Credit cards offer multiple advantages for millennials focused on building their financial foundation.

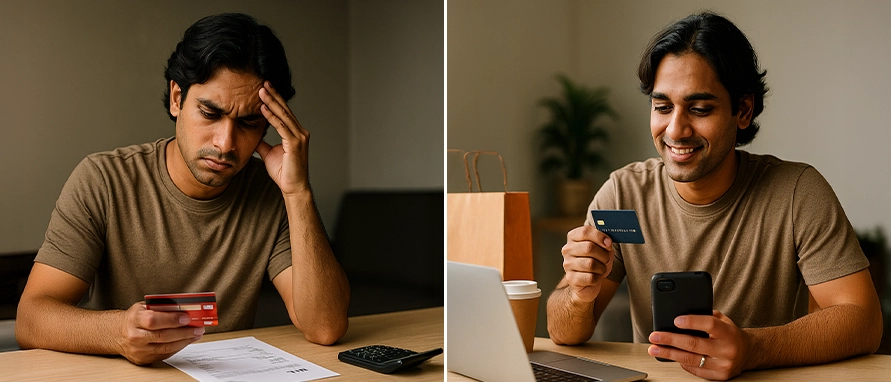

Credit cards often provide reward points and cashback for shopping, travel, and bill payments. Millennials can redeem these points for vouchers, gadgets, or further discounts, making each expense more rewarding. Many banks also provide exclusive offers on dining, fuel, and online shopping, tailored to young adults’ spending habits.

Building a Good Credit Profile

Responsible credit card usage, such as timely payments, boosts your credit score. A higher score improves eligibility for future loans, car finance, or a home loan at better rates. Early credit card users tend to have a longer credit history, which is essential for a strong credit profile.

Credit cards can act as a backup during emergencies when you do not have immediate funds available. Whether it’s a sudden hospital bill or a critical travel booking, having a credit card provides a vital financial cushion in urgent situations.

Safe and Convenient Transactions

Using a card can be safer than carrying cash. Modern cards offer robust fraud protection, instant blocking features, and secure online payment options. This safety allows millennials to make digital payments confidently.