| Bajaj Allianz Car Insurance | SBI General Car Insurance | HDFC ERGO Car Insurance | Acko Car Insurance |

| Bajaj Allianz Bike Insurance | SBI General Bike Insurance | HDFC Ergo Bike Insurance | Acko Bike Insurance |

E Challan Pune

Maharashtra has incorporated new traffic rules and regulations to mitigate road violations in cities like Pune. For instance, you will not get an e-challan in Pune if you get caught for a traffic violation while operating a vehicle. Newer provisions like these help the Pune traffic police enforce.....

E Challan Karnataka

If you do not wish to be fined for violating traffic rules in Karnataka, it is imperative for you to be aware of what the law states. In a bid to fine offenders, the Karnataka RTO has resorted to issuing e-challans to all violators.

These e-challans range between Rs.500 .....

E Challan Himachal Pradesh

Being a mountainous state, Himachal Pradesh requires you to be extra careful if you’re driving on hilly roads. It is very important to follow the traffic rules in place. In case of any violation, you may receive an e-challan from the traffic police in the state. Fines for traffic violation i.....

E Challan Surat

The world is going digital, and so are the traffic rules and regulations. An E-Challan allows people to pay their outstanding challan via an online payment method without having to physically visit the police station. Surat, Gujarat has now accommodated itself to this technology and upgraded.....

E Challan Tamil Nadu (TN)

Tamil Nadu is the sixth most populated state in India. Hence, it's no surprise that traffic management is a serious issue in the state. Roads face a huge amount of congestion and traffic regulations are broken with great frequency. As a result, the government has put an e-challan system in place .....

E Challan Noida

A busy city like Noida is never spared traffic rules violations. The population and number of vehicles in Noida are increasing in number leading to traffic congestion, accidents, and air pollution. To overcome problems related to traffic violations, the government has implemented the system of e-.....

E-Challan Rajkot

The Government has taken measures towards making the process of paying challans convenient for you. Hence, along with the identification process for traffic violators, the e-challan payment process has been digitised. If you have an e-challan in Rajkot that needs to be paid, you may complete the .....

E Challan Madhya Pradesh (MP)

An e-challan is a receipt issued by the traffic police to individuals who break traffic rules. This receipt is in digital SMS form and sent to your registered mobile number with the violation and the fine amount. You can use the e-payment system created by the Madhya Pradesh Traffic police a.....

E Challan Chhattisgarh

Chhattisgarh is one of the busiest states in India, with a traffic network spanning far and wide across states. Also, regardless of the city you are from, traffic regulations, pertaining to Chhattisgarh as a whole, are quite stringent. Chhattisgarh traffic authorities have managed every possible .....

E Challan Uttarakhand

The hilly terrains of Uttarakhand require drivers and riders to follow all the traffic rules and guidelines. However, in case of violations, the state levies heavy fines, albeit with an option to make online payments. Since the implementation of the e challan system, the challan-based earnings in.....

Bangalore Traffic Fines & Violations

With the increased vehicle traffic on the road, the responsibility of the traffic department also increases. Bangalore is one of the cities with heavy traffic and so the traffic rules are equally strict. Everyone who tries to break the traffic rule should be ready to pay hefty penalties and fine.....

E Challan

e-Challans or electronic challans, introduced by the government, are basically fines that are sent to traffic offenders digitally through SMS. e-challans have many benefits over normal challans due to their transparency. People issued with an e-challan can instantly go to the E Challan Parivahan .....

Traffic Rules in Delhi

Traffic rules in Delhi are quite strictly implemented especially after the introduction of the Motor Vehicles Act, 2019. Soon after the implementation of the new amendments, 3,900 challans were issued against the traffic rule breakers in Delhi. Some of the traffic offences include driving without.....

Traffic Rules and Violations in Gujarat

It is important for all citizens to know about the various traffic laws and regulations since breaking these could put you in trouble, in terms of legal action and fines. For instance, Gujarat has a varied list of traffic rules that must be followed and the actions that can be taken against you f.....

