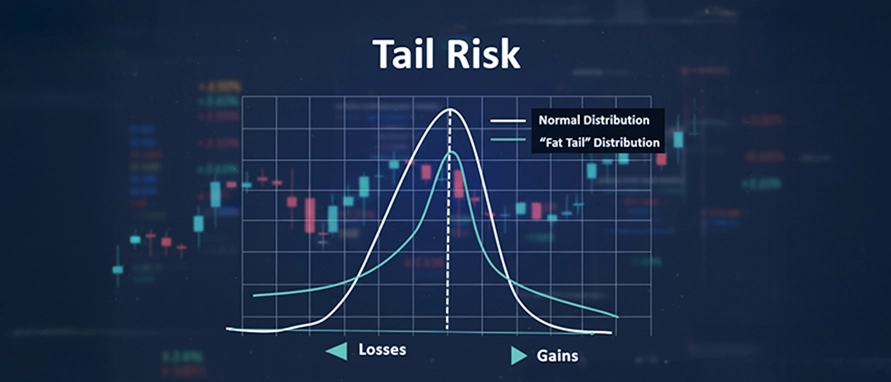

Evaluating tail risk hedging helps assess how different risk-mitigation approaches behave during rare but severe market disruptions and what trade-offs they introduce during normal market conditions.

Protective Puts

What it is:

Protective puts involve purchasing put options on an existing equity position, giving the holder the right to sell the asset at a predetermined price.

How it works during extreme events:

During sharp market declines, the put option increases in value as the underlying asset falls, offsetting part of the portfolio’s losses by setting a minimum exit value.

Tail Risk Fund

What it is:

A tail risk fund is a specialised investment vehicle structured to respond positively during extreme market stress, typically through exposure to volatility-linked instruments, asymmetric payoff strategies, or defensive assets such as treasury bills to preserve capital during periods of heightened uncertainty.

How it works during extreme events:

In periods of heightened volatility or abrupt market sell-offs, these funds are positioned to benefit from sharp price movements, helping counterbalance losses in traditional equity holdings.

Volatility-Based Strategies

What it is:

Volatility strategies use instruments such as volatility futures or options that are linked to market volatility indices.

How it works during extreme events:

Market stress is often accompanied by spikes in volatility. These strategies gain value when volatility rises sharply, providing an indirect hedge against equity market declines.

Example: Protective Put Illustration

Portfolio value: ₹500,000 invested in equities listed in the stock market

Hedge cost: ₹10,000 spent on put options with a strike value of ₹450,000

Market movement: Equity markets decline by 30%, reducing portfolio value to ₹350,000

Outcome: The put option allows the investor to sell at ₹450,000 instead of the market value of ₹350,000, limiting the effective loss after hedge cost to ₹60,000

.jpeg)