Discover Form 15G’s benefits and the process to download and fill this form for Employee Provident Fund (EPF) withdrawal.

Form 15G is a self-declaration form which helps you avoid TDS on the interest earned from different sources. These include Employees' Provident Fund (EPF), Recurring Deposits (RD), or Fixed Deposits (FD). This form is specifically for individuals under 60 years of age and Hindu Undivided Families (HUFs).

Learning how to fill in Form 15G is important as submitting it ensures that banks do not deduct Tax Deducted at Source (TDS). Banks deduct TDS when the EPF withdrawal you make is greater than ₹50,000 and before 5 years of service.

To download and fill in Form 15G, you can visit your EPF portal or obtain it from the income tax website. Ensure you submit the form at the beginning of the financial year to avoid unnecessary deductions.

According to Section 192A of the Income Tax Act of 1961, TDS (Tax Deducted at Source) applies to EPF withdrawals that exceed ₹50,000. That is applicable only when you have worked for less than five years.

To claim a TDS exemption, individuals under 60 years old need to use Form 15G. However, anyone aged 60 and above must complete Form 15H. To understand how to apply for these forms better, you first need to learn the applicability of TDS.

When is TDS Applicable

When you wish to withdraw an EPF amount of ₹50,000 or more and have worked for less than five years, the following TDS rules apply:

Condition |

TDS Rate |

PAN card submitted; Form 15G/15H not submitted |

10% |

PAN card not submitted; Form 15G/15H not submitted |

20% |

When is TDS not Applicable

TDS is not applicable on your EPF under the following conditions:

EPF amount is less than ₹50,000 with less than 5 years of service

Withdrawal of ₹50,000 or more with less than 5 years of service but submitting Form 15G/15H along with PAN card

Transferring an EPF account to another account

Withdrawal of EPF amount after completing a total of 5 years of service

Termination of service due to ill health, business discontinuation, or other uncontrollable causes

Form 15G allows you to avoid TDS deductions if your income is below the taxable limit. It is a useful tool for simplifying tax compliance. Here's what you need to know about Form 15G:

You can prevent TDS deduction if your income is below the taxable limit under Section 197A of the Income Tax Act, 1961

The form's format was updated in 2015 to reduce compliance efforts

The Central Board of Direct Taxes (CBDT) introduced the latest version of Form 15G

Submit Form 15G in the first quarter for existing investments or before the first interest credit for new ones

Now that you know what this form is, the next step is to learn about Form 15G’s eligibility criteria. Here are the terms to know:

You should be an individual, trust, or Hindu Undivided Family (HUF), but you should not be a company or a firm

You should be an Indian resident

Your age must be below 60 years

Your calculated income tax must be nil

Your net income for the whole year must be below the limit of the basic exemption of that year. For the fiscal year 2022-23 (AY 2023-24), this amount is ₹2.5 Lakhs

You can download Form 15G online from the official EPFO portal and the websites of various banks in India. You can also access it from the official website of the Income Tax Department.

The process for each of these platforms varies, and you should pick the easiest option.

