Chapter VIA in the Income Tax Act is one of the most useful sections of the law, since it contains several provisions that allow taxpayers to enjoy several tax benefits. Section 80CCC, which is a part of chapter VIA of the Act, is one such provision that gives individuals some much-needed relief from high taxes.

So, how does this section work, and what are the tax benefits it offers? Read on to discover the answer to these questions.

What is section 80CCC?

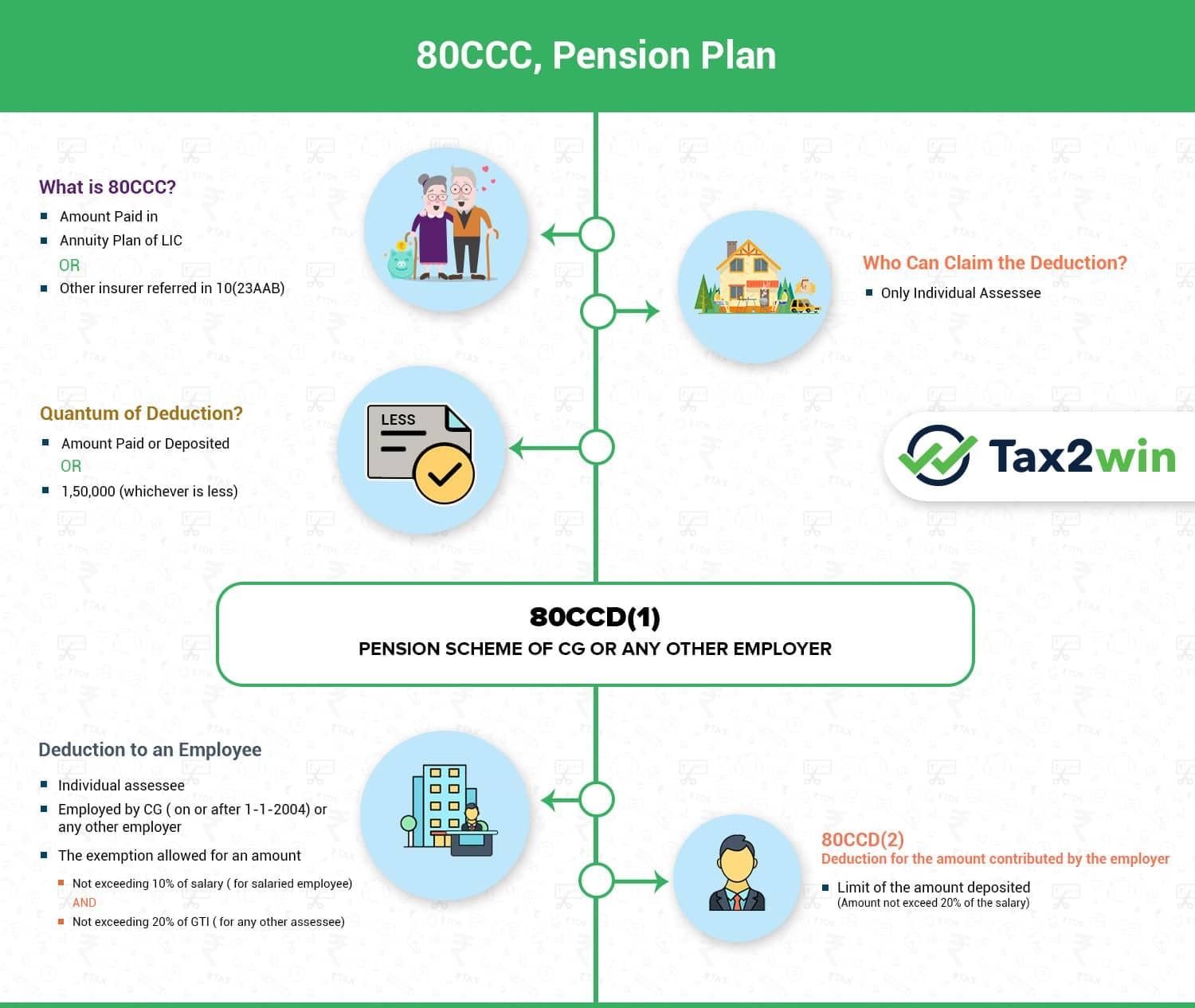

Section 80CCC is a part of the Income Tax Act, 1961. It states that if you, being an individual, pay any amount to purchase or remain invested in a pension plan or an annuity plan, then you can claim that amount paid as a deduction when you’re calculating your total income.

What are the salient points regarding the deduction under section 80CCC?

Aside from the basic provision mentioned above, 80CCC comes with other clauses that determine whether or not the amount paid for the pension or annuity plan is eligible for deduction. Here are some key points of interest about this section.

The pension or annuity plan must be issued by the Life Insurance Corporation of India (LIC) or by any other fund set up by any recognized insurer, as mentioned in section 10 (23AAB). In other words, the insurer is required to be recognized and approved by the Insurance and Development Authority of India (IRDAI).

The amounts paid must be for the purpose of purchasing a new pension or annuity plan, or for renewing an existing plan.

The amount must be paid out of the income chargeable to tax.

Interest amounts and bonuses credited to your account from the plan are not eligible to form part of the deduction.

Is there a limit on the tax benefits offered by section 80CCC?

Yes, the provisions of 80CCC specify that the amounts paid for the qualifying investment options are deductible up to a maximum limit of Rs. 1,50,000. Moreover, this limit on the tax benefits under section 80CCC is to be read in conjunction with the provisions of sections 80C and 80CCD. So, this essentially means that the total amount of tax benefits you can avail from all these three sections (80C, 80CCC, and 80CCD) cannot exceed Rs. 1,50,000.