E Challan Mumbai

Mumbai is one of the most crowded and busiest cities in Maharashtra. With the increased population, the number of vehicles have also increased on the roads of Mumbai. As a result, to reduce the number of accidents, traffic officers have become stricter than before. An e-challan Mumbai system has .....

E Challan Uttar Pradesh (UP)

Uttar Pradesh has dense traffic that can be difficult to navigate. This is why it is essential to follow the traffic rules if you are driving in UP. Violations can result in fines ranging from ₹500 for driving without a helmet to ₹10,000 for offences like drunk driving or blocking emergency vehic.....

E Challan Gujarat

As a result of the rising population, the number of vehicles on the road has also risen. This also means that there is an increased incidence of road accidents. To curb these, state governments have imposed stricter traffic rules and implemented e-Challan, Gujarat included.

E Challan Rajasthan

In spite of being the seventh most populous state in India, Rajasthan boasts of well-controlled traffic. This is due to well-maintained roads, and strict traffic norms. With the introduction of the Rajasthan e-Challan, people can now opt to pay the same online.

In the state of R.....

E Challan Ahmedabad

Being a major economic and industrial hub, traffic and road congestion in Ahmedabad is very frequent. However, with the introduction of the e-challan system, the city has witnessed a decline in the number of traffic violations in the recent past.

With the help of CCTV.....

E Challan Vadodara

Vadodara is the second largest city of Gujarat and home to a large volume of traffic. To properly regulate the traffic and decrease the risk of accidents, Vadodara e-challan is an effective and efficient management method. An e-challan can be issued for a wide range of traffic violations and can .....

E Challan Telangana (TS)

Telangana (TS) and other states of the county have started issuing e-challans for anyone violating the traffic rules. According to the New Motor Vehicles Act of 2019, in TS, e-challans issued by traffic police can range from ₹1,000 to ₹20,000, based on the severity of the violation.

E Challan Maharashtra

Maharashtra traffic e-challan is nothing but a digital challan, and gets issued if you are found guilty of violating any traffic rules and regulations. These rules are regulations imposed to ensure the safety of the drivers, pedestrians, and reduce road accidents.

Maharasht.....

Traffic Rules in Delhi

Traffic rules in Delhi are quite strictly implemented especially after the introduction of the Motor Vehicles Act, 2019. Soon after the implementation of the new amendments, 3,900 challans were issued against the traffic rule breakers in Delhi. Some of the traffic offences include driving without.....

E Challan Andhra Pradesh (AP)

The state of Andhra Pradesh has introduced a set of traffic rules and fine regimes to reduce traffic violations and make roads safe. Among these is the Andhra Pradesh e-challan, which is an effective and swift way to ensure that appropriate fines are issued to the traffic rules violators.

E Challan Odisha

In case you violate any of the traffic rules in place in Odisha, you will receive an e-challan from Odisha’s traffic police. The fines for violating traffic regulations in Odisha range from Rs. 500 for first-time general offences to Rs. 10,000 for driving after disqualification. There are also fi.....

E Challan Kerala

If you do not wish to be fined for violating traffic rules in Kerala, it is imperative for you to be aware of what the traffic law states. In a bid to fine offenders, the Kerala traffic police have resorted to issuing e-challans to all violators. These e-challans range between Rs.500 and Rs.10,00.....

E Challan Jharkhand

It can prove to be quite a challenging task to drive in one of the most populated states in India- Jharkhand. This is why it is essential to follow the traffic rules while driving in Jharkhand. In case of any violation, you may receive an e-challan from the traffic police in the state.

E Challan Punjab

Punjab traffic police has become more active and advanced than ever before with the introduction of E-Challan. As the name suggests, an E-Challan is simply the digitised version of the traffic challan. It is issued on your name when you break a traffic rule while driving on the road. The cameras .....

E Challan Chandigarh

In case you violate any of the traffic rules in place in Chandigarh, you will receive an e-challan from the Chandigarh traffic police. Fines for violating traffic regulations in Chandigarh range from Rs. 500 for first-time general offences to Rs. 10,000 for driving while speaking on the phone or .....

