Understand how UPI credit cards function, from linking them to making safe, instant payments via popular UPI apps.

A UPI credit card works by connecting your credit card to a UPI-enabled app, allowing you to make payments directly from your credit limit rather than your bank account. It combines UPI's instant payment capability with the flexibility of a credit facility.

Here the steps you can follow to use a UPI credit card:

1. Get a UPI Credit Card

Apply for a credit card from an issuer that supports UPI linkage

2. Install a UPI-Enabled App

Use a recognised app like BHIM, GPay, PhonePe, or Paytm

3. Link the Credit Card to UPI

Within the app, go to 'Add UPI Payment Method', select 'Credit Card', and choose the issuing network

4. Set UPI PIN

Authenticate using your registered mobile number and set a secure UPI PIN for transactions

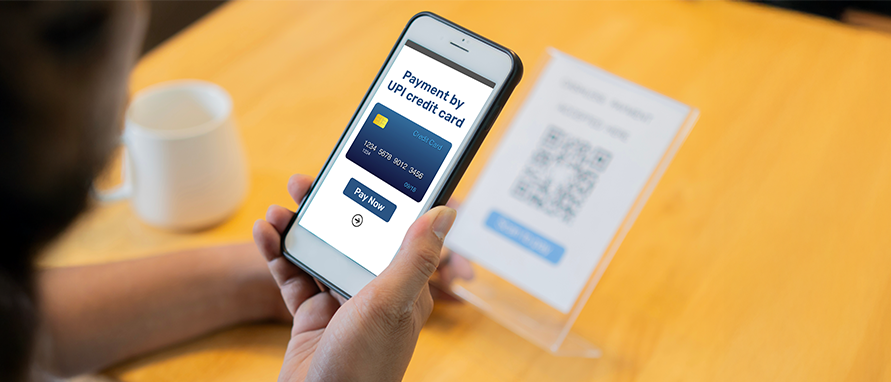

5. Make Payments Using UPI

At checkout or while scanning a QR code, select the linked credit card and authorise the payment using your UPI PIN

This setup allows you to complete credit-based transactions instantly through UPI without needing to swipe a card.

A frequently asked query is — how does UPI credit card work? The process enables cardholders to pay using UPI while drawing from their credit limit instead of their bank balance.

Your credit limit is determined based on your income, credit history, and repayment behaviour. It can vary widely between users, depending on the risk profile assessed by the issuer.