Check your claim status on EPFO website with a quick and easy process!

If you have savings accumulated in your EPFO account, you can withdraw these funds by submitting a withdrawal request, also known as a claim. An EPFO claim status shows the progress of this withdrawal request, whether it is under review, processed successfully, or if any issues have arisen. Regularly tracking your EPFO claim status helps you ensure that your withdrawal is processed smoothly, letting you quickly address any delays or discrepancies.

After submitting a claim, either online or offline, you can easily track its progress. Your EPFO online claim status indicates the current stage of your withdrawal request. The status updates range from ‘under process’ to ‘settled’, helping you know exactly when the money is credited or if any issues require attention.

Here are the situations where you can make EPF claims:

Pre-Retirement

You can request partial withdrawals for specific needs before retirement, such as purchasing a home, funding higher education, or covering medical costs

Upon Retirement

You qualify for a full withdrawal of your EPF balance once you reach the age of 58, providing you with financial support for retirement

During Unemployment

If you have been unemployed for more than a month, you may withdraw a portion of your EPF savings to help manage your finances

Your eligibility for an EPF withdrawal depends primarily on your age and employment status. Below is a quick summary of the conditions for withdrawing various percentages of your EPF corpus:

Claim Type |

Conditions |

100% Claim of EPF Corpus |

|

90% Claim of EPF Corpus |

|

75% Claim of EPF Corpus |

|

Tracking your EPF claim status is easy, with convenient methods at your fingertips. Here’s how you can check your EPF claim status online and through other simple options:

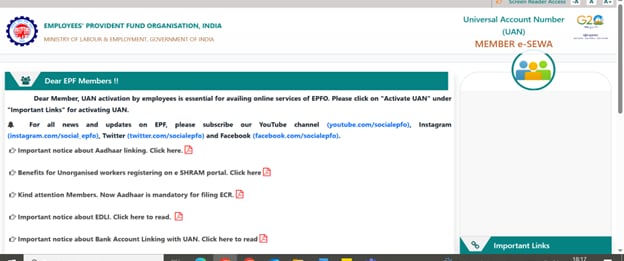

Check EPF Claim Status Online Using Universal Account Number (UAN)

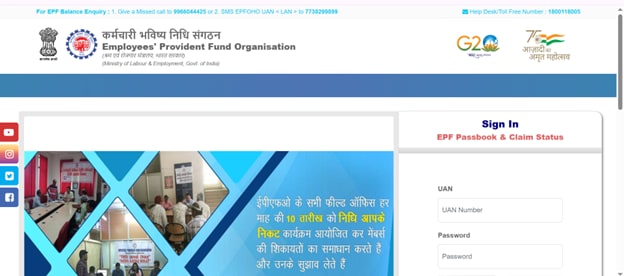

You can simplify the management of your Provident Fund account with the Universal Account Number (UAN). To view your EPFO login claim status, log in to the UAN Member Portal using your UAN and password.

Here is the process to check the claim status using UAN:

Log in to the UAN Member Portal using your UAN and password.

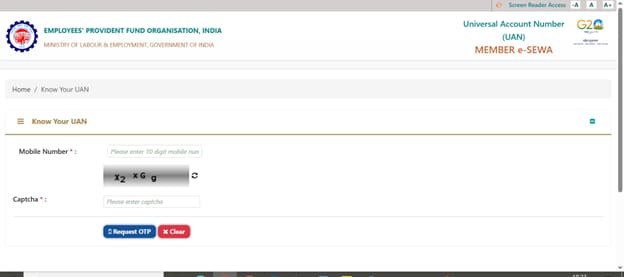

Click on the ‘Know your UAN’ tab

Enter your details and click on ‘Request OTP’

View the status of your withdrawal claim on the screen

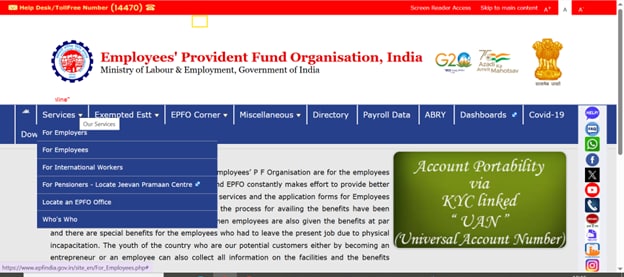

Check Claim Status via EPFO’s Official Website

You can also track your EPF claim status online through the EPFO’s official website. Follow these simple steps:

-

-

To check EPF claim status online, visit EPFO’s dedicated portal

Look for the ‘Services’ option.

