Know the process to generate an E-Way Bill and transport goods without any hassles!

Generating an E-Way bill is a crucial step for businesses involved in the transportation of goods in India, ensuring compliance with GST regulations. To initiate this process, you must first register on the E-Way Bill portal and gather essential documents, including tax invoices and transporter details. It is also essential to understand various methods to generate E-Way bills efficiently, whether through the portal, SMS, or in bulk. Understanding these steps will not only streamline your logistics operations but also ensure that your business adheres to regulatory requirements seamlessly.

To generate an E-Way bill, you need to be registered on the E-Way bill portal. In addition, here are the documents you need to generate the bill:

Tax invoice, delivery challan, or bill of sale

Transporter ID or vehicle number if the transport is by road

Transporter ID, transport document number, and date if the transport is by air, rail, or ship

It is crucial to note that you cannot combine multiple invoices into a single e-Way bill. Instead, you can create a single consolidated e-Way bill if all the goods are being transported by a single vehicle.

There are multiple ways through which you can generate an E-Way bill easily and conveniently. However, you cannot generate a backdated e-Way bill. Here is an overview of the process you need to follow depending on the mode:

Through the E-Way bill portal (E - Waybill System)

Step 01: Login your username, password, and captcha

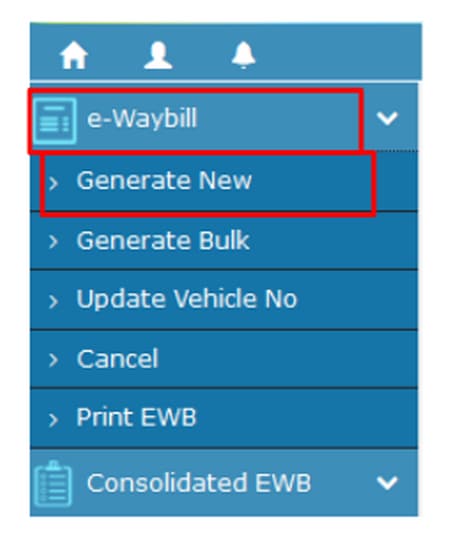

- Step 02: Navigate to the ‘Generate New’ option under the ‘e-Waybill’ tab

Step 03: Enter the required details, such as

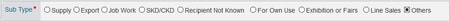

Transaction type and subtype

Document type, number, and date

To / From section details (Supplier or recipient)

Item and transporter details

2. Submit the request and wait for the bill to be generated

Disclaimer: The images provided are for representation purposes only.

In case of any errors, the screen will display the same. Once the bill is successfully generated, you can keep the E-Way bill number for future use.

Via SMS

Follow these steps:

Step 01: Login to the E-Way Bill portal

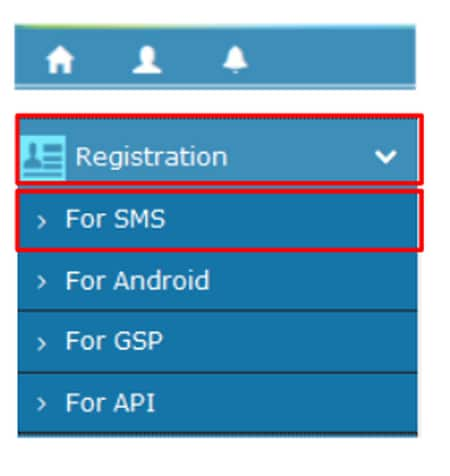

Step 02: Go to the ‘Registration’ tab and choose ‘For SMS’

Step 03: Check your registered mobile number and click on ‘Send OTP’

Step 04: Enter the code and verify your number

Once you register, do the following to generate the bill:

Step 01: Enter 7738299899 as the recipient

Step 02: Type the message as per the format and send

For suppliers: EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

For transporters: EWBT TranType SuppGSTIN RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

You will receive an SMS with the bill number and date once the bill is generated. Save it for future use. You can also find the SMS codes for generation on the official website.