Step-by-step process to link Aadhaar with PAN card via SMS/online/offline

On July 1, 2017, the Indian government made it mandatory for every resident of the country to link their Aadhaar and PAN cards. Filing income tax returns, opening a stock trading account, opening a bank account, buying/selling financial securities, or even checking your CIBIL score becomes easy with this linkage. Dec 31, 2024 has been set as the last date for you to link your Aadhaar Card to your PAN Card to avoid any severe consequences.

Follow these simple steps to check the status of your PAN Aadhaar linking application:

Go to the Income Tax Department’s official e-filing portal

Navigate to ‘Quick Links’ and click on ‘Link Aadhaar Status’

Provide your PAN details and Aadhaar number

Next, click the ‘View Link Aadhaar Status’ option

Following this, your PAN Aadhaar linking status will be displayed on the screen.

There are several ways in which you can link your PAN card to your Aadhaar card to avoid serious implications of being unable to do so -

Link Aadhaar to PAN Card online,

Link Aadhaar to PAN Card online through an SMS

Even Link Aadhaar to PAN Card manually

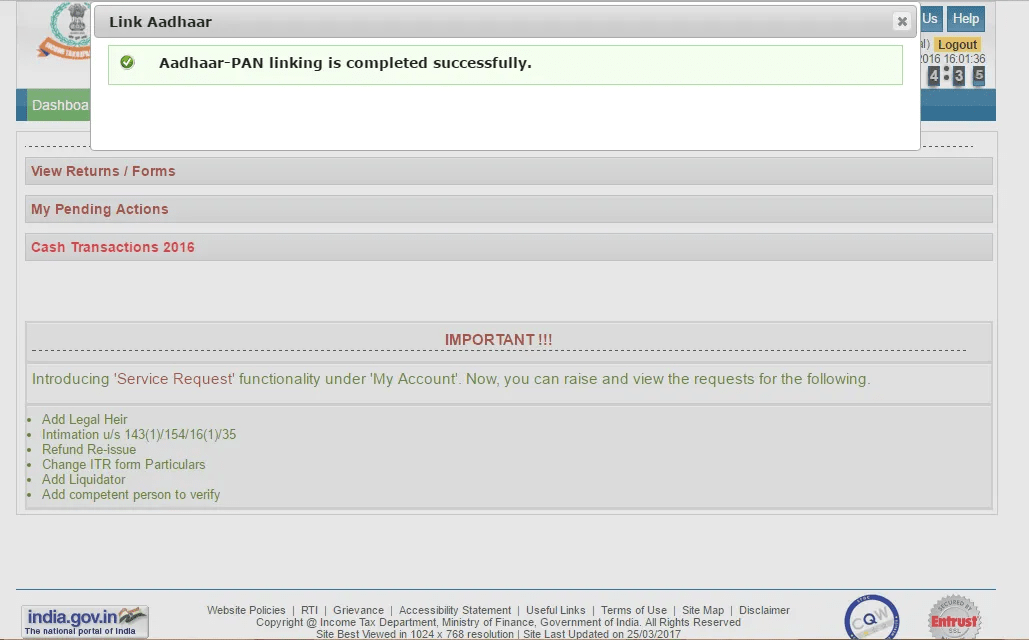

Below are the steps on how to link your PAN Card to Aadhaar Card online with the help of the e-filing website of the Income Tax Department of India -

Visit the official Income Tax e-filing website at incometax.gov.in/iec/foportal

On the homepage, you will be able to see the ‘Quick Links’ button. Click on the same and then select the ‘Link Aadhaar’ sub-option from it to move further.

Once you do the same, you will see a pop up notification saying that your payment details have been verified. Click on the ‘Continue’ option to move further.

On the page that you will be redirected to, you must then enter your PAN and Aadhaar number. Conclude this step by clicking on the ‘Validate’ button to proceed.

Feed in your PAN Card number, Aadhaar Card number, your name as per your Aadhaar Card. Additionally, you will find two tick boxes underneath that. One will ask you whether your Aadhaar number only states your date of birth and the other one will ask you for your consent for validating your Aadhaar. Click on the first one if that is true in your case. In the case of the other, you will have to mandatorily click on the same to proceed.

Enter the One Time Password (OTP) that you will receive on your mobile number on the following page. Click on the ‘Validate’ option to proceed. Note that you will receive the said OTP from the Income Tax Department of India itself.

You will finally see a notification stating that your Aadhaar-PAN linking request has been shared with the Unique Identification Authority of India (UIDAI). Additionally, it will also say that you must check the status of the same after a few days. If you see such a notification, you have successfully placed a request for linking your Aadhaar to your PAN Card.

You can also link aadhar and PAN card by simply sending an SMS to a particular number. Note that in order to do so, you will need to make the payment to the concerned authorities through the NSDL portal as per the standard procedure mentioned previously. Once you have made the payment, you must:

Type an SMS message in the format of UIDPAN <12-digit Aadhaar> <10-digit PAN>.

