Know the benefits, eligibility, and steps to apply for PMAY Gramin and build your home in rural India.

The Pradhan Mantri Awas Yojana Gramin (PMAY-G) aims to support rural families living in kutcha houses. It offers financial help to those without a permanent home or living in poor conditions. Under this scheme, beneficiaries can build pucca houses equipped with basic amenities. These include clean water, electricity, and proper sanitation. The scheme also promotes the use of local materials and designs. Trained masons are encouraged to ensure quality construction across rural areas.

The Pradhan Mantri Awas Yojana Gramin (PMAY-G) was launched in 2016 to improve rural housing in India. It replaced the earlier Indira Awas Yojana, which began in 1985. The scheme aims to provide pucca houses with basic amenities to families living in kutcha or unsafe homes. It supports the government’s goal of 'Housing for All' in rural areas. Beneficiaries are identified using data from the Socio-Economic and Caste Census (SECC) 2011. This ensures a transparent selection process and prioritises families in genuine need. PMAY-G continues to bridge the rural housing gap across the country.

Here are the key features of the Pradhan Mantri Gramin Awas Yojana scheme and understand its benefits:

Focus on Scheduled Caste Majority Villages

The scheme promotes the integrated development of villages with a majority Scheduled Caste population. It aims to improve living standards and housing conditions in these communities.

Support for Toilet Construction

Eligible households can receive up to ₹12,000 for building toilets. This assistance is provided under schemes like the Swachh Bharat Mission Gramin (SBMG) and MGNREGA.

Funding for Uncovered Activities

The scheme provides up to ₹20 Lakhs per village for activities not covered by existing government schemes. This ensures holistic development and fills critical gaps.

Special Support for Northeastern States and Jammu & Kashmir

In these regions, the central government covers 90% of housing costs. State governments contribute up to ₹1.30 Lakhs for each housing unit.

Full Financing for Union Territories

The central government provides 100% funding for house construction in Union Territories, including Ladakh. This guarantees complete financial support for eligible beneficiaries.

Target to Build 1 Crore Pucca Houses

The scheme set a target to build pucca houses for 1 Crore rural families. This goal focused on families living in kutcha or dilapidated homes between 2016–17 and 2018–19.

Use of Eco-friendly and Sustainable Construction Methods

The scheme encourages the use of eco-friendly, sustainable, and disaster-resilient construction techniques. This helps ensure long-term durability and reduces environmental impact.

Direct Benefit Transfer (DBT) for Transparency

Financial assistance is directly transferred to the beneficiary’s bank account. This maintains transparency and prevents leakages in fund disbursal.

Provision of Skilled Workforce

Training programmes are organised to skill rural masons. This ensures quality construction and creates employment opportunities at the village level.

Geo-tagging of Houses

The construction process is monitored using geo-tagged photographs. This helps track progress and ensures accountability at every stage.

Support for Convergence with Other Schemes

PMAY-G promotes convergence with schemes such as Saubhagya (for electrification) and Ujjwala Yojana (for LPG connections). This provides beneficiaries with a comprehensive package of essential amenities.

Learn about the core objectives of the Pradhan Mantri Awas Yojana Gramin, aimed at improving rural housing conditions:

Providing Safe and Affordable Housing

The scheme aims to offer safe and secure housing to families living in kutcha or dilapidated houses. It supports rural households in building pucca homes with essential facilities.

Enhancing Quality of Life in Rural Areas

By providing basic amenities like toilets, clean water, and electricity, the scheme improves living standards. It also focuses on creating a healthy and hygienic environment.

Promoting Inclusive Development

The scheme gives priority to marginalised communities, including Scheduled Castes, Scheduled Tribes, and minority groups. This ensures that vulnerable sections of society receive proper housing support.

Supporting Sustainable and Eco-Friendly Construction

PMAY-G encourages the use of local materials and sustainable building practices. This helps reduce environmental impact while promoting local employment.

