Imports and exports play a vital role in global trade, allowing goods to move between countries. When goods are transported across borders in India, it is mandatory to generate an e-way bill. This ensures transparency, monitors the movement of goods, and helps prevent tax evasion. The e-way bill is an essential document for both importing goods into India and exporting goods out of the country. Whether goods are being shipped by road, rail, or air, having an e-way bill helps streamline the process. It ensures goods reach their destination without delays or penalties.

Imports and exports form the core of a country’s international trade and boost its foreign exchange earnings. In India, all entities taking part in import and export activities are required to abide by the E-way bill rules specified under the Central Goods and Services Tax (CGST) Act, 2017. As per the Act, an ‘Import’ is defined as bringing goods from other nations to India. An ‘Export’, on the other hand, means transporting goods from India to a foreign country.

As far as the role of a GST E-way bill is concerned, one must be generated for all goods’ consignment that travels interstate and has a market value of over ₹50,000. Such goods attract what is known as the Integrated Goods and Service Tax (IGST) as per the law. However, the export of goods does not attract any tax as it is considered as a zero-rated supply. This article will talk about the E-way bill requirements when it comes to matters of import and export of goods. Read on to know more.

E-way bill requirements vary depending on whether the goods are being imported or exported. In some cases, there is no need to generate an E-way bill while in other cases, there are minimal to zero E-way bill requirements. Let us now examine the import and export process in detail.

E-way Bill for Import & Stages of Importing a Consignment Into India

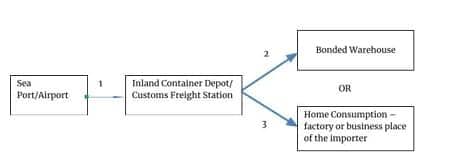

A consignment is considered to be successfully imported into the country when it either reaches the seaport or the airport.

After that, the goods are moved to the custody of the customs department. Then, they are transported to an Inland Container Depot (ICD) or a Container Freight Station (CFS) for clearance purposes. This type of transportation does not require the generation of an import E-way bill.

At the ICD or CFS, a bill of entry is filed and the applicable customs duties are paid by the importer. Post which, the goods are cleared for home consumption. In case they are not cleared, they are kept in a bonded warehouse until clearance. The movement of the goods from an ICD/CFS to such a facility does not require the generation of an E-way bill either. But, as and when they are cleared, the transportation of goods that follow this clearance requires the generation of an Eway bill for import

E-way Bill for Export & Stages of Exporting a Consignment out of India

When goods are being transported from the place of business to the warehouse of the exporter, the concerned individuals will be required to generate an E-way bill for export.

- The goods are then later transported to an ICD or a CFS. This part of the export process does not require the generation of an export E-way bill.

Note that the likes of petrol, diesel, and kerosene do not require E-way bill generation.

Apart from the above, no GST E-way bill needs to be generated in the following scenarios:

If the goods are being transported to or from Nepal/Bhutan

- If the goods are being moved between custom ports/ICDs or CFS

The table below shows when an E-way bill is required and not required in the case of import and export.

|

E-way Bill Required |

E-way Bill Not Required |

Import |

Movement of goods from ICD or CFS or warehouse to factory or importer’s business location, post clearance |

|

Export |

Movement of goods from exporter’s business place to ICD/CFS/Warehouse, post clearance |

|

The steps for the E-way bill generation process remain the same in the case of import and export but below mentioned E-way bill particulars need to be noted while generating an E-way bill in case of import and export.

Import/Export E-way bill Particulars |

Import |

Export |

Transaction Subtype |

Import |

Export |

Document number and type |

Bill of Entry |

The tax invoice meant for the export of goods |

Bill From |

Unregistered Person (URP) |

Details of the exporter (such as their name and GSTIN number) |

Dispatch From |

The pin code 999999 will have to be entered and ‘other countries’ will have to be selected in the ‘State’ column |

Address of the warehouse/ place of business of the exporter |

Bill to |

Details of the Importer (such as their name and GSTIN) |

An unregistered person living outside (mention URP in such cases) |

Ship to |

The address of the warehouse/business place of the importer |

The pin code 999999 has to be entered. Additionally, “Other Countries” must be selected in the state column |

Transportation details |

Transporter details (such as vehicle details, transporter ID, etc.) |

Details of the transporter (such as vehicle details and your transporter ID, among others) |

While a GST E-way bill generation is mandatory for the import and export of goods, it is important that the E-way bill generated stands valid. The validity of an E-way bill depends on the distance of movement of goods. For imports, the distance is calculated between the ICD/CFS and the factory/importer’s business location, whereas for exports, the distance is computed between the warehouse/exporter’s business location to the ICD/CFS. Ensure that the distance covered is calculated exactly when generating the E-way bill.

High sea sales do not require an E-way Bill because these transactions occur outside Indian jurisdiction. Since the goods have not yet entered Indian territory, they are not subject to Indian GST regulations.

The exemption from needing an E-way bill for high sea sales is outlined in Rule 138(14)(g) of the Central Goods and Services Tax (CGST) Rules, 2017. This rule specifies that transactions occurring while goods are still at sea do not require an E-way bill.

Consequently, businesses engaged in high sea sales are relieved from generating this document until the goods arrive in India. After customs clearance, if the goods are transported within the country (either intra-state or inter-state), an E-way bill becomes mandatory. This is the case, if their value exceeds ₹50,000. Businesses must ensure compliance with GST regulations during this phase to avoid penalties and ensure smooth logistics operations.