Late payments on your CIBIL report can have a significant impact on your financial health. It is essential to understand how they affect your credit score, how long they stay on your report, and what steps you can take to correct or prevent them. In the case of an inaccurate entry, it is important that you raise a complaint and get the record removed from your report. Let’s learn about the impact of late payments in detail and how to correct an inaccurate late payment record in your report.

Late payments can harm your credit score significantly. When you miss a payment deadline, lenders report this to credit bureaus like CIBIL. Here's how it can impact you:

Immediate Score Drop

A single late payment can cause a noticeable and immediate drop in your credit score, often by up to 100 points. However, this depends on your overall credit profile. Generally, if you have a strong credit history and high scores the impact is greater due to your past reliability amplifying the severity of the mistake.

The extent of the drop also depends on how late the payment is. Delays of 30 days may result in a smaller score reduction compared to payments overdue by 60 or 90 days. Additionally, the type of credit account matters; for example, missing a mortgage payment tends to have a more severe impact on your score than missing a credit card payment.

Negative Impact on Creditworthiness

Late payments cast doubt on your reliability as a borrower, directly affecting your creditworthiness. Lenders view such delays as a sign of potential financial instability, making it harder for you to secure future loans or credit cards. Even if you manage to get approval, the terms may not be favourable.

You may be offered reduced credit limits, higher collateral requirements, or might need a guarantor for credit approval. Moreover, late payments tarnish your reputation with financial institutions, making you less preferred for pre-approved offers or preferential lending rates. This lingering perception of risk can complicate your financial opportunities for years to come.

Higher Interest Rates

A late payment not only lowers your credit score but also increases the cost of borrowing. Lenders use your credit score to assess risk, and a lower score makes you a higher-risk borrower. To mitigate this risk, lenders charge higher interest rates, significantly increasing the cost of new loans and credit cards.

This means you may end up paying much more in monthly payments and overall interest over the loan’s duration. Additionally, a poor credit score limits your options, often restricting you to products with unfavourable terms. These may include steep Annual Percentage Rates (APRs) or additional charges. The financial consequences of higher interest rates can persist for years, affecting your ability to save or invest.

Persistent Effect

The effect of a late payment isn’t fleeting; it can remain on your credit report for up to 7 years. While its impact on your credit score lessens over time, the record continues to act as a red flag for lenders assessing your repayment capabilities. Payment history usually accounts for up to 35% of your credit score. Thus, even one late payment can have a long-lasting effect.

If late payments occur repeatedly, the cumulative damage can make rebuilding your score more challenging. Making consistent on-time payments over time can gradually repair your credit profile. Even so, the presence of late payments on your report can still deter lenders, resulting in less favourable borrowing terms.

Late payments typically stay on your credit report for up to 7 years from the date of delinquency. While their impact on your credit score reduces over time, the record remains visible to lenders throughout this period. The most significant effect is seen over the first 2 years, as lenders closely scrutinise recent payment history when evaluating your creditworthiness. After 7 years, the late payment is automatically removed from your report, ceasing to impact your financial profile.

Addressing inaccurate late payment records in your CIBIL report is crucial for maintaining an accurate credit profile. The detailed steps to address such errors are as follows:

Review Your Credit Report

The first step is to obtain a copy of your CIBIL report and examine it carefully for inaccuracies. Look for entries showing late payments that you know were made on time. Pay close attention to the dates, payment amounts, and account details. Errors may occur due to system glitches, reporting delays, or clerical mistakes by lenders. Identifying these discrepancies early allows you to take corrective action promptly, preventing further damage to your credit score.

Contact the Lender

Once you’ve identified an error, contact the lender responsible for reporting the incorrect late payment. Reach out to their customer service or grievance redressal team, providing detailed information about the discrepancy. Include proof of on-time payments, such as bank statements, payment receipts, or transaction records. Be clear and concise in explaining the issue, and request them to update their records. Many lenders have a formal dispute process, and resolving the error at this stage is often quicker and more efficient.

File a Dispute with CIBIL

You can also file a dispute directly with TransUnion CIBIL. Log in to the official website and navigate to the dispute resolution section. Provide accurate details about the incorrect entry and upload all necessary supporting documents. These include your correspondence with the lender and payment proofs. Ensure the information submitted matches the details in your report. CIBIL will investigate the claim by contacting the lender for verification and resolve the dispute within 30 to 45 days in most cases.