Encouraging Transparency and Accountability

The scheme uses technology like geo-tagging and Direct Benefit Transfers (DBT) to ensure transparency. These measures help track progress and prevent fund misuse.

This data helps you understand the progress of rural housing under PMAY-G across different states and Union Territories. Here, you can see the number of houses completed between 2014 and 2026 under the scheme:

State Name |

Houses Completed (2014–2025) |

Andaman and Nicobar |

1,248 |

Andhra Pradesh |

2,10,864 |

Arunachal Pradesh |

35,595 |

Assam |

24,48,460 |

Bihar |

57,09,011 |

Chandigarh |

– |

Chhattisgarh |

14,62,170 |

Dadra and Nagar Haveli |

4,001 |

Daman and Diu |

32 |

Goa |

1,063 |

Gujarat |

6,89,432 |

Haryana |

76,808 |

Himachal Pradesh |

40,031 |

Jammu and Kashmir |

3,17,886 |

Jharkhand |

18,22,346 |

Karnataka |

5,12,636 |

Kerala |

2,15,378 |

Ladakh |

3,004 |

Lakshadweep |

45 |

Madhya Pradesh |

41,77,998 |

Maharashtra |

16,89,518 |

Manipur |

41,981 |

Meghalaya |

1,60,096 |

Mizoram |

26,959 |

Nagaland |

37,551 |

Odisha |

28,57,914 |

Puducherry |

– |

Punjab |

43,697 |

Rajasthan |

20,08,207 |

Sikkim |

3,666 |

Tamil Nadu |

9,51,682 |

Telangana |

48,564 |

Tripura |

4,06,386 |

Uttar Pradesh |

45,55,208 |

Uttarakhand |

94,304 |

West Bengal |

44,40,856 |

Total |

3,50,94,597 |

Disclaimer: The above data is based on available government records and may be subject to updates or revisions over time.

Understand the key details of the PMAY-G 2024 subsidy scheme, including loan support and interest subsidy for rural housing:

Loan Facility for Beneficiaries

Eligible beneficiaries can avail of institutional loans of up to ₹70,000 to help cover construction costs. This loan is optional and can be used in addition to the grant provided by the government.

Interest Subsidy on Housing Loans

Beneficiaries under PMAY-G are eligible for an interest subsidy of 3% on housing loans. This subsidy helps reduce the overall repayment burden for rural families.

Maximum Loan Amount for Subsidy

The interest subsidy applies to loans of up to ₹2 Lakhs. Any loan amount above this limit does not qualify for the subsidy benefit.

Applicable Under the Rural Housing Interest Subsidy Scheme (RHISS)

The PMAY-G subsidy benefits are part of the Rural Housing Interest Subsidy Scheme. RHISS aims to make housing loans more affordable for rural families, especially those in economically weaker sections.

Subsidy Applied Through Participating Financial Institutions

The subsidy is processed through recognised banks and housing finance companies. These institutions ensure the subsidy is credited to the borrower’s loan account, reducing the effective interest payable.

