Tax-free Investments | Top-rated funds across industry | Zero Allocation Charges

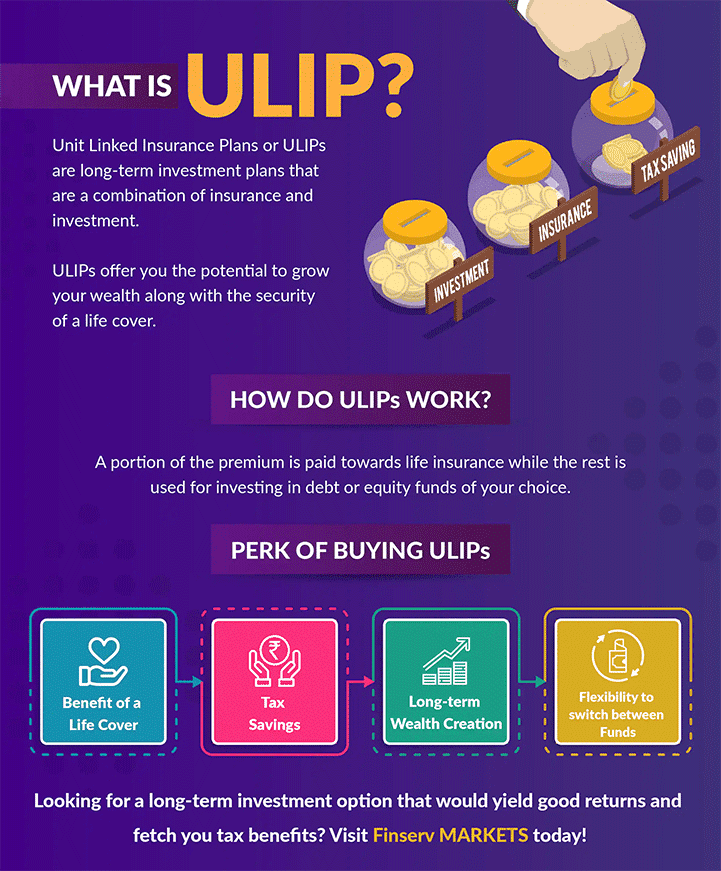

ULIP, or a unit-linked investment plan, is a financial product that combines two very important financial products - insurance and investment. It is a type of life insurance plan that offers its subscribers death benefit to the policy’s beneficiaries while also providing an opportunity to invest. Policyholders can invest in a wide range of investment funds, this helps them tailor their ULIP to suit their investment needs and objectives.

Here is a list of must-know terms in ULIP investments.

Fund Value – It is the total monetary value of the fund units owned by the policyholder.

Sum Assured – It is the amount guaranteed to the policyholder after the policy term is over.

Partial Withdrawal – The policyholder can withdraw a certain amount before the policy matures. Partial withdrawals can be done after the completion of the five-year ULIP lock-in period.

Fund Switch – It is a feature in ULIP that allows policyholders to switch between investment funds. With this, you can switch from equity to debt and vice versa as per the market performance of your investment. Check with your insurer whether fund switching is chargeable or not before availing the feature.

Top-up Premium – It is an additional amount that you can pay over and above your existing premium amount.

Premium Payment Term – You can choose to pay ULIP premiums either as single-premium payment or as regular premium payment. In single-premium payment, you pay a lump sum amount together. Whereas, in regular premium payment, you get to pay premiums at regular intervals.

Policy Surrender – This means you want to exit the plan before the policy matures.

Surrender Value – It is the amount you pay in the event of policy surrender.

Maturity Benefit – It is the amount you receive in the event of policy term completion.

Death Benefit – It is the amount your beneficiaries receive from the insurer in case of your sudden and unfortunate dismissal.

ULIP Charges – These are the charges levied by the insurer. We have discussed ULIP charges in detail in the section below.

Types of ULIP Plans can be broadly divided based on death benefits paid out:

Type-I ULIP

Under the Type-I ULIP plan, the nominee gets the Sum Assured or Fund Value as the death benefit. In case the policyholder dies during the initial years of the policy when the fund value is relatively lower than the sum assured, the insurer will pay the sum assured to the nominee.

However, when the fund value is higher than the sum assured, the fund value is offered as the death benefit to the nominee. In simple terms, Type I ULIP plans offer either the Sum Assured or Fund Value, whichever is higher as the death benefit.

