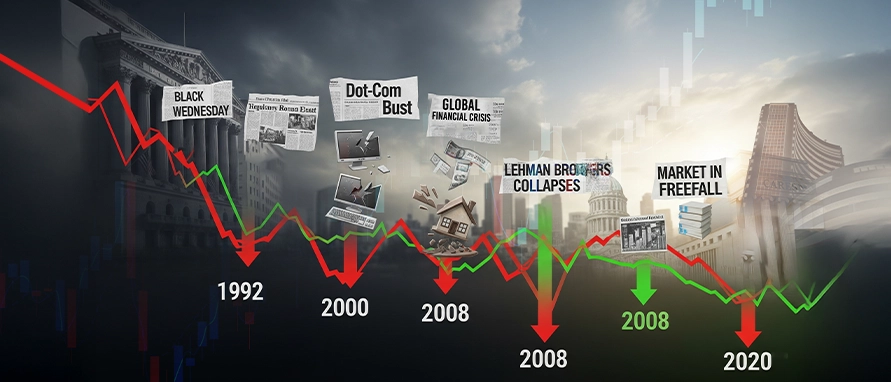

1992 Harshad Mehta Scam & Crash

What happened:

Stockbroker Harshad Mehta exploited gaps in the banking system by using fraudulent bank receipts to channel funds into equities, artificially inflating prices during early 1992.

Impact:

The BSE Sensex rose sharply before falling by roughly 40–50% once the irregularities surfaced. The episode led to tighter market oversight and accelerated reforms in disclosure, settlement, and surveillance mechanisms.

2008 Global Financial Crisis

What happened:

The collapse of major financial institutions in the United States, including Lehman Brothers, triggered widespread global risk aversion and capital withdrawal from emerging markets.

Impact:

Indian equities declined by close to 60% from their peak. The period saw heightened volatility and foreign outflows. Market regulators and the Reserve Bank of India implemented liquidity measures, while supervisory frameworks for intermediaries and market infrastructure were strengthened.

2015–16 Chinese Yuan Devaluation

What happened:

China’s unexpected currency devaluation in August 2015 led to global uncertainty, affecting capital flows across emerging economies.

Impact:

Indian indices corrected by approximately 20% during this phase, reflecting broader risk-off sentiment. Portfolio flows remained volatile as global investors reassessed exposure to emerging markets.

2016 Demonetisation

What happened:

On 8 November 2016, the Indian government withdrew ₹500 and ₹1,000 currency notes from circulation, creating a temporary liquidity shock in cash-dependent segments of the economy.

Impact:

Equity markets experienced short-term volatility, particularly in consumer-facing sectors. Unlike global crisis-driven crashes, this event primarily affected domestic demand conditions rather than triggering systemic market declines.

2020 COVID‑19 Crash

What happened:

The onset of the COVID-19 pandemic and nationwide lockdowns led to one of the fastest market declines on record.

Impact:

Between February and March 2020, the Sensex fell by about 38%. Subsequent recovery was supported by fiscal measures, central bank liquidity operations, and increased domestic market participation.

.jpeg)