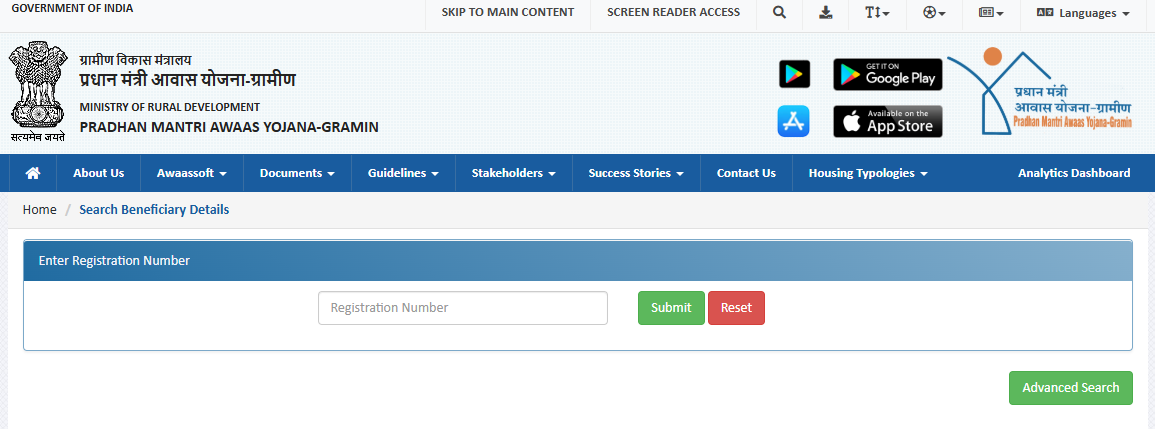

Here, you will find the steps to check the PMAY-G beneficiary list online, whether or not you have your registration number:

Steps to Check with Registration Number

Visit the official PMAY-G portal: https://rhreporting.nic.in/netiay/Benificiary.aspx

Enter your registration number on the 'Search Beneficiary Details' page

Click on 'Submit' to view your beneficiary details

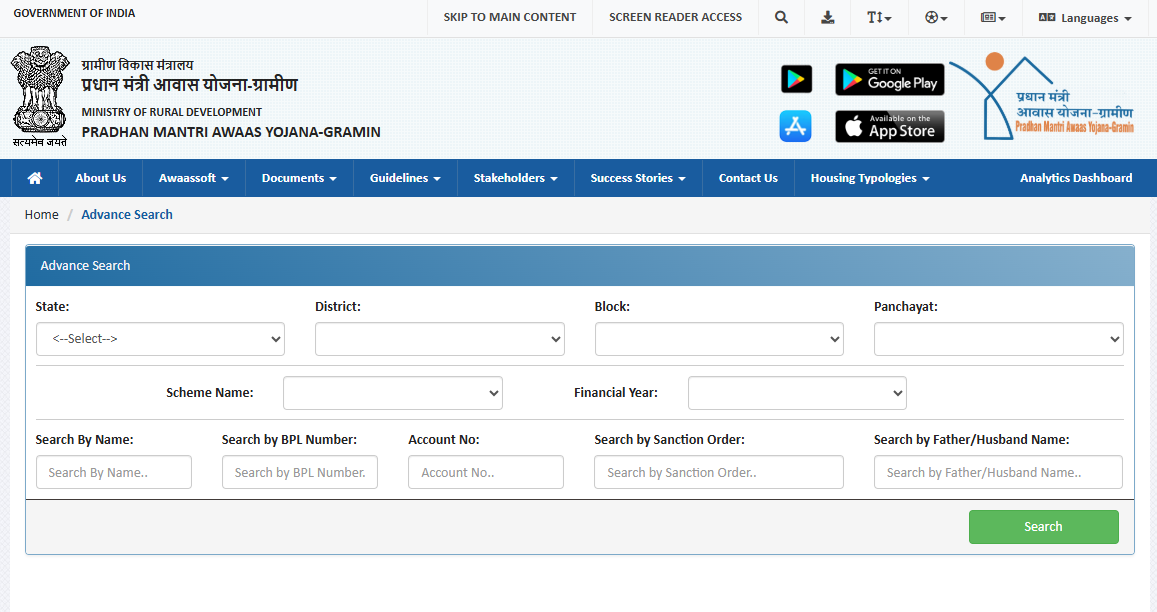

Steps to Check Without Registration Number

Go to: https://rhreporting.nic.in/netiay/Benificiary.aspx

Click on the 'Advanced Search' option

Select your state, district, block, panchayat, scheme name, and financial year

Enter details such as your name, sanction order number, BPL number, account number, and your father’s or husband’s name

Click 'Search' to view the beneficiary list for your area

Here are the steps to apply online for a housing unit under the PMAY Gramin scheme, as per the official process:

Personal details

Bank account details

Convergence details

Details from the concerned office

Follow these steps to register as a beneficiary and apply for a housing unit under the PMAY-G scheme:

Visit the official PMAY-G website and log in to your account

Fill in all the required personal details in the application form

Upload the consent form to link your Aadhaar number with your application

Click on the search button to find the PMAY ID, beneficiary name, and priority

Click on ‘Select to Register’ to proceed with the application

The system will then generate the beneficiary details automatically

Enter any remaining beneficiary details by filling in all the required fields

Upload the Aadhaar consent form if required for the beneficiary’s verification

Add the beneficiary’s bank account details in the relevant fields

If the beneficiary opts for a loan, select ‘Yes’ and enter the desired loan amount

Enter the Swachh Bharat Mission number and MGNREGA job card number of the beneficiary

The next section will be completed by the concerned office during verification

Understand the key benefits of the Pradhan Mantri Awas Yojana Gramin (PMAY-G), aimed at improving rural housing and quality of life:

Financial Assistance for Housing Construction

Eligible beneficiaries receive direct financial support to build pucca houses. This reduces the financial burden of constructing a safe and permanent home.

Access to Basic Amenities

Houses built under PMAY-G include essential facilities like toilets, clean drinking water, and electricity. These amenities promote better hygiene and living conditions in rural areas.

Optional Loan Facility for Additional Support

Beneficiaries have the option to avail of institutional loans for further construction needs. This provides additional flexibility for improving the quality and size of the house.

Interest Subsidy on Housing Loans

PMAY-G offers an interest subsidy of 3% on housing loans under the linked Rural Housing Interest Subsidy Scheme. This helps lower the overall cost of borrowing for rural families.

Targeted Support for Marginalised Communities

The scheme prioritises Scheduled Castes, Scheduled Tribes, minorities, and other vulnerable groups. This ensures inclusive development and equal access to housing benefits.

Employment Generation Through Construction Activities

The scheme promotes the use of local labour and trained masons for house construction. This supports rural employment and skill development at the community level.

Transparency Through Direct Benefit Transfer (DBT)

Financial assistance is transferred directly to the beneficiary’s bank account. This ensures transparency and minimises the risk of fund mismanagement.

Monitoring with Technology Integration

The scheme uses geo-tagging and IT platforms to track progress. This improves accountability and keeps beneficiaries informed about their application status.

The Pradhan Mantri Awas Yojana (PMAY) is a government initiative aimed at providing affordable housing to eligible families across India. It has two components: PMAY-Urban (PMAY-U) for urban areas and PMAY-Gramin (PMAY-G) for rural regions.

Under this scheme, beneficiaries receive financial assistance to build or upgrade homes with essential facilities such as toilets, electricity, and clean water. The scheme also focuses on transparency, with benefits transferred directly to the beneficiary’s bank account.

Through the use of technology like geo-tagging and online monitoring, PMAY ensures timely completion and accountability. By promoting inclusive development, the scheme supports marginalised communities and contributes to the larger goal of ‘Housing for All’.

The PMAY-G scheme follows a transparent process to identify beneficiaries, ensuring support reaches rural families in need of proper housing. The selection is data-driven and aims to assist those living in poor housing conditions.

Beneficiaries are chosen using data from the Socio-Economic and Caste Census (SECC) 2011, which records details about housing status and income. This list is verified by the local Gram Sabha to confirm eligibility, focusing on households without land or living in kutcha houses.

A Permanent Wait List (PWL) is created from the verified data to help states track eligible households. This process maintains fairness and ensures housing assistance is provided in a phased and accountable manner.

The beneficiary list for PMAY Rural status is prepared using the Socio-Economic and Caste Census (SECC) 2011 data. Priority is given to landless households, especially those dependent on manual casual labour for their livelihood. These families are placed at the top of the Permanent Wait List to ensure they receive timely housing assistance.

The State Governments and Union Territories are responsible for providing land to landless beneficiaries from available government or public land resources. Once the preliminary list is prepared, it is verified by the local Gram Sabha to confirm the eligibility of each household. This verification process maintains transparency and ensures support reaches those who need it most.