From available tabs, click on ‘For Employees’.

Once redirected to the next page, click on the ‘Service’ option.

Next, open the ‘Know your Claim Status’ option.

Enter UAN number and password

Enter CAPTCHA in the respective blocks

Proceed by clicking on the ‘Search’ option.

Next, select ‘Member ID’.

At last, click on the ‘View Claim Status’ option to check the progress of your PF claim.

-

Check EPF Claim Status via Missed Call or SMS

To check your EPF claim status using the missed call service, simply follow these steps:

-

-

Register your mobile number with your UAN on the Unified Portal.

Link your UAN with at least one KYC detail: Bank Account Number, Aadhaar, or PAN.

Give a missed call to 9966044425 from your registered mobile number.

Your call will automatically disconnect after two rings, and you will receive an SMS with details of your last contribution and PF balance.

-

To know your latest PF contribution and balance via SMS, send a message from your registered mobile number using the following format:

‘EPFOHO UAN’ to 7738299899

To receive the SMS in a language other than English, add the first three letters of your preferred language after UAN. For example, for Hindi, the SMS should be:

‘EPFOHO UAN HIN’ to 7738299899

You can receive information in English, Hindi, Punjabi, Gujarati, Marathi, Kannada, Telugu, Tamil, Malayalam, and Bengali. The service will provide your last PF contribution, balance details, and available KYC information.

Understanding the status of your EPF claim is crucial for tracking its progress. Here are the four possible stages and what they mean:

Not Available: The claim process has not been initiated yet.

Payment Under Process: Your claim is currently being processed and the amount will be transferred upon completion.

Settled: The EPFO has accepted and processed your claim and the funds have been credited to your account.

Rejected: The EPFO rejected your claim due to discrepancies in the details you provided or failure to submit the signed claim application within 15 days.

The processing time for EPF claims is typically around 20 days. This timeframe can vary based on factors such as the claim type, documentation completeness, and verification processes.

To expedite your claim, ensure that all your details are accurate and that your KYC documents are linked to your UAN.

When filing an EPF claim, several factors can cause delays or rejections. Here are some common factors that could affect the smooth processing of your claim:

Unclear Scan of Documents

Ensure the scanned copy of your cheque, passbook, or bank statement is clear. It must show your name, account number, and IFSC code. If unclear, EPFO may ask you to resubmit, causing delays.

Wrong Details

Make sure your bank details, such as the IFSC code, match the UAN records. Incorrect information or unlinked accounts can delay processing. Employers must approve any changes to KYC details.

Not Fulfilling Criteria

You must have contributed to EPF for at least three months to be eligible for a non-refundable advance. Claims filed without meeting this requirement will be rejected.

Time Taken by Banks

EPFO processes claims within three days, but banks may take an additional one to three days to credit the amount. Check if the delay is from the bank's side.

The possible reasons for rejection of an online claim by the employer can be classified into two categories:

For claims submitted for attestation by the previous or current employer:

The claim (physical or online) has already been forwarded to the EPFO and has not been rejected to date.

The signed copy of the claim printout submitted online has not been received from the member (applicable after 15 days of online submission).

The member’s details do not match the employer's records.

The member’s signature does not match those available in office records.

For verification of member details by the previous employer when the claim is submitted through the current employer:

The member’s details do not match the employer's records

To successfully navigate the EPF claim process, you need to understand the steps to address a rejection. Here’s what you should do before you re-apply:

Check Your Eligibility

Verify your eligibility for the EPF claim. There are specific criteria you must meet. Learn about the different types of PFs and ensure you fulfill the requirements before reapplying for your EPF withdrawal online.

Correct the Errors

Identify the mistakes that led to your claim's rejection and rectify them. Common issues include misspelt names, incorrect information, mismatched signatures, or missing documentation. Verify with the officials, make the necessary corrections, and submit your claim again.

Get Professional Help

If you need assistance, reach out to experts in the field. Your employer, the finance team, or EPFO officials can help you with any difficulties you encounter.

Submit Your Claim on Time

Stay mindful of the timeline, which is crucial in the EPF claim process. Submitting your claim too early or too late can lead to rejection, so be sure to adhere to the deadlines.

You can contact the EPFO for assistance through the Helpdesk or the Grievance Redressal Portal.

Helpdesk

For assistance with your EPF account, you can reach out to their helpdesk by calling 14470. This dedicated helpline is available to address your queries and provide support. It's a quick way to get help with any EPF-related issues.

