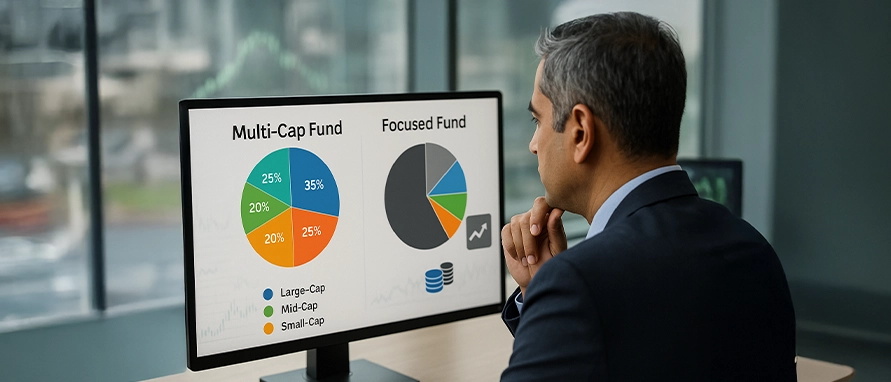

What are multi cap funds can be understood by looking at their structure within the Indian mutual fund framework. Multi-cap funds are equity mutual funds regulated by SEBI that invest across large-cap, mid-cap, and small-cap stocks, providing exposure to companies with different market capitalisations within a single portfolio.

Regulatory allocation requirement

Under SEBI’s mutual fund classification norms, multi-cap funds are required to allocate a minimum of 25% each to large-cap, mid-cap, and small-cap equities. This mandatory allocation distinguishes multi-cap funds from other diversified equity categories and defines how capital is distributed across market segments.

Risk–return profile

By investing across multiple market capitalisation segments, multi-cap funds reflect a blended risk profile. Large-cap holdings contribute relative stability, while mid-cap and small-cap allocations introduce higher growth potential along with increased volatility. Portfolio performance is influenced by movements across all three segments rather than a single market-cap category.

Portfolio suitability characteristics

Multi-cap funds are structured to provide broad equity market exposure within one scheme. Their design allows participation across different phases of the market cycle, as returns are derived from a combination of large, mid, and small-cap stock performance rather than concentrated exposure to one segment.

Features of Multi-Cap Funds

Mandatory allocation: Under SEBI’s classification norms, multi-cap funds are required to allocate a minimum of 25% each to large-cap, mid-cap, and small-cap stocks.

Portfolio composition: Investments are distributed across companies of different market capitalisations, resulting in exposure to multiple segments within a single portfolio.

Investment horizon context: Multi-cap funds are structured to hold equity investments across market cycles, with returns influenced by performance across large-, mid-, and small-cap segments.

.jpeg)