Type-II ULIP

Under the Type-II ULIP plan, the nominee gets both the Sum Assured and Fund Value as a death benefit in the event of the demise of the policyholder. Hence, Type-II offers a more considerable death benefit as compared to a Type-II ULIP plan.

However, the premium for the Type-II ULIP plan is relatively higher as the insurance company assumes higher risk from the policyholder.

What is ULIP and how does it work?

Let’s have a quick recap on what ULIP is and how the policy works.

The most convenient feature of ULIP is the policy’s premium payment method. Here’s a walkthrough on the same.

Single-Premium Payment: You are liable to pay the entire ULIP premium as a lump sum amount in one go. This is usually done at the start of the policy term.

Regular Premium Payment: Here, you have to pay a predetermined premium amount regularly (annually, monthly, quarterly), depending on the term opted.

The Number of Premium Paying Years: Ideally, the policy term and the years of premium payment is the same in ULIP. However, most insurers in India allow you to decide the number of premium payment years at the time of policy purchase.

The Insurance Regulatory and Development Authority of India (IRDAI) has made several changes in ULIP terms and conditions since 2010. One of the significant changes made to the policy was to increase the lock-in period from three years to five years. Since ULIP is primarily an insurance product, staying invested in it for a longer duration is beneficial for the investors. Therefore, a minimum of a five-year lock-in period will help you reap reasonable ULIP returns.

Here are a few ULIP fees and charges that you need to be aware of before investing in the policy.

Fund Management Charges – These are the expenses incurred when managing your funds. Generally, they are charged as a percentage of the fund’s value and are deducted before the Net Asset Value of the fund is derived.

Discontinuation Charges – This fee is applicable if the policyholder decides to discontinue the ULIP scheme before the lock-in period of 5 years is over.

Mortality Charges - This charge is levied monthly as compensation for the insurance company in case a policyholder does not live up to the assumed age.

Surrender Charges – This fee is applied in case of premature full or partial withdrawal of units. These charges are a percentage of the fund value and depend on the year in which the ULIP policy is surrendered.

Premium Allocation Charges – This fixed amount is deducted from the premiums paid. Generally, premium allocation charges are higher in the initial years of the policy. However, the amount may vary depending on whether the policy is a single premium plan or a regular plan, the amount of the premiums paid, premium frequency, and payment mode.

Policy Administrative Charges – This amount is charged for the administration of your policy every month. Generally, they are deducted by canceling units proportionately from the fund you have chosen to invest in.

Fund Switching Charges – Depending on your financial goals, you can switch between the funds. Your insurer gives you a fixed number of switches for free. Otherwise, each switch is chargeable, and these charges are deducted by canceling units proportionately from the fund you have chosen to invest in.

Partial Withdrawal Charges - ULIP allow a partial withdrawal facility after the completion of the five-year lock-in period. While some insurers offer unlimited partial withdrawals, some restrict this facility to up to 2-4 free withdrawals. It is best to check with your ULIP provider regarding the same.

You can read more about ULIP Charges and fees on Bajaj Markets. Besides, if you are now keen on buying a ULIP, consider the following factors that will encourage you to make an informed decision

ULIP gives you two withdrawal choices:

Withdrawal Before Completing the Lock-In Period

Every ULIP comes with a five-year lock-in period. So, ideally, you cannot make any withdrawals from your policy until the completion of this lock-in period. However, if you make a partial withdrawal or wish to take the entire amount invested in ULIP by surrendering the policy or not paying the premium, you still won't be able to access your cash until the lock-in period is not over.

Withdrawal After Completing the Lock-In Period

You can withdraw money from ULIP after completing the five-year lock-in period. However, some terms and conditions are applicable on these withdrawals. These include:

Limit on Withdrawal Amount: If you withdraw a significant amount from your ULIP, chances are that your life insurance cover will be terminated. Additionally, the withdrawal limits may differ from insurer to insurer. Some permit withdrawal of up to 10% of the premium paid, while for a few others, this can be up to 20%. The limit can also depend on the fund value post-withdrawal.

Withdrawal Rules for ULIP Top-Ups: Those who opt for ULIP premium top-ups and then plan to withdraw an amount know that the insurer will settle the same from the top-up amount. However, note that the withdrawal amount is not settled from the top-up if the policy is yet to complete its lock-in period.