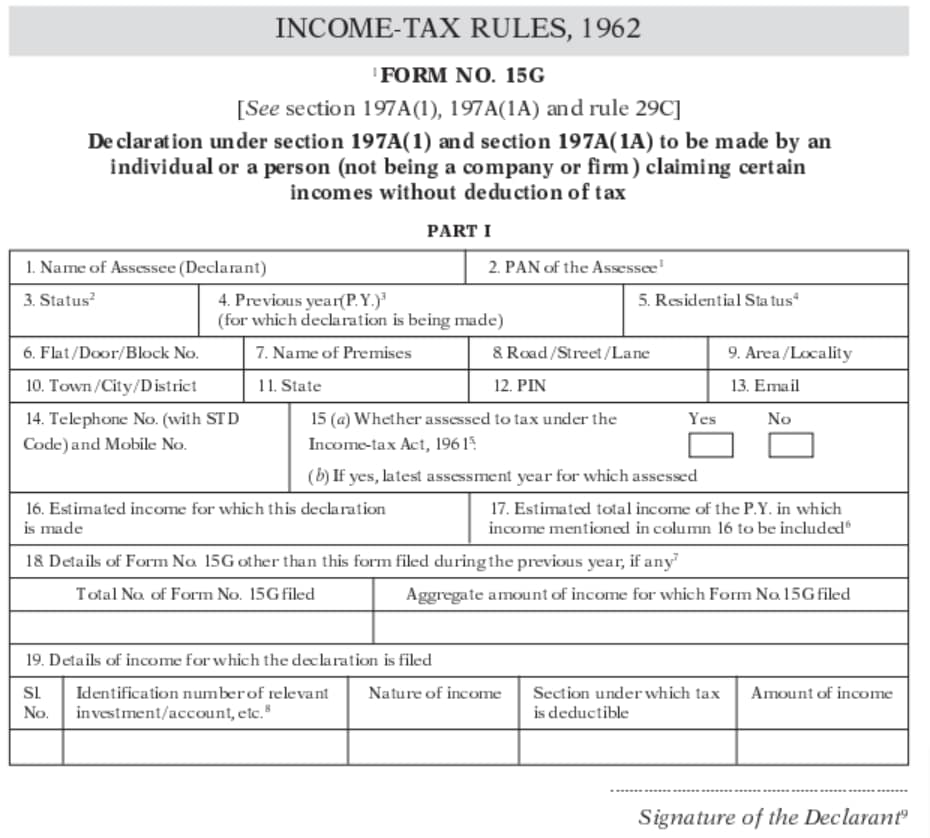

Here is a sample Form 15G for your reference:

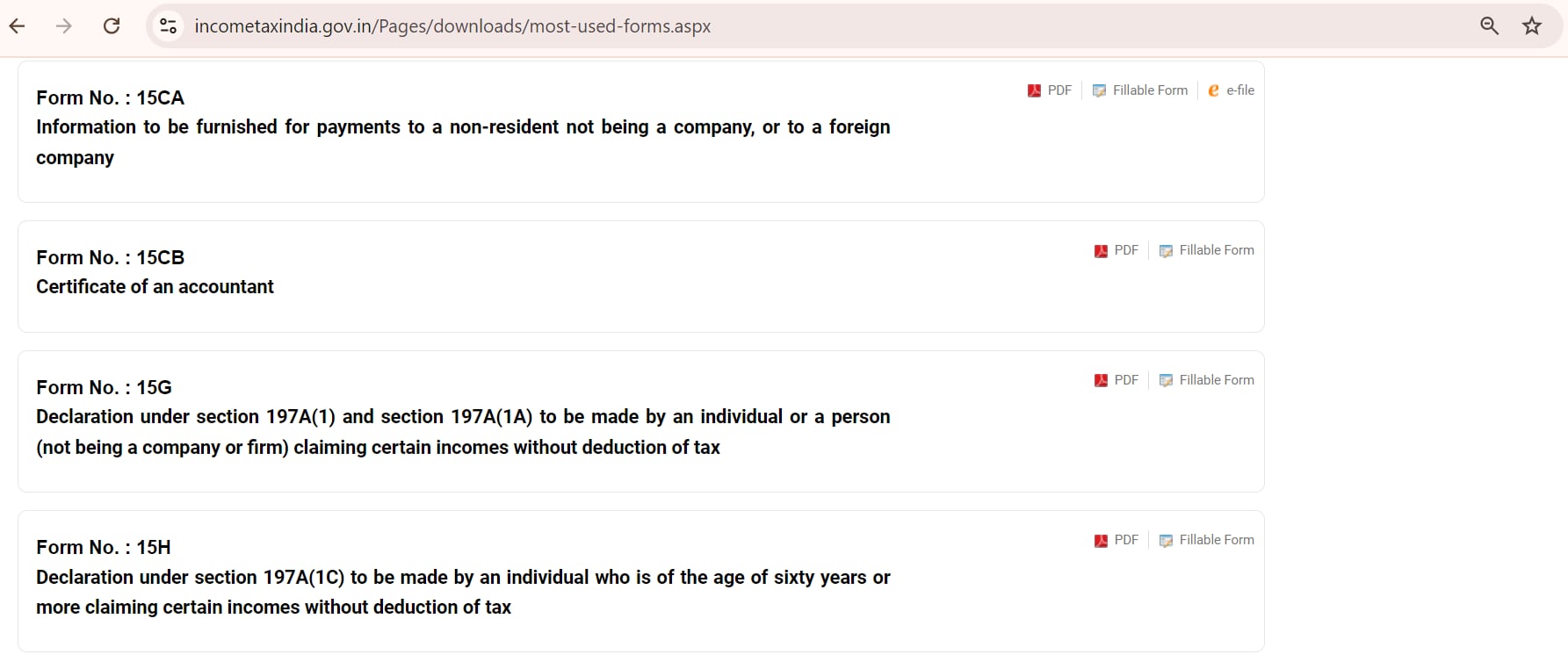

As mentioned, you can download Form 15G from the official online portal of EPFO or the Income tax e-filing. Here are a few general steps you can follow:

