Know All About Days Past Due (DPD) in CIBIL Report

DPD stands for Days Past Due and is one of the most crucial components in your credit report, which indicates your creditworthiness. It is crucial for loan approvals as it indicates the missed payments on your EMIs/credit card bills. Each loan creates a separate DPD table, on your credit report. In case of repayment default, the DPD stays on the report for three years.

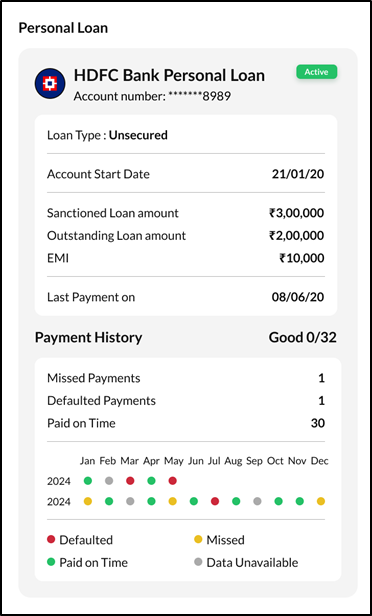

A separate DPD table exists for each loan/credit card in your credit report. The table displays your monthly repayment history, with values indicating any delay in EMI/credit card bill payment. Refer to the sample DPD table provided below for an overview of the format in your credit report.

DPD Value |

000 |

XXX |

30 |

60 |

Month |

01-26 |

02-26 |

03-26 |

04-26 |

It is important to know what the values provided in the DPD table indicate and understand how they impact your creditworthiness.

DPD Value |

Meaning |

Significance |

000 |

On-time payments with no outstanding dues |

Safest value; indicates timely EMI payments and financial responsibility. Lenders may approve loans despite a lower CIBIL score if DPD remains 000 consistently. |

XXX |

No data provided by lender to CIBIL |

No impact on the applicant’s profile and they are considered safe. In the above sample, it means that no details were provided for February 2026. |

30, 60, 90 |

Number of days passed after the payment due date. |

Any value (30 or 60) negatively impacts the credit report and overall creditworthiness. In the sample, 30 denotes a missed EMI in March 2026, while 60 indicates default for both March and April. |

Finance experts advise that you must not miss your EMI/credit card bill payments for more than 90 days (three months).

Understanding DPD is easier when you can see how your repayments have been recorded over time. The Bajaj Markets app offers a detailed view of your repayment history for each credit account—whether it’s a loan or a credit card.

What’s in it For You:

Month-wise breakdown of on-time, missed, and defaulted payments

Entries displayed in a visual format using coloured markers:

Green denotes ‘On-time’

Yellow denotes ‘Missed’

Red denotes ‘Defaulted’

Total count of payments made, missed, or delayed

This feature allows you to:

Spot patterns where DPD values have been consistently high

Track improvements after dispute resolution or regularised payments

Stay alert to future delays before they affect your credit score

Apart from the aforementioned values, you may also find other DPD values on your credit report:

DPD Value |

Meaning |

STD |

Standard Payment: Payment made within 90 days of the due date. |

SUB |

Sub-Standard Payment: Payment made more than 90 days after the due date. |

DBT |

Doubtful: Payment remained sub-standard for over 12 months. |

LSS |

Loss: Indicates a high likelihood that the borrower won't repay the loan amount. |

DPD is crucial as it reveals the frequency and duration of delayed payments for your loan EMIs or credit card bills. Timely repayments are a key factor in determining creditworthiness. This makes DPD a vital criterion for loan/credit card eligibility. In certain cases, a clean DPD can lead to loan/credit approval even with a less-than-ideal credit score.

- Identify the errors in your DPD on your CIBIL report

- Promptly raise a dispute and report the same to the credit bureau

- The credit bureau will the label your credit report as “Under Dispute” and forward the disputed information to the relevant lender for verification

- Once verified, your DPD will be accordingly updated, and remove the “Under Dispute” tag from your credit report

FAQs on Days Past Due (DPD) in CIBIL Report

What is the full form of DPD in CIBIL report?

The full form of DPD is Days Past Due.

Which DPD value is counted as negative?

Any DPD value other than “000” and “XXX” has a negative impact on your credit report.

When is DPD updated in your credit report?

Whenever your lender communicates the data with respect to your loan EMI/credit card bill payment to CIBIL, your DPD for that loan/credit card account is updated accordingly.

How do I check DPD in the CIBIL report?

You can find the DPD in the 'Payment History' section of your CIBIL report.

What companies include a DPD in their credit report?

All major credit bureaus, including TransUnion CIBIL, Experian, Equifax, and CRIF High Mark, report a DPD value. This value is derived from the consumer credit information that banks submit to the bureaus each month

What can a borrower do to prevent a negative DPD value?

To maintain a positive credit history, you must make timely payments on all credit obligations, including loan EMIs, credit card dues, and any other amounts which are borrowed. This will help prevent negative marks in the DPD section of your CIBIL report.