An E-Way Bill (EWB) is required for goods being transported between states if their value exceeds ₹50,000. However, some items may be too large to fit in a single vehicle. To solve this, these items are disassembled for easier transport. After disassembly, the goods are referred to as Semi Knocked Down (SKD) or Completely Knocked Down (CKD) goods. These goods are then sent to their destination state using multiple vehicles.

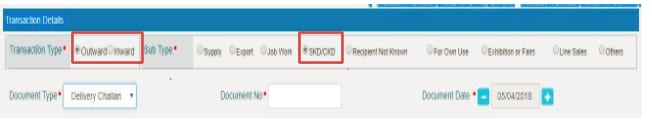

When generating an E-Way Bill, the person must choose between two transaction types: 'Outward supplies' or 'Inward supplies'. If SKD or CKD goods are being transported, and the 'Outward supplies' option is selected, the transaction subtype must be marked as 'SKD/CKD'.

This particular transaction type is more popular in industries that produce or trade in heavy machines or furniture, such as the automotive, infrastructure or the furniture industry. Oftentimes, such goods are dismantled at the place of origin, packed in compact boxes and taken across state borders through several vehicles.

To generate an e-way Bill for Completely Knocked Down (CKD) or Semi Knocked Down (SKD) goods, the supplier must follow the below-mentioned steps:

- Step 1: The supplier must login to the e-way bill portal with their credentials.

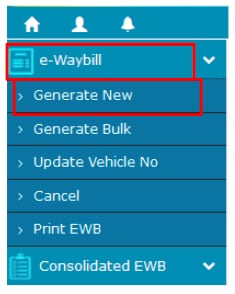

- Step 2: Then, the supplier must click on the e-way bill and then ‘Generate new’.

Step 3: Post that, the supplier must select the transaction type as “Outward” and “SKD/CKD” as the transaction subtype.

Step 4: Finally, the supplier must update the delivery challan details and fill up Part A and B in order to generate the e-way Bill against each and every such delivery challan.

FAQs

What is the full form of SKD in GST?

SKD stands for Semi Knocked Down. Under GST, SKD refers to goods partially disassembled for easier transport and then assembled at the destination. This classification is important for e‑way bill issuance and logistics documentation under GST rules.

What is the full form of CKD in GST?

CKD stands for Completely Knocked Down. It applies to goods broken down entirely into parts and shipped separately, requiring full assembly on arrival. CKD classification impacts GST compliance, invoicing, e‑way bills, and customs under the GST framework.