E Challan Haryana

Haryana is one of the fastest growing states of India and has a huge traffic volume. To streamline the process of imposing and paying fines for traffic violations, the Haryana Traffic police has introduced the e-challan system. This is an efficient and time-saving mechanism.

<.....

E-Challan Goa

Goa, known for its scenic beauty and vibrant atmosphere, also prioritizes road safety through the implementation of E-Challan. Whether you're a local resident or a visitor exploring this coastal region, understanding and complying with traffic rules is essential. This article serves as a straight.....

E Challan Gurgaon

Gurugram, earlier known as Gurgaon, is witnessing a boom in the job market. With the availability of vast opportunities, the population, as well as the number of vehicles, are at an all-time high. This has become the primary reason for increased air pollution, traffic congestion, and accidents du.....

E Challan Vijayawada

Getting a challan for a traffic violation can be frustrating for most vehicle owner-drivers. Furthermore, paying a challan fine in cash can be a hassle these days since most transactions are now being done via digital platforms. With the online e-challan payment provision in Vijayawada, paying fi.....

E Challan Bihar

Bihar is one of those northern states in India where road accident cases have gone down by 8.68% but fatalities have increased by 0.3% at the beginning of 2021. To curb traffic rule violations and ensure safety on the road, hefty fines have been implemented in the state. Failing to produce a vali.....

E Challan Bangalore

Bangalore, the Silicon Valley of India, is not only famous for being a tech city but also for the traffic congestion. Bangalore is 10th in the global ranking index of urban congestion in 2021. After the pandemic situation, there has also been a rise in the collection of traffic challans. To contr.....

E Challan Karimnagar

To simplify the process for the traffic police and drivers, the government of Telangana launched the e-challan platform throughout the state including Karimnagar which is among the major cities in Telangana. Through e-challan/electronic challan, the fines for any traffic rule violation are collec.....

E Challan Lucknow

Lucknow is one of the busiest cities in Uttar Pradesh. The population and the number of vehicles are at an all-time high leading to increased air pollution, traffic congestion, and accidents. To tide over problems related to traffic violations, the UP government has implemented the system of e-ch.....

E-challan Ranchi

As a convenience for its citizens, the government has implemented the electronic challan system for payment of traffic fines online. Traffic violations like overspeeding, not having motor insurance, jumping traffic lights, driving under the influence, etc. are covered by the e-challan in Ranchi.&.....

E Challan Hyderabad

Whenever you are involved in any sort of traffic violation in Hyderabad, you will have to pay a fine and this procedure has been given the shape of an online payment environment termed E-challan. You can easily pay your E-challan in Hyderabad by visiting the online portal and entering the vehicle.....

E-Challan in Jaipur

Paying your challan dues in Jaipur is a fairly easy process now that the Government has introduced the concept of e-challans. These are electronic challans that can be paid online through the official website of the Rajasthan Traffic Police and the Parivahan web portal.

The ch.....

E-Challan Complaint

Traffic violations are a common occurrence on the roads, necessitating strict enforcement by police and traffic management authorities to ensure road safety and an efficient traffic system. The advent of online e-challan through platforms like Parivahan has revolutionised this process. This is a .....

Fine for Traffic Rule Violation Captured by AI Camera

If a fine has been levied on you due to a traffic rule violation, then there is a rule for paying the amount. If you are caught on the traffic challan ai camera committing the violation of a traffic rule, in which it is proven that you have broken a traffic rule, you will have to pay the fine thr.....

New Motor Vehicle (Amendment) Act, 2019- Penalties

The Motor Act amendment bill was introduced in Lok Sabha on 15th July 2019,. Nitin Gadkari, the then Transport Minister insisted on amending the Motor Vehicles Act to bring a change in the fines charged for various traffic offences. As per the new rules, all motorcycles mandatorily need to h.....

Motor Vehicle Act 1988 in India

The Indian Motor Vehicle Act is a set of rules and regulations for all transport vehicles which was passed in 1988. The act covers almost every part of transportation, including the ownership and usage of road transport vehicles, licensing of conductors and drivers, traffic regulations, provision.....

