock exchanges. Alternatively, you could get in touch with a SEBI-authorized agent to buy SGBs.

Here is the latest subscription period series list for the Sovereign Gold Bond scheme for 2023-24.

Sr. No. |

Subscription Period |

Tranche |

Date of Issuance |

1. |

February 12-16, 2024 |

2023-24 Series IV |

February 21, 2024 |

2. |

December 18-22, 2023 |

2023-24 Series III |

December 28, 2023 |

3. |

September 11-15, 2023 |

2023-24 Series II |

September 20, 2023 |

4. |

June 19-23, 2023 |

2023-24 Series I |

June 27, 2023 |

Here is the latest subscription period series list for the Sovereign Gold Bond scheme for 2023-24.

Sr. No. |

Subscription Period |

Tranche |

Date of Issuance |

1. |

February 12-16, 2024 |

2023-24 Series IV |

February 21, 2024 |

2. |

December 18-22, 2023 |

2023-24 Series III |

December 28, 2023 |

3. |

September 11-15, 2023 |

2023-24 Series II |

September 20, 2023 |

4. |

June 19-23, 2023 |

2023-24 Series I |

June 27, 2023 |

Features of Sovereign Gold Bonds

Purity

SGB incurs no making charges, unlike gold jewelry, and its value is determined by 999 purity gold

Discount

Online investors are eligible for a discount of ₹50 per gram on the issue price of the bonds

Loan Collateral

Investors can use their SGBs as collateral against loans

Denomination

You can buy SGBs in many denominations characterised by weight, starting as low as one gram

Format

As an investor, you can hold these bonds either in your Demat account or as a physical copy

Rate of Return

Investors will receive an assured return of 2.50% p.a., which applies two times a year or semi-annually on its nominal value

Returns

SGB returns are directly linked to the prevailing market price of gold

Maturity Period

SGBs mature in 8 years, with an exit option available after 5 years from the issue date

Gift/transfer

You can gift or transfer SGBs if both parties meet the eligibility requirements

Tradable

If held in Demat form with depositories, SGBs can be traded through stock exchanges

Redemption Price in Rupees

It depends on the average closing price of 999 purity gold on the previous three consecutive business days published by the India Bullion and Jewellers Association (IBJA)

There are no TDS deductions on the purchase of SGBs or at the time of encashment. However, the interest received on SGBs is taxable according to the provisions of the Income Tax Act, 1961.

Additionally, when you do not opt for premature withdrawal, all your capital gains will be exempt from income tax. For long-term capital gains, you get indexation benefits arising to the person on account of the transfer of bonds.

Investors have the option to choose between a flat 10% without considering an indexation rate and 20% with an indexation rate on LTCG.

There is a minimum and maximum limit set for investing in sovereign gold bonds are stated below:

Category |

Minimum Requirement |

Maximum Limit |

Individual and HUF |

1 gram |

4kgs in a financial year |

Companies and Other Entities |

1 gram |

20kgs in a financial year |

To purchase the SGB, you must meet some basic eligibility criteria. Here are some of them:

You must be an Indian citizen

You must be an individual, trusts, Hindu United Family, charitable institute, or university

As per this scheme, you can purchase SGBs through eligible entities. Here are the documents you need to submit to purchase SGBs:

PAN card

Unique Client Code (UCC), if you have previously invested in SGBs

Note: You also need to ensure that the bank account details entered are linked with your Demat account. Failure to do so can result in the transaction being rejected.