The Ministry of Rural Development, along with State and UT authorities, regularly reviews the beneficiary list to monitor progress and address gaps. The final list is published on the official PMAY-G portal, where applicants can check their status using their registration number or by entering basic personal details.

Here, you will find the eligibility criteria for PMAY Gramin to check if your household qualifies for support under the scheme:

Beneficiaries are selected based on SECC 2011 data, which is verified by the Gram Sabha before final approval

Freed bonded labourers are eligible under the PMAY Gramin scheme

Eligible families include a husband, wife, and unmarried children

Households without any house or living in kutcha houses with kutcha walls and roofs are eligible

Families without a literate adult member aged above 25 years qualify for the scheme

Households without an adult male member aged between 16 and 59 years are eligible

Families with no able-bodied member to earn livelihood can apply under the scheme

Applicants must belong to Economically Weaker Section (EWS), Lower Income Group (LIG), or Below Poverty Line (BPL) category

Families with an annual income between ₹3 Lakh and ₹6 Lakh are eligible under the scheme

Landless households earning their income from casual manual labour qualify for assistance

Widows and next-of-kin of defence personnel, paramilitary forces, and ex-servicemen are eligible beneficiaries

Households without any adult member aged between 16 and 59 years can avail benefits

Families without any physically able member to perform manual work are given priority

Households without a male member aged above 25 years are considered eligible

Beneficiaries not owning land and dependent on public or government assistance are prioritised

To apply for PMAY Gramin benefits, you need to submit the following documents:

A duly filled PMAY-G application form is required

Submit proof of identity such as Aadhaar card, Voter ID, or Passport

Provide proof of address like Aadhaar card, PAN card, or electricity bill

An ethnic group certificate is required, if applicable

Submit an affidavit confirming no family member owns a pucca house

Provide land ownership documents or contract papers for house construction

Submit a No Objection Certificate (NOC) from the housing society, if required

An income certificate is needed if your earnings fall below the taxable limit

Attach your bank account passbook and statements for the last six months

For self-employed applicants, submit a letter confirming the nature of your business

If any advance payment is made to the builder, attach the receipt

Submit a letter confirming the allocation of property, if applicable

Provide copies of your latest Income Tax Return, Form 16, and assessment order

Attach the construction plan for your house

Submit a certificate detailing the cost of construction

Provide a valuation certificate from an official valuer

The beneficiaries for Pradhan Mantri Awas Yojana Gramin, are selected from the list based on the Census 2011 (SECC 2011). To avail the scheme, the applicant must belong to EWS or LIG or BPL category, and the annual income of the applicant’s family should be between ₹3 Lakhs to ₹6 Lakhs.

The following are the steps to check your name in the PMAY-G list using the registration number:

Login to the PMAY Gramin website

On the new page, start filling in the registration number

Click on ‘Submit’ to access the list

Steps to check your name in the PMAY-G list without the registration number:

Visit the site and click on the ‘Advanced Search’ option to proceed

A new page will appear, now enter all the required details on the page

Lastly, click on the ‘Search’ button to access the Pradhan Mantri Awas Yojana Gramin list