Section 177 of Motor Vehicle Act

To combat the rising number of road accidents, the Indian government made revisions to different provisions of the Motor Vehicles Act that took effect on September 1, 2019. Section 177 of Motor Vehicle Act is one of the primary sections, and it contains broad requirements for sanctions for numero.....

Section 181 of Motor Vehicle Act, 1988

The Section 181 of the Motor Vehicle Act governs the consequences of driving without a valid licence. Its recent amendment includes a penalty of ₹5,000, or 3 months of imprisonment, or both for minors and others caught driving without a valid licence.

Section 181 of the.....

Section 183 of The MV Act

Section 183 of the Motor Vehicle Act refers to the punishment and penalties imposed on offenders found guilty of overspeeding in the country. Overspeeding is a cause of big concern as it can lead to accidents and damage to property and/or life.

Guilty parties may need to pa.....

Section 184 of The Motor Vehicle Act in India

Section 184 of the Motor Vehicle Act deals with dangerous driving that can lead to on-road fatalities. The rising traffic violations in the country made the government take systematic measures to curtail them.

Punishments under Section 184 of the MVA have become more string.....

Section 185 of Motor Vehicle Act

Drunk driving can be lethal for anyone on the road. To curtail this danger, the Government has made stricter rules under Section 185 of the Motor Vehicle Act. Punishments under Section 185 of the MVA include a fine of ₹10,000 or imprisonment of up to 6 months or both. Subsequent offences can lead.....

Section 187 of the Motor Vehicles Act, 2019

Section 187 of the Motor Vehicle Act states the punishment for offences relating to an accident. Majority of the road accidents occur due to negligent driving or failure to follow traffic safety regulations. Under Section 187 MV Act, it is punishable if the vehicle owner refuses to cooperate with.....

Section 192 of Motor Vehicle Act 1988

Section 192 of the Motor Vehicle Act is one of the primary sections containing driving motor vehicles without registration. Driving without registration is considered a criminal offence, hence, to avoid this situation, you must follow all rules and regulations implemented by the Indian government.....

Section 196 of The Motor Vehicle Act in India

Driving uninsured vehicles is an offence under Section 196 of Motor Vehicle Act. The person found guilty of driving an uninsured vehicle can be punished with imprisonment of up to three months and/or penalty of ₹2000. A subsequent offence can lead to stricter punishment of imprisonment for 3.....

Section 207 of Motor Vehicle Act

The Section 207 of Motor Vehicle Act allows police officers and other authorised personnel to detain and take action against vehicles found being driven without the necessary permits and registration. They can, even, seize the vehicle if it is found to be used for any illegal purpose.

Section 279 of the Indian Penal Code (IPC)

As per Section 279 of the Indian Penal Code, any individual found guilty of rash or negligent driving, endangering human life, can be punished by law. As per the law, such an individual can be imprisoned for a period of up to 6 months, fined ₹1,000, or both. Negligent driving refers to a situatio.....

India witnesses around 4+ lakh accidents in a year. Around 3 lakh from these leave behind damage to life and health, while more than 1 lakh have resulted in fatal injuries. If this doesn’t highlight the significance of following traffic and road safety rules, there’s no telling what can.

The Ministry of Road Transport and Highways, along with state traffic departments, continue to introduce new ways of learning rules, regulations, and the dangers of on-road misconduct. The lives of countless people, including yourself and your loved ones, depends upon one’s on-road discipline. Hence, it is important to educate yourself about these traffic and road safety regulations.

In India, traffic signs are broadly split into three categories: mandatory signs, cautionary signs and informative signs.

