Mobile Payment Apps Driving Fintech Frenzy in India

The advent of digitization has led to a significant rise in the number of mobile payment apps in India. These mobile payment apps have helped our country take a step towards becoming cash-free. Moreover, the Indian Government has taken several initiatives to boost digital payment solution, and this has further contributed to the increasing popularity of mobile payment apps in India.

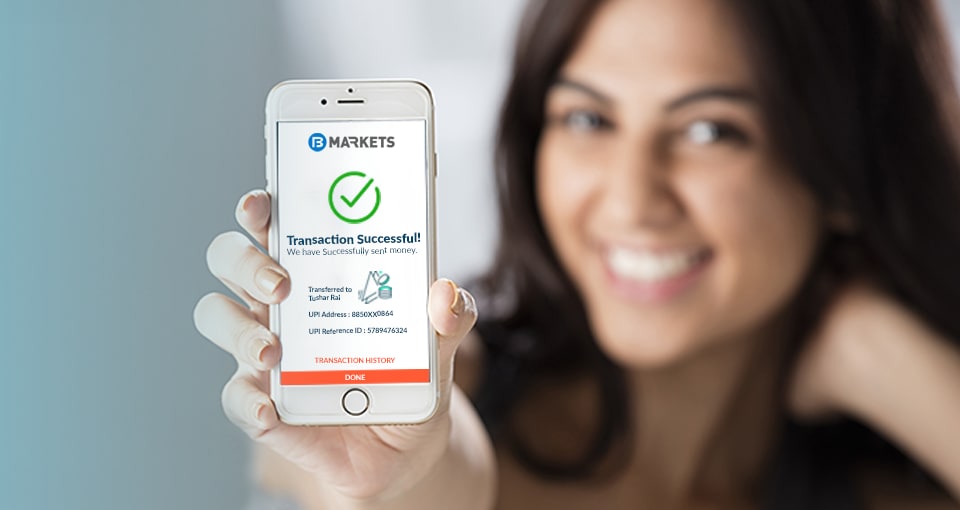

With the implementation of the Unified Payment Interface (UPI) platform, several banks and financial institution have launched their mobile payment app in India. UPI is a payment solution developed by National Payments Corporation of India (NPCI) under the guidelines of the Reserve Bank of India (RBI). UPI payment helps the users to send and receive money between the bank accounts linked with the mobile number. The transactions are made on a real-time basis, and it does not require the IFSC code. Instead of IFSC Code, both the sender and receiver are required to have a Virtual Payment Address (VPA). Some of the best UPI app in India for smooth and quick money transfer between the bank accounts are Google Pay, Paytm, PhonePe, PayZapp, etc.

Let us have a look at a few significant benefits of using mobile payment apps:

- Online shopping has become much more convenient due to the introduction of mobile payment apps. You can now easily make payments anywhere and at any by using mobile payment apps.

- Mobile payment is a secure way to make transactions. Moreover, mobile payments can help you become cash-free, thereby reducing the risk associated with carrying a large amount of cash.

- Since the transactions carried out through mobile payments are entirely digitized, you can easily keep track of your spending. This can help you plan your monthly budget in a far more efficient way.

- Mobile payments are quick. You don’t have to search for cash or wait for chip card transaction. All you are required to do is to present your mobile device and authenticate the transaction. Thus, the payment process is quicker and more user-friendly. Due to all these benefits of mobile payments, even small businesses’ usually stick to mobile payments to expedite the transactions.

Fintech Companies and Personal Finance Apps

Various Fintech companies have also launched personal finance apps that support UPI payment. You can easily send and request money from friends, family or pay merchants by using these finance app. These mobile apps follow the privacy policy and are very much safe to use. Therefore, the transactions you make are secure, and you can also secure your personal data with a password.

With the help of some finance app such as the Bajaj Markets app, you can also keep track of your finances, check your savings, credit card status, etc. This app can be used to avail credit products such as personal loan, business loan, home loan, etc. Applying for a loan through this app is a simple and quick process. You can receive the loan amount within 24 hours, and this makes it one the most reliable finance apps if you are in need of urgent funds. By using the Bajaj Markets app, you can keep track of your loan status easily. You can check your EMI dates, outstanding debt and the repayment history with ease. Moreover, you can check your credit score for free by and get your detailed financial report, and suggestions that can help you boost your credit score.

The Bajaj Markets app has a very smooth user interface and can be downloaded on both android and iOS platforms. So why wait? Download this app and make the most of it to meet your financial needs.

“Bajaj Markets, a subsidiary of Bajaj Finserv, is a one-stop digital marketplace that has been created for consumers on the go. It offers 500+ financial and lifestyle products, all at one place. At Bajaj Markets, we understand that every individual is different. And that’s why we have invested in creating a proposition – Offers You Value. A value proposition that ensures you get offers which are tailor made for you. We also offer an amazing product range and unique set of online offers across Loans, Insurance, Investment, Payments and an exclusive EMI store. Be it in helping you achieve your financial life goals or offering you the latest gadgets, we strive to offer what you are looking for. From simple and fast loan application processes to seamless and hassle-free claim-settlements, from no cost EMIs to 4 hours product delivery, we work towards fulfilling all your personal and financial needs. What’s more! Now enjoy the same benefits in just one click with our Bajaj Markets App.”

Blog Categories

Enter Your OTP