Follow Up Regularly

After filing a dispute, follow up consistently to monitor the progress of your case. Check for updates on the CIBIL portal or communicate with the lender for additional clarity. Persistence is key to ensuring timely resolution. Once the correction is made, request an updated copy of your credit report to confirm the changes have been implemented accurately.

Here are some tips you can utilise to stay on track and avoid making any late payments:

Set Up Auto-pay

Automating your bill payments is one of the easiest and most effective ways to avoid missing due dates. Most banks and lenders offer auto-debit services that deduct the payment directly from your account on the due date. This eliminates the risk of forgetting a payment, especially for recurring bills like EMIs, utility payments, or credit card dues. Ensure that your account always has sufficient funds to avoid failed transactions, which can also negatively impact your credit profile.

Use Payment Reminders

If you prefer making manual payments, set up reminders to alert you about upcoming due dates. Use phone alarms, calendar notifications, or e-mail reminders to stay informed. Many banking apps and credit platforms also provide alerts a few days before the due date. By staying notified, you can plan your finances accordingly and ensure timely payments.

Maintain an Emergency Fund

Financial emergencies, such as unexpected expenses or job loss, can sometimes lead to missed payments. Building an emergency fund can help you cover your obligations during difficult times. Aim to save at least 3 to 6 months’ worth of essential expenses, including loan repayments and bills. An emergency fund acts as a financial cushion, ensuring you don’t default on payments even during unforeseen situations.

Consolidate Debts

Managing multiple loans or credit card payments can be overwhelming, increasing the likelihood of missed payments. Consider consolidating your debts into a single loan with a fixed repayment schedule. This simplifies your finances, making it easier to track payments and reduce the risk of missing due dates. Debt consolidation also often comes with lower interest rates, reducing your financial burden.

Monitor Your Finances

Keeping a close eye on your income and expenses is crucial to avoid surpassing your budget. Create a monthly budget to allocate funds for all your obligations, including loan EMIs, credit card bills, and utilities. Track your spending habits to identify areas where you can cut back and free up cash for timely payments. Financial discipline ensures that you remain in control of your obligations and avoid unnecessary delays.

Regular tracking can help you stay alert to potential issues before they affect your credit report.

You don’t have to decode your credit score manually. With the Bajaj Markets app, key insights from your credit performance are now presented through a smart, easy-to-understand widget.

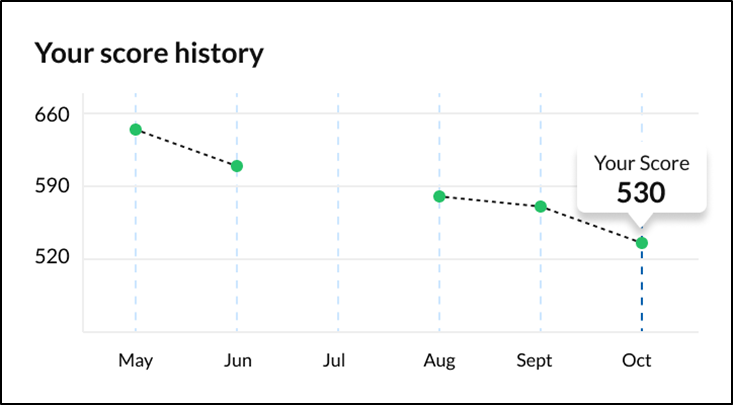

Score History

This widget helps you visualise how your credit score has changed over the past six months. If you're new to the app, you’ll see your current score, with previous months blank until sufficient data is available.

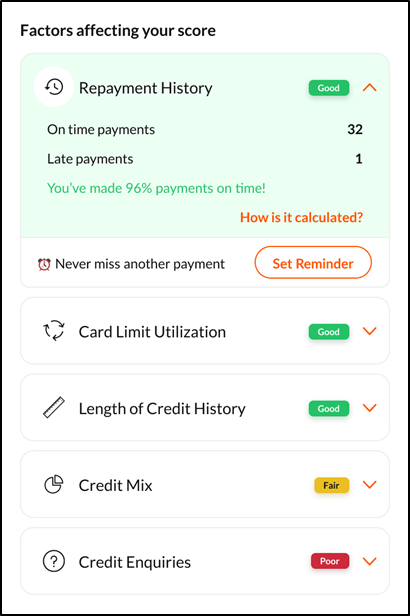

Credit Factors

This section breaks down what’s driving your score—be it your repayment behaviour, credit usage, or active loan accounts. It helps you understand which habits are helping and which may need attention.