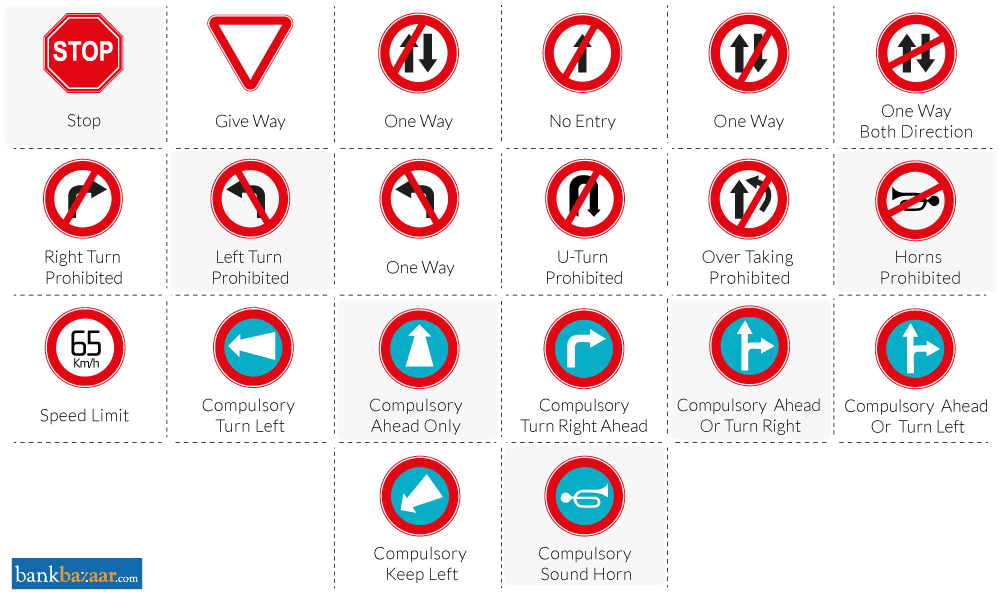

1. Mandatory Traffic Signs

As the title suggests, this set of road traffic signs are obligatory for drivers to follow. The purpose of mandatory traffic signboards is the smooth functioning of traffic on the road. In fact, violating any mandatory traffic signs is punishable by law.

Source: Bank Bazaar

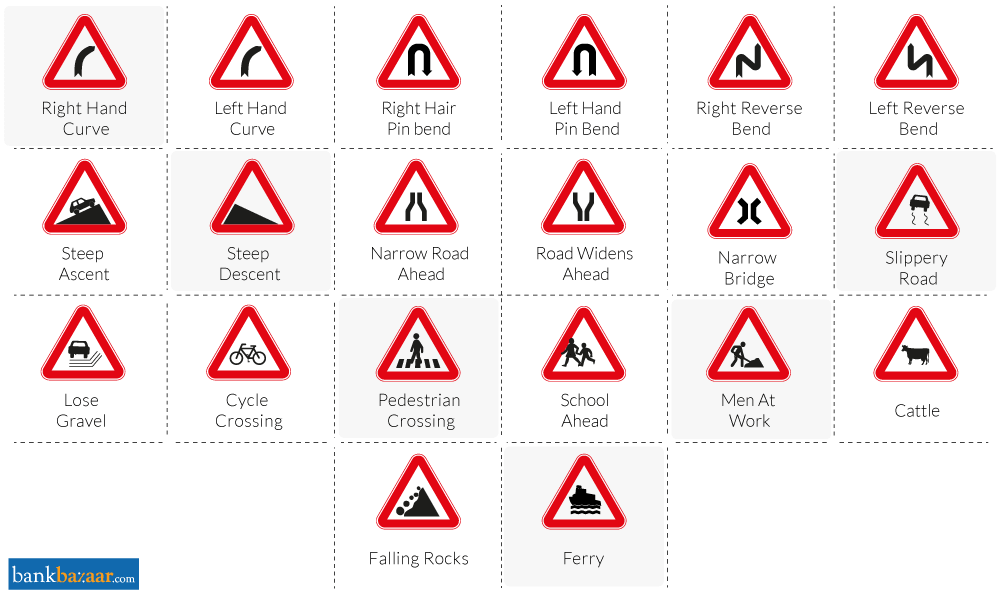

2. Cautionary Traffic Signs

The goal of cautionary traffic signs is to warn drivers of any potential threat on the road ahead, like road work, potholes, and speed bumps. While these things are not inherent, accidents could occur if one doesn’t slow down their vehicle. Hence, you must take cautionary road traffic signs as seriously as the mandatory ones.

