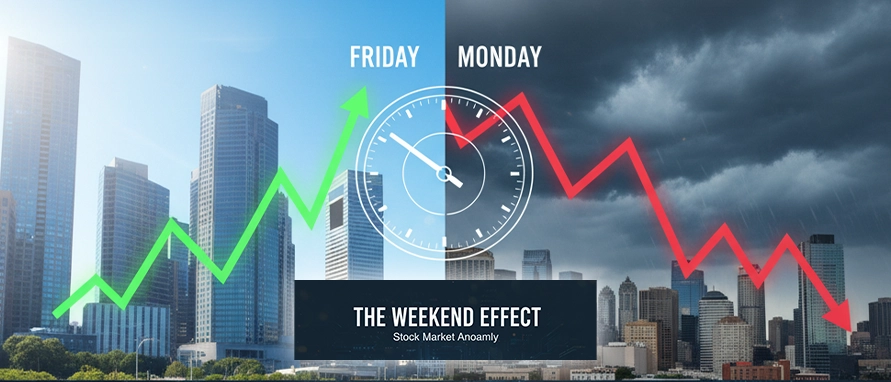

The weekend effect was first empirically observed by economist Frank Cross in 1973, who noted that average stock returns on Mondays were significantly lower than those on other trading days—particularly Fridays. Cross’s findings, based on data from the New York Stock Exchange (NYSE), showed that while Friday returns were often positive, Mondays exhibited frequent losses, despite no fundamental reason for such a pattern.

This anomaly gained further credibility during the 1970s and 1980s, as additional academic studies confirmed consistent negative Monday returns across various indices, including the S&P 500. Researchers pointed to investor pessimism over the weekend, delayed reaction to news, and institutional trading patterns as potential causes.

However, by the mid-to-late 1970s, and increasingly into the 1990s, evidence suggested that the weekend effect was diminishing in magnitude. The rise of automated trading, greater market awareness, and improved information flow reduced arbitrage opportunities. According to ASU research and Investopedia, the anomaly has become far less pronounced, although remnants of the effect still appear in certain markets and small-cap stocks.

.jpeg)