Here’s an explainer on ULIP, mutual funds, and PPFs. This should help you understand these three financial instruments a little better while also helping you identify which of these would best suit your financial needs.

|

Unit-Linked Insurance Plan (ULIP) |

Mutual Funds |

Public Provident Fund (PPF) |

Nature of Product |

Combination of life insurance and investment |

Pure investment |

Government-backed savings scheme |

Coverage |

Provides life cover that is a minimum ten times the premium amount |

Does not offer a life cover |

Does not offer a life cover |

Tax Benefits |

You can avail income tax deductions on the premiums paid under Section 80C of the Income Tax Act, 1961. Also, the maturity amount is tax-free under Section 10(10D). Note: ULIP issued after February 1, 2021, will be treated as capital gains if the annual premium paid is more than ₹2.5 lakh. Such policies will be taxed at 10% on maturity |

Only Equity-Linked Savings Scheme (ELSS) mutual funds allow you to avail tax deductions of up to ₹1.5 lakh under Section 80C of the Income Tax Act, 1961 |

In PPF, an amount of up to ₹1.5 lakh invested in a single financial year can be claimed for deductions under Section 80C of the old income tax structure |

Flexibility |

Flexibility of choice when switching between funds |

No such flexibility offered |

No such flexibility offered |

Returns |

ULIP returns depend on the type of funds you choose to invest in and the performance of the underlying markets |

Mutual fund returns depend on fund allocation in conjunction with the market performance |

PPF is known to provide fixed returns every year. The interest rate is decided by the Indian government at the start of each financial year. Currently, PPF has an interest rate of 7.1% (2021-22). |

ULIP investments provide several features and benefits that you can avail. However, the highlighting factor of the instrument is its tax benefits. Along with building your wealth over time and securing your family’s financial future, ULIP allows you to save money on tax.

Here’s a quick overview of ULIP tax benefits:

Tax Benefit on ULIP Premiums |

The premiums paid towards your ULIP investments can be claimed for tax deductions under Section 80C of the Income Tax Act, 1961 (old income tax structure). The maximum amount you can claim as a deduction under this section is ₹1.5 lakh. |

Tax Benefit on ULIP Maturity |

If all ULIP premiums are paid on time, you do not pay any tax on maturity (for policies issued before February 1, 2021) under Section 10(10D) of the Income Tax Act. However, for ULIP purchased after February 1, 2021, the scenario is different. If the aggregate annual premium exceeds ₹2.5 lakh, the maturity benefit will be taxed as a capital asset as stated in the Union Budget 2021. |

Tax Benefit on Partial Withdrawals |

Once the five-year ULIP lock-in period is complete, you can make partial withdrawals. These withdrawals are tax-free under Section 10(10D) of the Income Tax Act. Moreover, the premium payable to the sum assured should not exceed 10%, and the partial withdrawal amount should be less than or equal to 20% of the fund value. |

Tax Benefit on Payouts in the Event of Death |

In case of your unfortunate death, your family will receive the entire sum assured or the total fund value (whichever is higher). This payout is completely exempt from tax. |

Tax Benefit on ULIP Top-Ups |

Another great feature of ULIP is that the policy allows you to increase your investment with top-up premiums. As such, you can invest any surplus cash in ULIP and save money on tax. That’s because these top-ups are eligible for tax deductions under Section 80C of the old income tax regime. |

Long-Term Capital Gains (LTCG) Tax Benefit |

LTCG tax came into the picture with the Union Budget 2018. It is applicable on capital gains exceeding ₹1 lakh from equity investments (including ELSS). Thus, if you invest in equity-oriented funds through ULIP, you can avail this tax benefit. |

Best ULIP Plans Available At Bajaj Markets

Bajaj Allianz Future Gain |

Bajaj Allianz Goal Assure |

FAQs on ULIP

Is ULIP a good investment?

Is the ULIP maturity amount taxable?

No, ULIP maturity amount is exempted from tax under Section 10(10D) of the Income Tax Act, 1961. Thus, you will either receive the assured benefit or the value of the unit-linked investments, whichever is higher.

When can I withdraw my ULIP?

Are ULIPs safe?

Yes, if you choose a safer route to make the investments that give relatively good returns, it is secure to invest in ULIPs. However, high returns are acquired only on equity-oriented funds which are a risky investment for the young investors.

Can I terminate my ULIP?