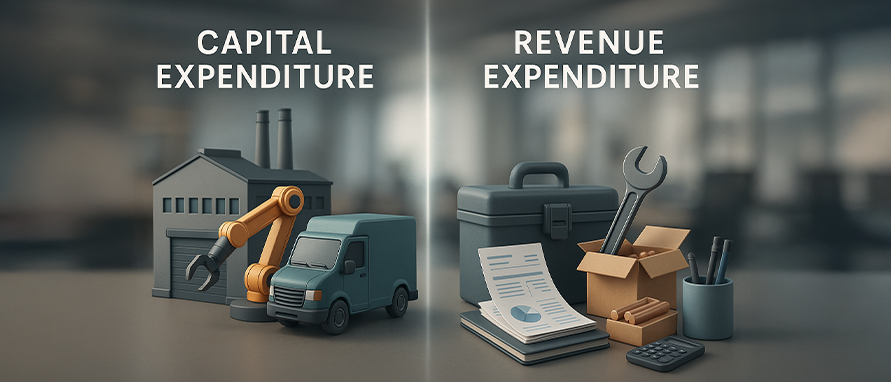

The examples below illustrate how business spending is typically classified based on asset creation, duration of benefit, and accounting treatment.

Capital Expenditure Examples

Common instances of Capital Expenditure include:

Purchase of a new delivery truck

Construction of a warehouse or factory building

Installation of solar panels on office premises

Acquisition of patents or licences

Major machinery upgrades that extend asset life or improve capacity

These expenses are recorded as a fixed asset on the balance sheet and allocated over time through depreciation or amortisation.

Revenue Expenditure Examples

Typical Revenue Expenditure items include:

Fuel costs for delivery vehicles

Routine machinery repairs

Electricity and water bills

Employee training expenses

Regular software subscription renewals

Such costs are recognised directly in the P&L statement in the period they are incurred, as they support ongoing operations without creating long-term assets.

Accounting example

The table below outlines how similar expenses receive different accounting treatment:

.jpeg)