Use your registered mobile number to send the message on 567678 or 56161.

For instance, if your Aadhaar card number is 123456789101 and your PAN is FGHIJ2345D, you have to send the message in the form of UIDPAN 123456789101 FGHIJ2345D and then send the text message to either 56161 or 567678. As soon as the informatio

To link your PAN with your Aadhaar post the set deadline of 31 Dec 2024, you need to pay a fee of ₹1,000.

If you do not wish to use any of the two above-listed methods, learn how you can link your Aadhaar and PAN card manually -

Visit the nearest NSDL office.

Fill up the relevant form after checking with the concerned official.

Feed in the relevant details and submit the supporting documents like your Aadhaar card, PAN card, and birth certificate. Post-verification, the Aadhaar will be linked to the PAN.

Benefits of Linking PAN Card with Aadhaar Card

Some of the reasons that you must link your PAN Card to your Aadhaar Card are as follows:

If you do not link your PAN card to your Aadhaar card before June 30, 2024, your PAN card will be deactivated. This means that you will not be able to carry out any financial transactions in the future.

You will get a summarised detail of all the taxes levied on you in a more streamlined form.

You will not be able to file your income tax returns.

In case a single entity or many of them have issued a PAN card in your name, they will get deactivated in the due course of time, thus saving you from cases of identity theft.

In the case that the name is completely different in the Aadhaar Card when compared to the PAN Card, the correction has to be made on the PAN database or the Aadhaar database. If the name mismatch is minor, you must generate a One Time Password (OTP) that will on be generated on your registered phone number. The OTP can be used to verify the name change. You must also make sure that the date of birth and gender details are the same.

Aadhaar Card Quick Links

- Maadhaar

- Aadhaar PVC Card

- Baal Aadhaar Card

- Aadhaar Card E-Signature

- Udyog Aadhaar

- PM Kisan Samman Nidhi Status

- PM Kisan Samman Nidhi Yojana

- Update Aadhaar Biometric

- Change Photo In Aadhaar Card

- Aadhaar Authentication

- Aadhaar Card Application Form

- Documents Required For Aadhaar Card

- Apply Pan Card Through Aadhaar

- Difference Between Aadhaar Card And Pan Card

- Aadhaar Card Name Change After Marriage

- Aadhaar Card Not Received

Link Your Aadhaar

- Link Mobile Number To Aadhaar Card

- Link Aadhaar With PNB Bank Account

- Link Aadhaar With Union Bank Of India Account

- Link Aadhaar To PM Kisan Samman Nidhi

- Link Aadhaar With LIC Policy

- Link Aadhaar With ICICI Bank Account

- Link Aadhaar With SBI Bank Account

- Link Aadhaar Card To EPF Account

- Aadhaar Pan Delinking

- Masked Aadhaar

- Jeevan Pramaan

- Prevent Misuse Of Aadhaar Card

- E Aadhaar Card

- Check Aadhaar Card Usage History Online

- Aadhaar Card Verification

- Aadhaar Card Password

Aadhaar Card Centers

- Aadhaar Card Customer Care Number

- Aadhaar Card Centers In Ahmedabad

- Aadhaar Card Centers In Hyderabad

- Aadhaar Services

- Aadhaar Card Centers in Mumbai

- Aadhaar Card Centers Kolkata

- Aadhaar Card Centers In Bangalore

- Aadhaar Card Centers In Ghaziabad

- Aadhaar Card Centers Chennai

- Aadhaar Card Centers In Delhi

- Aadhaar Seva Kendra

- Appointment For Aadhaar Enrolment

- Aadhaar Card Centers In Patna

- Aadhaar Card Centers In Lucknow

- Aadhaar Card Centers In Guwahati

- Aadhaar Enabled Payment System

Frequently Asked Questions

What to do if you are unable to link your PAN to Aadhaar?

If you are unable to link your Aadhaar card to your PAN card, chances are that the details in both of these documents do not match. If that is the case, you must get the details rectified and ensure that the information provided on both of the documents is the same.

Is it mandatory to link your PAN to your Aadhaar?

Yes, it is mandatory for you to link your PAN card to your Aadhaar card. The deadline for the same is March 31, 2026.

What are the documents required to link your PAN card to your Aadhaar Card?

The only documents you require to link your PAN card to your Aadhaar Card are your PAN Card and your Aadhaar Card. But, before initiating this process, you must ensure that the details in both of these documents match.

What happens if you do not link your Aadhaar Card to your PAN?

If you do not link your Aadhaar Card to your PAN card, your PAN card will become inoperative, which means that you will be unable to carry out any financial transactions in the future.

Can the Aadhaar and PAN card be unlinked?

No. Once you link your PAN card to your Aadhaar card, you cannot unlink them.