Source: Bank Bazaar

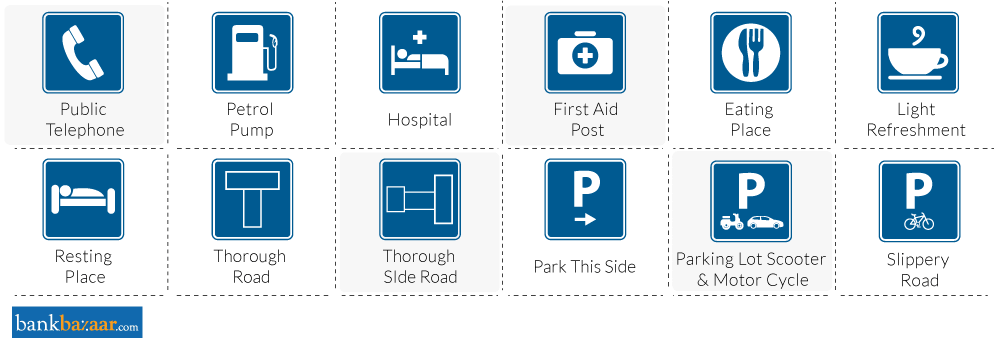

3. Informative Signs

Informative signs serve to aid any drivers without a map or knowledge of the facilities available in the area they are driving in. They can help guide drivers by offering directions or telling them about hospitals, public phones, and parking spots in the area. Informative signs are displayed below.

Source: Bank Bazaar

Traffic rules are officially listed in the 1989 ‘Rules of Road Regulations.’ They are as follows:

Category |

Rule |

Driving |

|

Turning |

|

Overtaking |

|

Pillion |

|

Parking |

|

Documents |

|

Vehicle |

|

Although the importance of following traffic rules and regulations is stressed regularly, one can’t ignore the number of daily road accidents and injuries in India. The rising road accident numbers also highlight the importance of purchasing motor insurance. In fact, third-party cover is not only mandatory in all states but also integral to protecting yourself from any road accidents.

You can consider obtaining your vehicle’s motor insurance at Bajaj Markets. By opting for the motor insurance policy on Bajaj Markets, you get access to numerous benefits—swift claim settlements, cashless claims at a network of garages all over the country, and 24/7 assistance whenever you need it. Get your vehicle insured at Bajaj Markets today.

Check Out Motor Insurance Partners Available at Bajaj Markets

FAQs About Traffic, Rules, Signs, and Violations in India

Is it necessary to have your driving licence while driving?

Yes. In case you are found guilty of not carrying your driving licence while driving, you may have to pay a fine or be imprisoned.

Is it necessary to wear seat belts while driving?

As per the traffic rules, the driver and the person seated in the front seat must always wear seat belts while the vehicle is in motion.

What is the punishment for drunken driving?

If you are found guilty of drunken driving, you may have to pay a hefty fine or may be imprisoned. The punishment depends upon the amount of alcohol consumed and the frequency of occurrence of such an offence.

What are traffic signal rules?

Traffic signal rules are followed to keep a smooth and consistent flow of traffic. The basic traffic light rules that you must know while you are at a traffic signal are:

At the traffic signal, a red light means stop, that is you need to bring your vehicle to a complete halt

At a yellow traffic light sign, you must slow down your vehicle

The green traffic light sign means you can keep driving

What are the documents to be carried by a driver when driving?

A driver must carry the following documents while driving:

Driving licence

Registration certificate

Taxation certificate

Emission test certificate

Insurance certificate

Fitness certificate and permit (in case of transport vehicles)

How can I buy car insurance online?

You can buy car insurance online by following these steps:

Visit the official website of a car insurer or an insurance provider such as Bajaj Markets

Navigate to the car insurance premium calculator page

Enter your car’s registration number and your contact number

Enter your personal details and choose the type of coverage you want

Complete the payment of the insurance premium through any mode of payment

You will receive an active car insurance policy for your car once you pay the premium.

Enter Your OTP

.jpg)