1. Visit the official website of the Income Tax Department https://www.incometax.gov.in/iec/foportal/

2. Navigate to the ‘Quick Access’ section

3. Click on ‘Income Tax Forms’

4. Scroll and find the Form 15G

5. Click on ‘PDF’ to download the form in the PDF format

After the confirmation of eligibility criteria, check out how to fill in Form 15G. Here is what you need to do once you download the form online:

Instructions to Fill Form 15G

You only need to complete Part I of Form 15G for EPF withdrawal. Here are the instructions for filling Form 15G’s remaining fields:

Name of the Assessee (Declarant): Enter your name as per your PAN card

PAN of the Assessee: Only individuals (not firms/companies) can submit Form 15G Ensure your PAN's fourth letter is 'P' to avoid invalidation

Status: Select ‘Individual’ as your tax status

Previous Year: Choose the financial year for which you're claiming non-deduction of TDS

Residential Status: Mark ‘Resident’; NRIs cannot submit Form 15G

Address: Enter your address, preferably from your Aadhaar, with the PIN code

Email ID and Phone Number: Provide a valid email and contact number

Assessed to Tax: Tick ‘Yes’ if you have filed an ITR in past years

Latest Assessment Year: Mention the year from your latest ITR

Estimated Income for Declaration: Enter the estimated withdrawal amount

Estimated Total Income: Mention your total estimated income for the financial year.

Previous Form 15G Submissions: List the number of Form 15Gs filed during the year and their total income amount

Income Details: Provide investment ID, nature of income, tax section, and income amount

After you submit Form 15G, here is what happens to ensure you receive the EPF amount without unnecessary tax deductions:

Verification by Relevant Authority

The relevant authority will check your Form 15G for accuracy, whether it's your bank, financial institution, EPF regional office, or employer's HR department. They will also ensure you meet the eligibility criteria.

Processing the Form

If your form is accurate and meets the eligibility requirements, it will be processed. This confirms your claim that your income falls below the taxable limit.

Exemption from TDS

The main advantage of submitting Form 15G is that TDS will not be applied to your EPF withdrawal.

Communication of Submission Status

You may receive acknowledgement or confirmation of your Form 15G submission. This could come via email, letter, or any other official channel. It's important to store this communication for your records.

Reporting and Accounting

The processing authority will record your declaration. They will also report it to the Income Tax Department to ensure compliance with tax regulations.

Potential for Further Verification

While your form may be processed, the Income Tax Department may carry out additional verification. This can happen if they identify discrepancies or suspect incorrect information.

Tax Filing Obligations

Even if TDS is not deducted due to your Form 15G submission, you must include your total income in your annual income tax return. This includes your EPF withdrawal. It's essential to report all income during the tax filing process.

Before going about the Form 15G filling process, take note of these essential points:

Ensure that your age is below 60 years

Cross-check the information you submit

Mention the accurate assessment year

Your estimated income should not be overstated

PAN card copy is essential for submission along with Form 15G

After successful submission, ensure you receive an acknowledgement slip

Do not submit the declaration if you have taxable income for the financial year

Form 15G is not a replacement for your Income Tax Return (ITR)

If Form 15G is submitted late and TDS is deducted, claim excess TDS via ITR

Fraudulent submission can lead to penalties under Section 277 of the Income Tax Act, 1961

Frequently Asked Questions

Can I have my Form 15G filled online?

Yes, you can fill in your Form 15G online through the websites of various banks or the EPFO portal.

When should we fill the 15G form?

This form is applicable for a single financial year. So, it is ideal to submit the form at the beginning of the fiscal year.

What is the total income in Form 15G?

Estimated income regarding Form 15G is the income that you have gained in the recent fiscal year.

What If I forget to Submit Form 15G?

You can claim a refund of the excess TDS deducted by filing your Income Tax Return. The IT department is responsible for reimbursing any surplus TDS upon ITR filing.

Many banks also deduct TDS every quarter. If you miss submitting Form 15G or Form 15H, submit it at the earliest to prevent any further deductions for the financial year.

Does Form 15G need to be submitted at all the branches of the bank?

You need to only submit Form 15G to the branch or office processing your EPF withdrawal.

Do I need to submit this form to the Income Tax Department?

No, you do not have to submit Form 15G directly to the Income Tax Department but to the deductor.

Is Form 15G mandatory for PF withdrawal?

No, Form 15G is not required for PF withdrawals that are less than ₹50,000.

What is the penalty for submission of a false declaration in Form 15G?

Under Section 277 of the Income Tax Act, 1961, any incorrect declarations may lead to prosecution and fines.

If the tax you evade exceeds ₹25 Lakhs, your imprisonment term will be no less than six months and may extend up to seven years, along with a fine

For cases where the evaded tax is lower, your imprisonment can range from three months to two years, along with a fine