Changing the name on a credit card may be necessary for various personal and legal reasons. Below, have a look at the most common situations that require such a change:

Common Scenarios

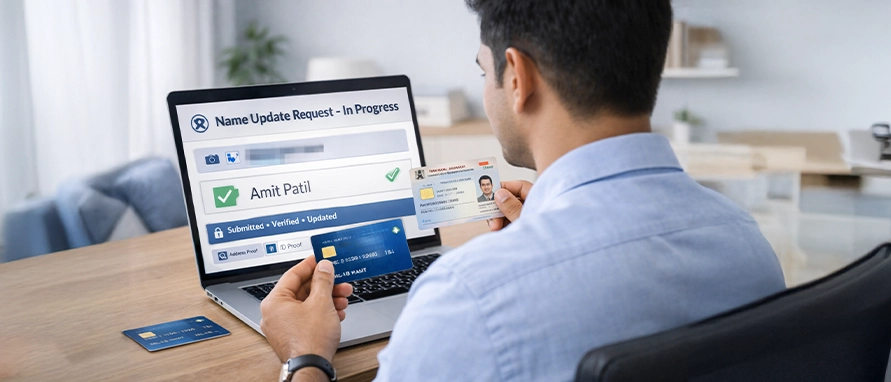

There are several reasons why a cardholder may need to change their credit card name. The most common reasons include marriage, divorce, legal name change, or a simple spelling correction. For instance, after marriage, many people adopt their spouse’s surname and must update this change across all financial documents. In cases of divorce, an individual might revert to their previous name. Occasionally, errors in the spelling or order of names during card issuance may also need correction.

Legal Documentation

Every name change must be backed by valid legal documents. Whether the change is due to marriage or a legal affidavit, the requesting individual should have appropriate government-approved documentation. Proof such as a gazette notification, marriage certificate, or court order ensures the issuer can validate the name change request.

Issuer-specific Requirements

Each credit card issuer such as HDFC Bank, SBI Card, Axis Bank, or ICICI Bank, has specific policies for changing a name. Although the fundamental process remains similar, some issuers may require physical submission of documents, while others might allow requests via post or email through their customer care team. Always confirm the exact requirements on the respective bank’s website before proceeding.