It shows two key figures:

- On-time payments: Total number of payments made on or before the due date.

- Late payments: Total number of delayed or missed payments.

You can also see a payment success rate presented as a percentage (e.g., “You’ve made 96% payments on time!”), which gives a quick sense of your credit discipline.

Additionally, the Bajaj Markets app offers a reminder option to help you avoid future delays. You can tap on ‘Set Reminder’ to ensure you never miss a due date, protecting your score from unnecessary drops.

Account Summary: Repayment History

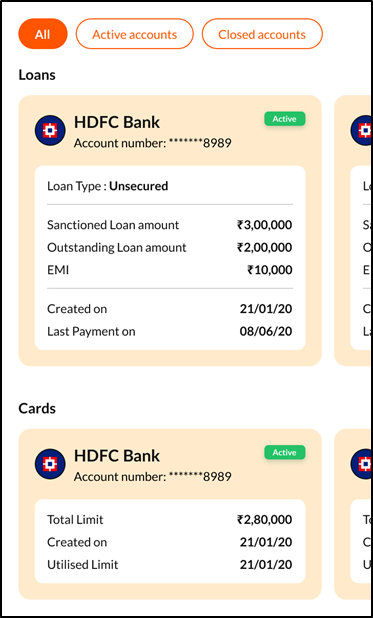

You can access a comprehensive view of all your active and closed credit accounts, both for loans and credit cards. Key capabilities include:

Loan Account Summary

View important loan details such as:- Bank name and account number

- Loan type (secured/unsecured)

- EMI amount

- Last payment date

- Bank name and account number

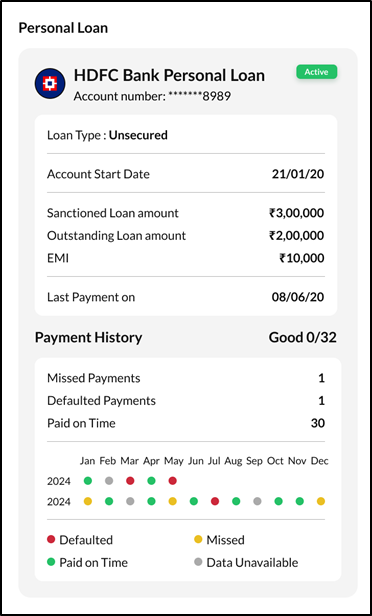

Repayment History

Detailed monthly repayment history for each loan.

Breakdown includes:

Missed payments

Defaulted payments

On-time payments

A colour-coded timeline shows your performance month-wise.

This makes it easy to assess your repayment behaviour and track issues.

Credit Card Overview

View your card account details at a glance:

Total credit limit

Created date

Utilised limit

Track credit card usage efficiently to avoid overutilisation and score dips.

This helps you organise your financial obligations and close inactive accounts if needed.

Late payments can have a lasting effect on your credit score, but understanding their impact and taking proactive steps can help. By disputing incorrect entries and avoiding future delays, you can safeguard your financial health and maintain a strong credit profile.

Frequently Asked Questions

How long does it take to recover from one late payment?

Recovery from one late payment may take 6 to 12 months. During this period, you would be required to make consistent, on-time payments, to improve your credit score.

Can a single bounced cheque impact one's credit score?

A bounced cheque itself does not directly affect your credit score. However, if it results in missed payments, it could lead to a negative impact.

Can you have a 700 credit score with late payments?

Yes, it is possible, especially if the late payment is old and your overall credit history is strong. If you make on-time payments consistently since the incident, your score can improve substantially to even reach about 700 in certain cases.

Why has my credit score dropped 100 points for one late payment?

A significant drop of 100 points in your credit score may occur because late payments are viewed as a serious default.

Do failed payments affect the credit score?

Yes, failed payments, like insufficient funds for auto-debit transactions, can lead to missed payment reports and negatively affect your credit score.