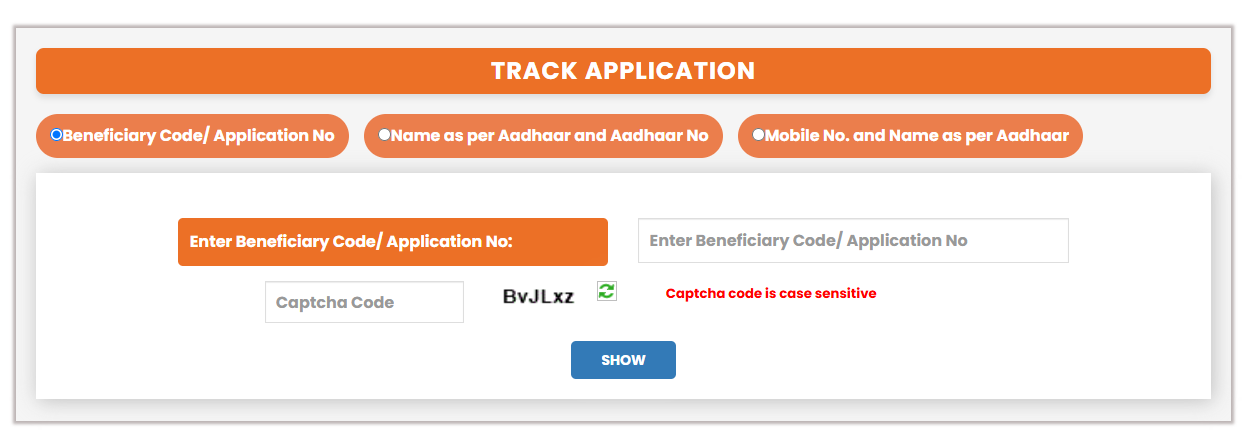

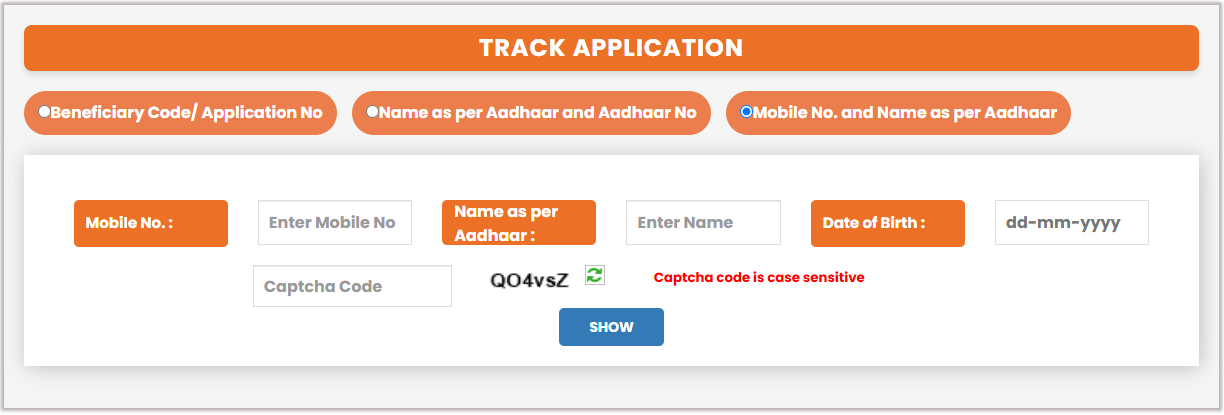

You can track your PMAY-G application status online through three methods available on the official portal. Follow these steps to check your status easily:

Method 1: Using Assessment ID

Visit the official PMAY application tracking page

Select the option 'Beneficiary Code / Application No.'

