One of the essential features of GST is the seamless way in which input credit can flow across the country’s supply chain. Input tax credit is a reference to the tax that has already been paid by an individual at the time they choose to purchase goods or services. This tax is also available as a deduction from the payable tax.

Consider the following example. Let’s assume a trader buys goods for Rs. 100 and pays a 10% tax on it. The trader then chooses to sell these foods at Rs. 150 collecting Rs. 15 from their buyers as tax. In this case, the trader would have to pay the government Rs. 15 while also having paid Rs. 10. So, the input tax credit will let the trader deduct the Rs. 10 tax she paid from the payable tax meaning she just has to pay Rs. 5 as the net tax from her sales.

To claim input tax credit under GST, the following conditions need to be fulfilled:

The person claiming input tax credit needs to be in possession of a bit note or tax invoice issued by a supplier that is officially registered under GST.

The person claiming input tax has to have received the goods and/or services.

The tax that is charged in respect of this supply needs to be paid to the account of the appropriate Government responsible.

The person claiming input tax credit needs to furnish the return under Section 39.

Input tax credit is authorised only on acquisitions made for the sale of zero-rated or taxable goods or services. ITC claiming is not permitted on purchases made for any supplies that are exempt from these categories.

To claim input tax credit of appropriate items/services, only a registered taxable individual has authority. The amount of credit that one is eligible for is calculated based on terms of Section 16(7) of the MGL read with GST ITC Rules (which are to be issued). Keep in mind that, currently, the credit on capital goods would also be permitted on this type of proportionate basis.

In the case where the goods against an invoice are received in instalments, the registered taxable person is entitled to claim input tax credit after they have received the final instalment.

Input tax credit under GST for capital goods is not permitted when the individual also claims depreciation in the income tax act for the GST component. A person can either claim depreciation in income tax or claim input tax credit for the same goods and/or services and not both.

An appropriate tax invoice issued by the goods/services supplier.

An appropriate debit note issued by the supplier to the recipient of the goods/services.

A bill of entry.

An invoice issued under specific scenarios such as the bill of supply that is issued instead of a tax invoice when the amount is less than Rs. 200.

A credit note or an issued by the Input Service Distributor(ISD) in accordance with the invoice rules under GST.

A bill of supply that is issued by the goods/services supplier.

The due date for the return is the month of September or later in the next financial year.

The annual return has been filed for the relevant year (with respect to the filing date, and not the due date).

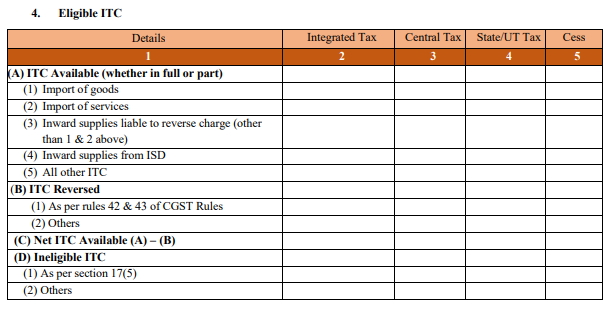

To file input tax credit in GST, filling out the table above is necessary. Regular taxpayers should report the amount of ITC (input tax credit) from their monthly GST returns. In the above table, the summary figure for ineligible ITC, eligible ITC, and ITC reversed in the tax period is required. As per the format of the table, a taxpayer can claim ITC on a provisional basis in Form GSTR-3B to a 20% extent of the eligible ITC that is declared in the auto-generated GSTR-2A return by suppliers.

Hence, before proceeding to file Form GSTR-3B, a taxpayer should cross-check the GSTR-2A figureUntil 9th October 2019, a taxpayer could have claimed any amount of provisional input tax credit. However, the CBIC has notified that from 9 October 2019, a taxpayer can claim no more than 20% of the eligible ITC available in the GSTR-2A as provisional ITC. In other words, matching the expense ledger with the Form GSTR-2A is crucial.

Here are circumstances in which input tax credit can be reversed:

ITC will be reversed if they are filed against any invoices that are not paid within 180 days of issuance.

ITC will be reversed if the credit note is issued to ISD by the seller.

ITC will be reversed if its inputs are partly for business purposes and partly for exempted supplies or ‘personal use.’ While exempted goods cannot receive input tax credit under GST, personal use goods and services will have a proportionate reversal.

ITC will be reversed for capital goods that are partly for business purposes and partly for exempted supplies or for ‘personal use.’

After the annual return is furnished, if the total ITC on inputs of exempted/used for non-business purposes exceeds the ITC reversed during the year, the difference in this amount is added to one’s output tax liability with applicable interest.

Amount of Input Tax Credit on account of IGST: First, this amount will be used for paying IGST, then CGST, and then for SGST and UTGST.

Amount of Input Tax Credit on account of CGST: This amount will first be used to pay for CGST and then IGST. It cannot be used for paying UTGST or SGST.

Input Tax Credit for Capital Goods

Any input tax credit on capital goods can be availed of in one instalment. Claiming ITC is not allowed for capital goods if the person has claimed ITC depreciation for their GST component. One can opt for either income tax depreciation or claim ITC.

Input Tax Credit on Inputs Sent for Job Work

One can claim ITC on goods or capital goods sent to a job worker for that work. Input is allowed even in the case of the goods being sent directly to the worker without first being brought to her place of business. If such goods are not received back by the principal from the job worker within a year of sending, then it shall be deemed that the inputs were supplied to the job worker on the day they were sent out. This time limit extends to three years for capital goods.

Input Tax Credit Provided by Input Service Distributor (ISD)

An ISD is an input service distributor that can be the branch office, head office, or registered office of the registered person under GST. ISD also collects ITC on all purchases made by them and it distributes it to all its recipients under various heads such as IGST, CGST, SGST/UTGST, or cess.

Input Tax Credit on Transfer of Business

ITC can be claimed for transfer of business and in cases of mergers and amalgamations. At the time of the business transfer, the transferor will have available ITC that can be passed to the transferee.

Academy by Bajaj Markets