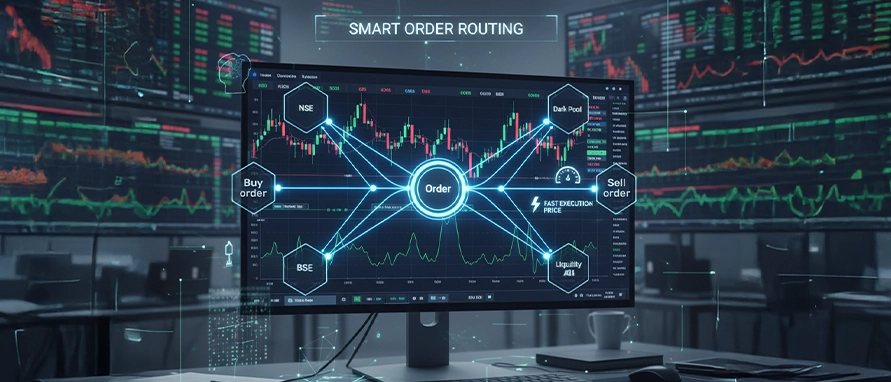

Smart Order Routing (SOR) is an automated system that directs a client’s trade orders to the most optimal trading venue based on pre-defined parameters such as price, speed, and liquidity. It is widely used by brokers and institutional participants to achieve what is often called "best execution" — that is, securing the most favourable combination of price, cost, and speed for an order.

SOR is particularly useful in markets like India where equities are listed across multiple exchanges, primarily the NSE and BSE. It ensures that a buy or sell order is routed to the platform offering the most efficient execution opportunity.

.jpeg)