Enter your Beneficiary Code or Application Number

Enter the captcha code

Click on ‘Show’ to view your application status

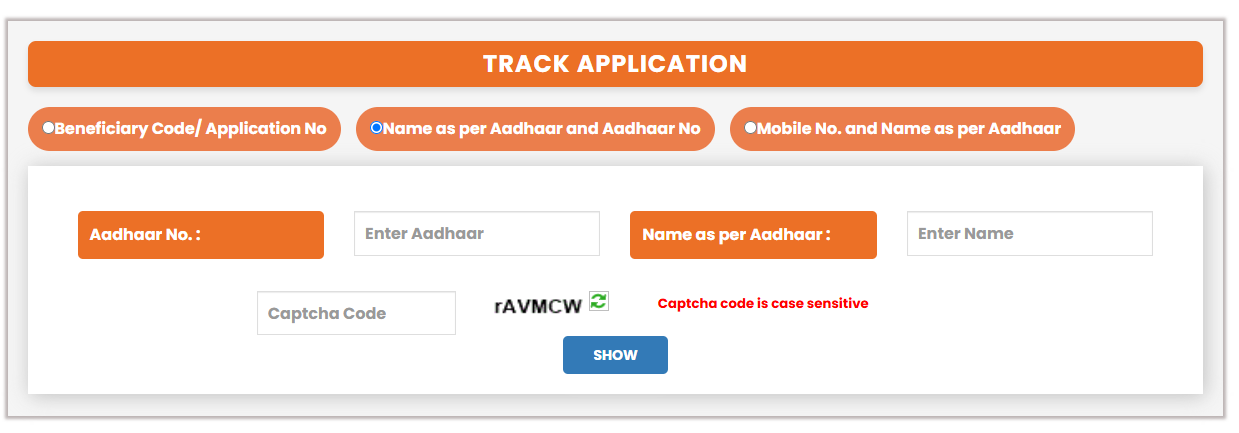

Method 2: Using Aadhaar Details

On the same page, choose the option 'Name as per Aadhaar and Aadhaar No.'

Enter your Aadhaar number and your name as per Aadhaar

Enter the captcha code

Click on ‘Show’ to view your application status

Method 3: Using Mobile Number and Aadhaar Name

On the tracking page, select the option 'Mobile No. and Name as per Aadhaar'

Enter your mobile number, name as per Aadhaar, and your date of birth

Enter the captcha code

Click on 'Show' to check your application status

The PMAY-G scheme supports rural families in building safe and permanent homes through transparent processes and financial assistance. You may also easily apply for a Home Loan on Bajaj Markets platform to meet your housing needs. With these combined efforts, the goal of affordable housing in rural India moves closer to reality.

Everything About PMAY

- PMAY List

- PMAY Documents

- Types Of PMAY Schemes

- PMAY Urban

- PMAY Subsidy Status

- Schemes Linked To PMAY

- CLSS - PMAY Credit Linked Subsidy Scheme

- PMAYG High Level Physical Progress Report

- Calculate Savings Under PMAY

- PMAY Allottees Rejected The Offer

- Avoid Claim Rejection For PMAY

- Home Loan Subsidy Under The PMAY

- Carpet Area Can Affect Your PMAY Subsidy

- Is PMAY Applicable For Home Loan Transfer

- Construction Allocation Status Under PMAY

Home Loan Quick Links

- House Loan

- Online Home Loan EMI Calculator

- Calculate Home Loan Eligibility Online

- Current Home Loan Interest Rates

- House Loan Process

- Home Loan Documents

- Plot Loan

- Types Of Home Loan

- Pre-Approved Home Loan

- Home Construction Loan

- Home Renovation Loan

- NRI Home Loan

- Joint Home Loan

- Home Loan for Under Construction Property

- Home Loan for Resale Flat

FAQs on PMAY Gramin

Can I avail of a loan for the PMAY Gramin unit?

Yes, beneficiaries can avail of an institutional loan of up to ₹70,000 to support house construction. The loan is optional and can be taken alongside the financial assistance provided by the scheme.

What is the minimum size of units under the PMAY Gramin scheme?

The minimum size for houses built under PMAY-G is 25 square metres. This includes a dedicated area for hygienic cooking space.

How many houses have been sanctioned under PMAY-G?

As of the latest updates, over 3 crore houses have been sanctioned under PMAY-G since its launch. The number is regularly updated on the official portal based on ongoing approvals.

How many houses have been completed under PMAY-G?

More than 2.9 crore houses have been completed under PMAY-G so far. Completion progress is tracked and published by the Ministry of Rural Development.

Do I have to consult my local Gram Sabha to get approval for this scheme?

Yes, the preliminary beneficiary list prepared from SECC data is verified by the local Gram Sabha. Their approval is essential to confirm eligibility under the scheme.

How can I avail of the interest subsidy benefit under this scheme?

To avail of the 3% interest subsidy, apply for a housing loan through recognised banks or housing finance companies linked to the scheme. The subsidy is credited directly to your loan account.

Can I acquire a loan through the PMAY-G scheme if I live in a remote area?

Yes, eligible beneficiaries in remote areas can apply for loans under PMAY-G. The scheme covers rural and remote locations, and participating financial institutions process such applications.