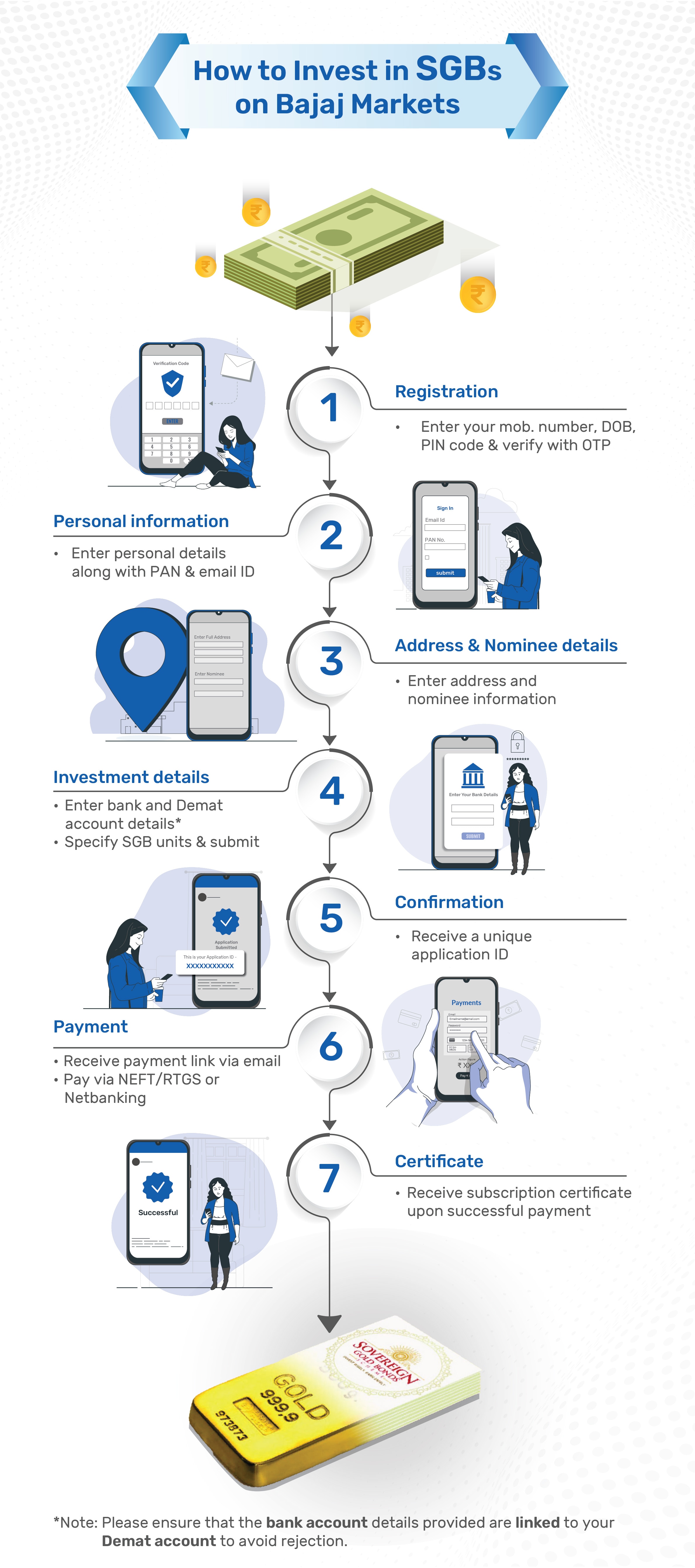

All you have to do is follow the steps mentioned below:

Step 1: Click on the ‘INVEST NOW’ option on this page

Step 2: Enter your mobile number, PIN code, and date of birth

Step 3: Submit the OTP sent on your mobile number

Step 4: Enter your personal and nominee details

Step 5: Fill in the investment details

Step 6: Click on ‘Submit’ to place your order

Step 7: Look for a payment link sent to your registered mobile number and email ID from BSE STAR MF

- Step 8: Complete the payment to invest in SGB and save the confirmation you receive

If you opt for the offline mode, you will have to visit the nearest registered institute offering SGBs. At the branch, you must fill out the required form and submit it. Upon evaluation, the institute will offer a purchase receipt and you will receive a confirmation for the same.

FAQs on Sovereign Gold Bond

At what price are the bonds sold?

The price of the bonds will be fixed in Indian currency based on the average of the closing price of 999 purity gold. These are announced by the India Bullion and Jewellers Association Limited (IBJA) as per the previous 3 days performance before the period of subscription.

The issue price of the bonds will be ₹50 less per gram than the nominal value to investors applying online.

What is the Sovereign Gold Bond interest rate?

You will receive 2.50% p.a. assured returns on the nominal value of your SGB.

Can I gift SGBs to a relative or friend on some occasion?

Yes, SGBs can be transferred to anyone who fits the eligibility criteria.

Is it possible to pledge SGBs as collateral for loans?

Yes, you could pledge SGBs as collateral when availing loans from banks and NBFCs.

Who can invest in SGBs?

Investors with a low-risk tolerance who are looking to diversify their investment portfolios can opt for SGBs.

What is the subscription window for SGB tranche 2023-24 Series IV?

SGB tranche 2023-24 Series IV will be available for subscription between 12th and 16th February 2024.