Section 80C specifies certain investment options and expenses that are deductible from the total income. Some of the investments and expenses qualifying for a deduction under section 80C are listed here.

Investment in Public Provident Fund (PPF)

Investment in Equity-Linked Savings Scheme (ELSS)

5-year tax-saving fixed deposits

Investment in National Savings Certificate (NSC)

Repayment of principal component of housing loan

Additionally, the premium paid for life insurance and term insurance can also be claimed as a deduction as per the provisions of section 80C. For instance, when you purchase the Bajaj Allianz Life Smart Protect Goal term plan, available on Bajaj Markets, you’ll be required to pay a premium to purchase the policy and renew it year after year. Since this is a pure term plan, the premium is deductible from your total income.

In addition to these tax benefits, the term insurance plans on Bajaj Markets also offers a host of other advantages to the customer. Among these are the option to add your spouse onto the plan with the joint life cover variant, and the ability to meet your child’s educational expenses with the child education extra cover variant. You can even enjoy a protective life cover as high as Rs. 1 crore by paying low premiums.

As for section 80CCD, it allows for deduction of the amounts parked in investment options like National Pension Scheme (NPS) and Atal Pension Yojana.

Who is eligible to take advantage of the deduction under section 80CCC?

To be eligible for enjoying the tax benefits under section 80CCC, you need to satisfy certain conditions, as explained here.

You must be a resident of India, NRI, or a foreign national.

A Hindu Undivided Family (HUF) is ineligible for the tax benefits under section 80CCC.

The pension/annuity plan must be purchased from a recognized insurer.

Source: tax2win.in

Are the maturity proceeds taxable?

Once the annuity or pension plan has reached maturity, a lump sum amount is typically paid out to the investor. This is followed by regular periodic payments for life or for a specified number of years, depending on the terms of the plan. These proceeds are all taxable according to the income tax slab applicable to you.

Additionally, in case you decide to surrender the policy prematurely, the insurance company will pay out a surrender value if you’re eligible for the said benefit. This surrender value is generally calculated as a specific percentage of the premiums paid from the time of purchase to the time of surrender. As per the provisions of the Income Tax Act, the proceeds received as part of the surrender value are taxable.

The Takeaway

By investing in a qualifying pension plan or an annuity plan, you can enjoy tax benefits specified under section 80CCC. In addition to this, you also get to build a steady corpus of funds for your retirement. Thus, section 80CCC allows you to receive tax benefits coupled with wealth creation.

Also read in detail about the ULIP tax benefits you can avail with a Bajaj Allianz ULIP plan available on Bajaj Markets.

Term Insurance Covers and Requirements

- Term insurance plan with return of premium

- Critical illness insurance

- Cancer insurance

- Joint life insurance policy

- Term insurance maturity benefit

- Term insurance for family

- Term insurance age limit

- Use Term Insurance Premium Calculator

- Spouse Term Insurance

- Term Insurance For Senior Citizen

- Bajaj Allianz Term Insurance Plans

- One Crore Term Insurance Plan

- Term Insurance Nominee

- Term Insurance For Nri

- Term Insurance Riders

- Joint Term Insurance For Couples

- Term Insurance Payout Options

- Term Insurance Claim Process

- Term Insurance Benefits

- Single Premium Term Insurance

Read More About Term Insurance

- Term insurance comparison

- How much return to expect from a term insurance

- Difference between term insurance and life insurance

- Term insurance tax benefits

- Difference between term plan and endowment plan

- ULIP vs Term Insurance

- Types of term insurance plans

- Term Insurance Claim Settlement Ratio

- Ways To Reduce Your Term Insurance Premium

- Is Term Life Insurance Worth It

- All About Term Life Insurance

- Lump Sum Term Insurance Payout

- How To Purchase Lowest Premium Term Plan

- Online Vs Offline Term Insurance

- Term Insurance Terms And Conditions

- Critical Illness Insurance Benefits

- What Is Decreasing Term Insurance

- Term Insurance Vs Life Insurance

- 5 Year Term Life Insurance Policy

- Married Womens Act Mwp Act

- Limitations Of Group Term Life Insurance

- Increasing Term Insurance Plan

- Importance Of Term Insurance Renewal

- 5 Short Term Investment Options To Consider

- Best Term Insurance Plan

- Difference Between Term Insurance And Whole Life Insurance

- Pmjjby Vs Pmsby Differences And Similarities

- The Comprehensive Section 80C Deduction List

- Importance Of Term Insurance For Women

- Term Insurance Buying Guide

- Difference Between Child Plan And Term Plan

- Reasons To Buy Term Insurance

- Group Term Life Insurance Vs Individual Term Insurance

- How To Choose Best Critical Illness Insurance

- Difference Between Term Insurance And Health Insurance

- Term Insurance Myths

- Why Is It Important As Parents To Have Term Insurance

- How Is Term Insurance Premium Calculated

- Irdai Regulations For Term Insurance

- How To Buy Suitable Term Plan

- 5 Term Insurance Claim Rejection Reasons

- 5 Tips To Choose The Best Term Insurance Plan In India

- How To Buy Term Insurance Online

- What Is Whole Life Insurance

- What Is Term Insurance

- Benefits Of Group Term Life Insurance

- Cheap Term Life Insurance

- Types Of Deaths Not Covered Under Term Insurance

- Term Insurance Without Medical Test

- The 4 Types Of Life Insurance You Should Know About

- 5 Reasons For Low Premium In Term Insurance Plans

Enter Your OTP