Grievance Redressal Portal

Visit the EPF Grievance Management System (EPFiGMS) at https://epfigms.gov.in/ to file your grievances for any EPFO service. Once registered, you will receive a unique registration number and an acknowledgement via SMS and email.

The system is bilingual and offers faster redressal after recent updates. You can send grievances to the head office in New Delhi or any of the 135 field offices across the country.

To successfully make an EPFO claim, you need to have the right documents. Doing so can streamline the process and reduce delays. Here is a list of key documents required for different types of claims, including PF withdrawal, pension, and transfer:

Universal Account Number (UAN)

Bank account information

Identity and address proof

Cancelled cheque

Composite Claim Form

Two revenue stamps

Personal information

If you withdraw your EPF before five years of continuous service, include ITR Forms 2 and 3

Tracking your EPF claim status is easy, with convenient methods at your fingertips. Here’s how you can check your EPF claim status online and through other simple options:

Check EPF Claim Status Online Using Universal Account Number (UAN)

You can simplify the management of your Provident Fund account with the Universal Account Number (UAN). To view your EPFO login claim status, log in to the UAN Member Portal using your UAN and password.

Here is the process to check the claim status using UAN:

Log in to the UAN Member Portal using your UAN and password.

Click on the ‘Know your UAN’ tab

Enter your details and click on ‘Request OTP’

View the status of your withdrawal claim on the screen

Check Claim Status via EPFO’s Official Website

You can also track your EPF claim status online through the EPFO’s official website. Follow these simple steps:

To check EPF claim status online, visit EPFO’s dedicated portal

Look for the ‘Services’ option.

From available tabs, click on ‘For Employees’.

Once redirected to the next page, click on the ‘Service’ option.

Next, open the ‘Know your Claim Status’ option.

Enter UAN number and password

Enter CAPTCHA in the respective blocks

Proceed by clicking on the ‘Search’ option.

Next, select ‘Member ID’.

At last, click on the ‘View Claim Status’ option to check the progress of your PF claim.

Check EPF Claim Status via Missed Call or SMS

To check your EPF claim status using the missed call service, simply follow these steps:

Register your mobile number with your UAN on the Unified Portal.

Link your UAN with at least one KYC detail: Bank Account Number, Aadhaar, or PAN.

Give a missed call to 9966044425 from your registered mobile number.

Your call will automatically disconnect after two rings, and you will receive an SMS with details of your last contribution and PF balance.

To know your latest PF contribution and balance via SMS, send a message from your registered mobile number using the following format:

‘EPFOHO UAN’ to 7738299899

To receive the SMS in a language other than English, add the first three letters of your preferred language after UAN. For example, for Hindi, the SMS should be:

‘EPFOHO UAN HIN’ to 7738299899

You can receive information in English, Hindi, Punjabi, Gujarati, Marathi, Kannada, Telugu, Tamil, Malayalam, and Bengali. The service will provide your last PF contribution, balance details, and available KYC information.

Income Tax Exemptions & Deductions

Income Tax Tools & Articles

- Top Tax Saving Investment

- Tax Declaration vs Tax Filing

- What Is TDS Rate?

- What Is TDS?

- Important Sections Of Income Tax

- Critical Illness Tax Benefit

- Income From Other Sources

- Tax On Interest Income

- Tax Benefit On Personal Loan

- Tax Benefits on Business Loan

- Tax Benefits On Loan Against Property

- Health Insurance Tax Benefits

Frequently Asked Questions

Why is my EPFO claim taking longer than expected?

If your EPFO claim is taking longer than expected, the following factors may be causing the delay:

Claims may be delayed or rejected due to incorrect details provided.

Withdrawal claims can be rejected if Aadhaar and UAN are not linked.

The previous employer may not have specified the exit date.

The employer may reject the online claim application within 15 days.

An IT issue at the EPFO may lead to delays in claim settlements.

How do I check my claim status without a UAN?

You run an EPF claim status check without a UAN number with your PF account number. Visit the EPFO website and go to the ‘Know your Claim Status’ page. Select your state and city, enter your PF account number, and click ‘Submit.’

To check your PF balance without a UAN, you can use the missed call and SMS services. You can also use the EPFO online portal or the UMANG mobile application.

What should I do if my claim status shows ‘Rejected’?

If your claim status shows ‘Rejected’, first check your eligibility for the EPF claim and ensure you meet the requirements. Next, identify and correct any errors that led to the rejection, such as misspelt names or missing documents.

If needed, seek help from your employer or EPF officials. Finally, reapply while adhering to the submission timeline to avoid further issues.

Quick Links