Understand how the gross spread ratio reflects the cost of raising capital and evaluates underwriting efficiency in financial offerings.

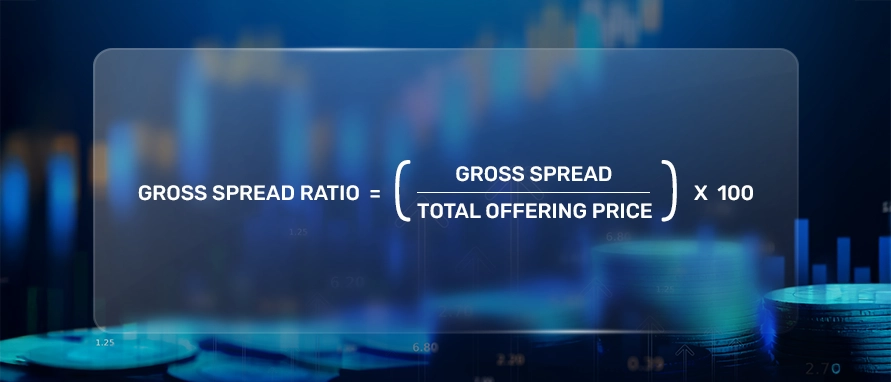

The gross spread ratio measures the difference between the price investors pay for securities and the amount received by the issuing company. This gap represents the underwriting fees and associated issuance costs charged by investment banks for managing the offering.

Understanding this ratio is essential for assessing the true cost of raising capital through public or private issues. A higher gross spread indicates greater intermediary costs, while a lower one suggests more efficient fundraising.

In essence, the gross spread ratio provides insight into how much of the raised capital actually reaches the issuer after all underwriting expenses are deducted.

.jpeg)