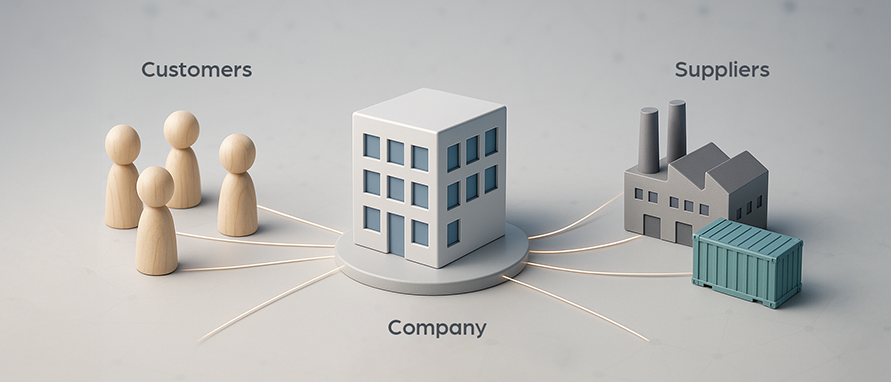

Building a balanced portfolio of customers and suppliers is key to long-term sustainability. The process requires proactive expansion and relationship management:

1. Target New Customer Segments or Geographies

Explore new markets, industries, or regions to reduce reliance on existing clients. For example, an Indian exporter heavily dependent on the U.S. could expand into Southeast Asia to hedge against regional slowdowns.

2. Onboard Backup Suppliers and Manage Sourcing Risk

Use multi-sourcing to secure alternate suppliers for critical inputs. Establish long-term contracts and performance clauses to ensure quality and delivery reliability.

3. Strengthen Relationship Management

Maintain consistent communication with major customers and suppliers. Collaborative forecasting and joint planning improve transparency and reduce surprises.

4. Implement Supplier Performance Dashboards

Track delivery timelines, defect rates, and pricing stability to identify potential risks early. Diversify before a single supplier becomes irreplaceable.

5. Invest in Data & Analytics

Use CRM and ERP tools to monitor revenue concentration trends and simulate “loss of major customer” scenarios for stress testing.

.jpeg)